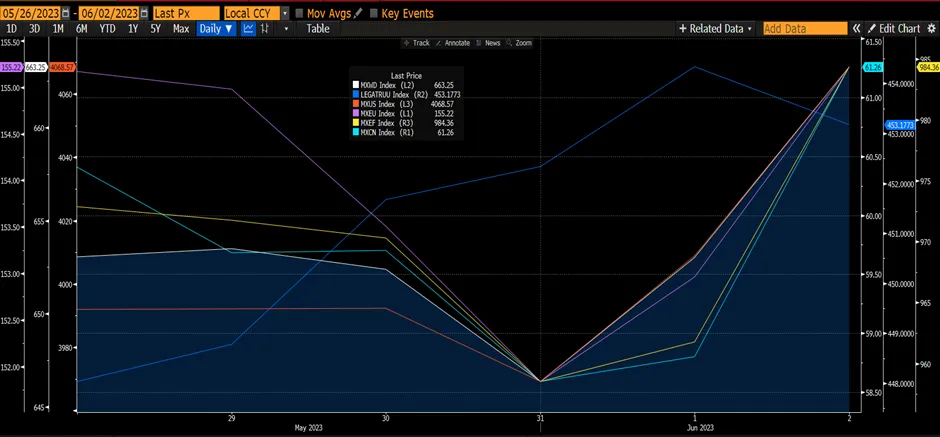

Global markets turned positive in the latter part of this week driven by fading expectations of a debt crisis and a stronger-than-expected US job market. The China market however lost 3% through Thursday but returned a +1.53% to end the week, after the release of Caixin PMI, which reflected a more positive manufacturing environment in May compared to the official PMI that was released a day earlier. The official PMI indicated a contraction and was below expectation. Also, the market was boosted by Tesla CEO Elon Musk’s visit to China where he met various government officials. The global equity market ended the week rising by 1.63% and it outperformed the global fixed income index, which increased by 1.15%. Despite MXEU being flat (+0.07%), the rise in the global equity index was driven by MXUS (+1.97%) and MXEF (+1.26%).

Figure 1: Major Indices Performances

Source: Bloomberg

Source: Bloomberg

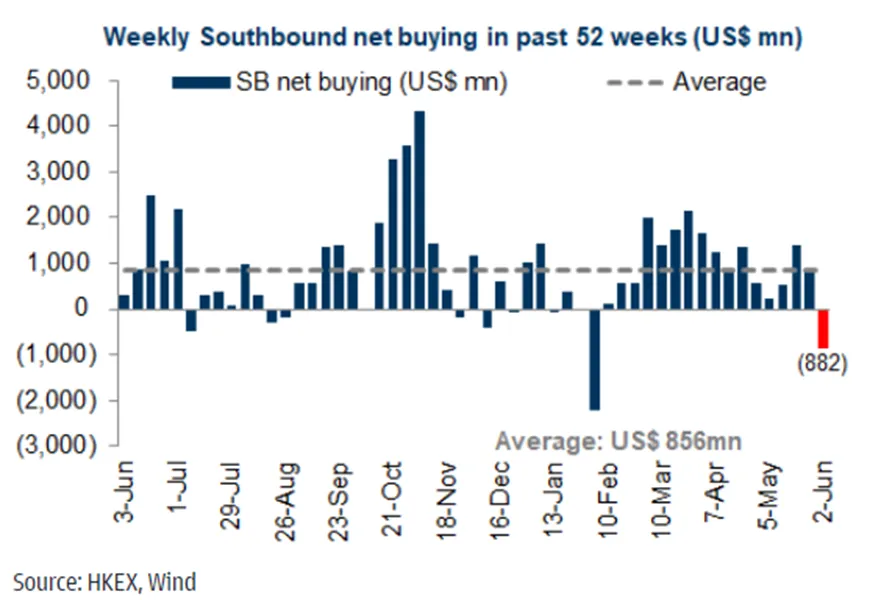

China’s market appears to be entering a bear market after weak manufacturing data reinforced the pessimism over a market that investors are giving up on. Global funds are on track to turn net sellers of Chinese equities for a second straight month, something that hasn’t happened since the rout in Oct-22. Some China bulls, including Citigroup and Jefferies Financial Group, have started to trim portfolio allocation to China.

