A lack of financial knowledge in today’s economic climate can precipitate severe consequences. Firstly, it can make one susceptible to scams and fraudulent activities. Secondly, and perhaps more crucially, it may hinder the ability to secure a comfortable standard of living for oneself and one’s family.

Indeed, many of us have never been formally educated on astute money management, often resulting in a paycheck-to-paycheck lifestyle. However, you've likely encountered the adage, "Money should work for you." But how can we actualize this? One viable option that may pique your interest is investing. Ever fantasized about becoming a shareholder in a major international company? Contrary to what you might believe, it's entirely within reach!

The journey begins with personal development, specifically in fostering financial acumen. This entails adopting a new mindset, cultivating prudent money management habits, and curbing unnecessary and impulsive expenditures. While having a mentor for advice is beneficial, absence of one doesn’t spell doom. Insightful answers can be gleaned from the books of successful individuals willing to share their wealth-building secrets. Herein, we present a curated selection for budding investors.

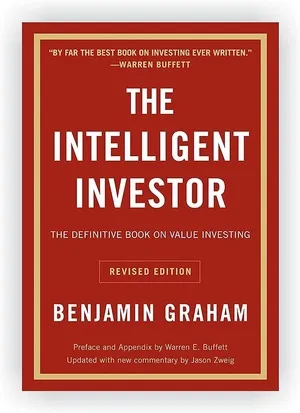

Your inaugural guide is Benjamin Graham’s "The Intelligent Investor: The Definitive Book on Value Investing", penned in 1949. Graham unveils a fundamental truth: investing is not a gamble based on luck and skill but a nuanced financial science. Often hailed as the stock market Bible, this book delineates the disparities between market speculation and investing, acquainting readers with strategies for both passive and active investors through tangible securities analysis examples. Warren Buffett, a legendary investor, proclaimed, "I thought then, and I think now, that this is by far the best book about investing ever written." Each chapter concludes with a comprehensive commentary by Jason Zweig, a Wall Street Journal investment columnist, providing a contemporary perspective.

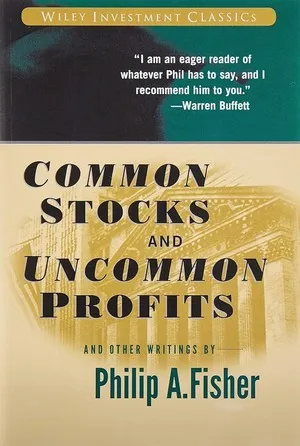

The second luminary in the field is Philip Fisher, author of "Common Stocks and Uncommon Profits", and rightfully dubbed "one of the greatest investors of all time" by Morningstar. This collection, encompassing "Common Stocks and Uncommon Profits," "Conservative Investors Sleep Well," and "Paths to Wealth through Common Stocks," is revered as classic literature in the field. Fisher’s 15-point method for identifying promising stocks and his sagacious advice on astute portfolio management and strategic buying and selling of securities are invaluable. Notably, Warren Buffett, an admirer of Fisher, once stated, "My view is that 15% Phil Fisher and 85% Benjamin Graham."

Don't miss "One Up On Wall Street" by Peter Lynch, who steered the Magellan investment fund from 1977 to 1990. During this 13-year tenure, the fund realized an astounding average annual return of 29.2%, doubling the return of the S&P 500 index, which encompasses the largest U.S. companies. The fund’s assets burgeoned from $18 million to $14 billion, catapulting Magellan to the zenith as the world's largest fund. Lynch demystifies basic financial strategies for beginners, utilizing straightforward examples from his career.

"King of Capital: The Remarkable Rise, Fall, and Rise Again of Steve Schwarzman and Blackstone" by Morris John and Kerry David is another indispensable read. This narrative unfolds the saga of Blackstone, the world’s preeminent private investment company, and its meteoric ascent in the business realm. It transcends a mere American "success story," chronicling a financial revolution that redefined Wall Street and reverberated through the global economy. The authors vividly portray Steve Schwarzman’s extraordinary metamorphosis from a humble bank employee to a billionaire, the "king of capital." The book invites readers to formulate their own perspectives, based on presented facts, on whether Blackstone and similar entities exploit or fortify the companies they acquire. It promises to captivate a diverse readership.

Concluding our review is Burton Malkiel’s perennial bestseller, "A Random Walk Down Wall Street." This quintessential guide introduces private investors to the requisite knowledge for assured financial management. It stands as a premier guide to investment, elucidating the fundamental terminology of Wall Street and steering through its tumultuous waters with a straightforward yet potent long-term investment strategy. Malkiel, a financial connoisseur, contends that an investment portfolio, even with securities randomly chosen from various indexes, can occasionally outperform stocks meticulously selected by professionals.

Indeed, investing capital carries inherent risks. Prior to embarking on this venture, ensure you acquaint yourself with Malkiel’s tried-and-true guidance. The author elucidates not only on evaluating the potential returns of stocks, bonds, and mutual funds but also on appraising real estate and other investment portfolio components.

An alternative, particularly for those at the onset of their investment journey, is to entrust asset management to professionals. Investbanq, one of Singapore’s leading companies, proffers a unique algorithm and curates an optimal investment portfolio tailored for you. Whether you opt to trade independently or delegate portfolio management to us, we assure you of one paramount element - the security of your funds!