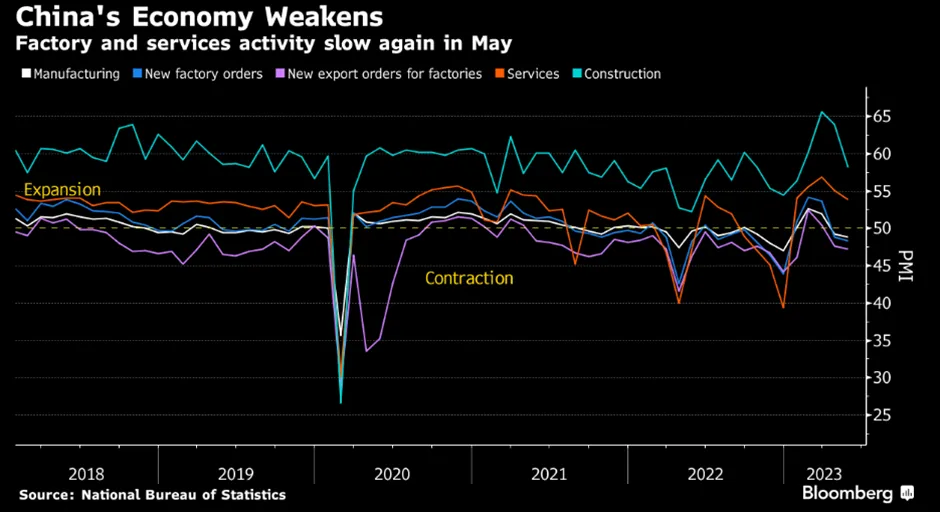

In this latest slew of disappointing data from China’s consumer spending to inflation, China’s manufacturing activity contracted for a second month in May and at a worse pace than in April, while service expansion eased suggesting the post-Covid rebound had lost momentum. Investors sold off everything from Chinese shares to the RMB and commodities as this weakness raises fresh fears about the growth outlook and prompted calls for more central bank action to counter the downturn.

Figure 2: China Fund Flows

Figure 3: China’s Official PMI Show Contraction

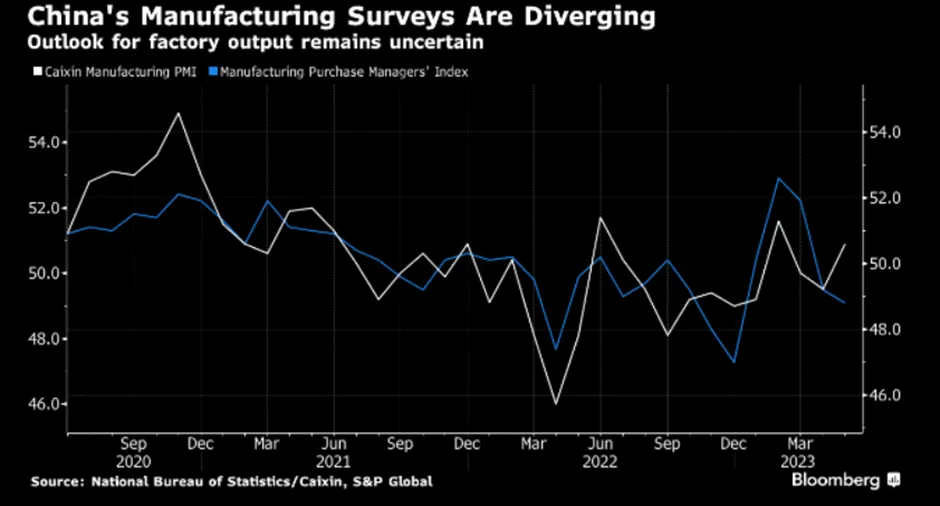

However, on Thursday (1 June), the Caixin purchasing managers index showed factory activity expanded slightly in May, a surprise improvement after official data published a day earlier pointed to a deeper contraction in manufacturing in the month. The mixed figures add to concern about China’s economic recovery and suggest more evidence is needed to gauge the growth outlook. A faltering property market remains a big risk for the economy as well. Data are showing a slowdown in home sales, business and consumer confidence have yet to rebound to pre-pandemic levels, and youth unemployment is at a record high. Nevertheless, the markets recovered on the back of this Caixin data and after a rout the day before.

Figure 4: Caxin Showed China Manufacturing PMI Expanding

According to economists, the divergence in the PMIs was likely due to the different sample sizes, geographic locations, and types of businesses surveyed. The Caixin report, which is compiled by S&P Global, is based on a survey sample of around 650 private and state-owned manufacturers but the official PMI, published by the National Bureau of Statistics, is based on a survey of 3200 companies. Analysis by Bloomberg Economics shows the NBS index has a stronger correlation to industrial production, while the Caixin index is better correlated to exports. Nevertheless, both would suggest that China’s and global economic recovery is waning.

Tesla’s CEO Elon Musk’s visit to China also excited the market on Friday (2 June). Musk visited Tesla’s Giga Shanghai plant and met with Chinese government officials, including Foreign Minister Qin Gang and Minister of Industry and Information Technology Jun Zhuanglong. He also held a discussion with Shanghai Party Secretary Chen Jining and had an audience with China’s Vice Premier Ding XueXiang, who is reportedly close to President Xi Jinping. Although the conversations were not documented, Elon expressed his appreciation for the “incredibly impressive” way employees overcame difficulties and challenges. He also lauded the made-in-China cars as ones of the highest quality. It is not surprising that Musk gets a better reception and fanfare compared to President Biden’s cabinet members in China.

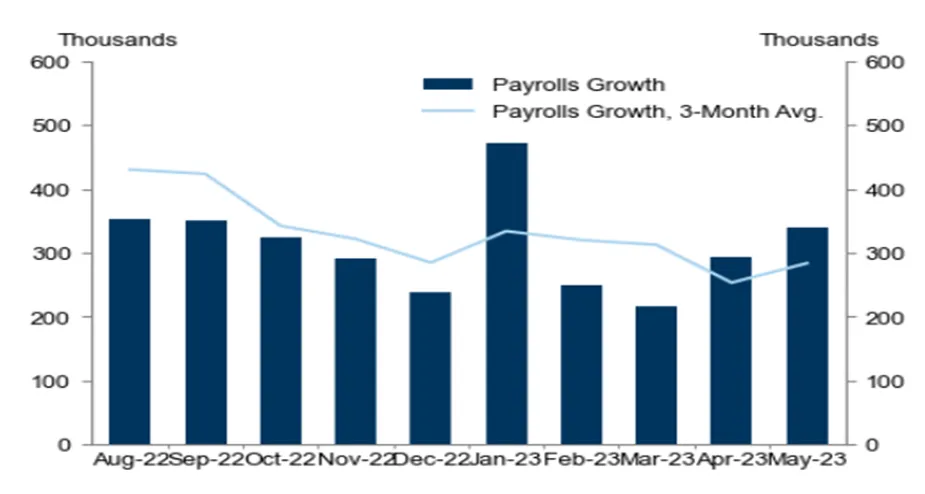

Meanwhile, The House has passed debt-limit legislation forged by President Biden and Speaker Kevin McCarthy that would impose restraints on government spending through the 2024 election and avert a destabilizing US default. Lawmakers from both parties joined to approve the bill, sending the measure to the Senate for consideration as a default deadline draws near. Furthermore, nonfarm payrolls released on Friday rose 339k in May, exceeding consensus expectations for the fourteenth straight month. The household survey also showed a large increase in employees, but at the expense of fewer self-employed workers, and the net number of unemployed people rose enough to boost the unemployment rate by three-tenths to 3.7%. Average hourly earnings increased by 0.33% in May and it came from Information (+1.6%), financial activities (+0.5%), and utilities (+0.5) industries. However, initial jobless claims rose to 232k from 229k in the previous month.

Figure 5: Payrolls Growth

Source: Labour Department

Source: Labour Department

That said, the US labour market data is calling into question the argument from Fed officials to skip an interest rate increase next week. The argument is that skipping a rate hike decision in June will allow them to assess the data without ruling out the possibility of an increase in rates at the next meeting. Investors are pricing for a pause currently (20% chance of a rate hike). Markets were also cheered by further indications from top Federal Reserve officials that there might be a pause in rate hikes at the central bank’s policy meeting later this month. Philadelphia Fed President Patrick Harker said “We should at least skip this (June) meeting in terms of an increase” and that “we are close to the point where we can hold rates in place.” Furthermore, global investors appeared to take some comfort from a larger-than-expected fall in Eurozone inflation for May.

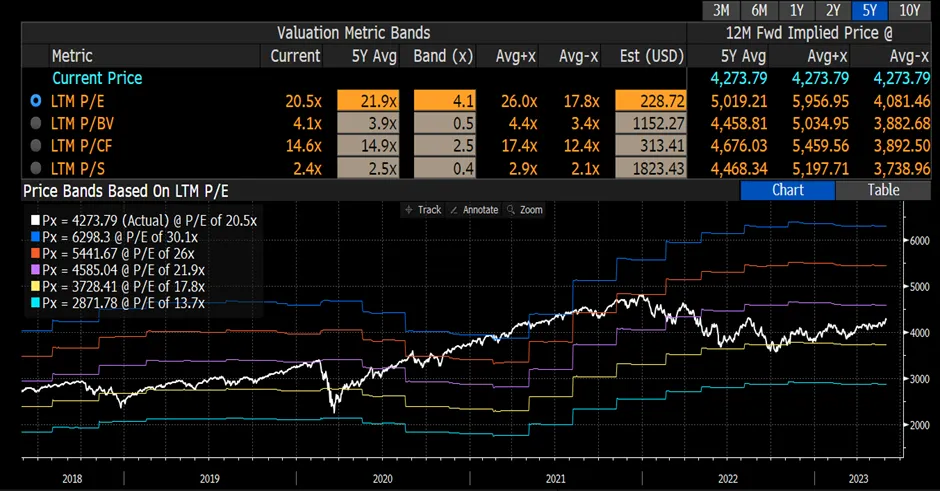

What is driving the US equity market? Besides market sentiment improving with the successful raising of the US debt ceiling and the labour market report showing moderating wage growth in May, the US equity market rally has also been fuelled by the rise of technology stocks, as reflected by a YTD 26% rise in NASDAQ. The FANG+ Index, which tracks the 10 most traded tech companies in the US, has risen 66% this year – mostly driven by the AI theme. By contrast, an equal-weighted version of the S&P 500, which dilutes the impact of these mega-cap tech stocks, has advanced 2.5% so far in 2023, compared to a 12% gain for the S&P500 index. Strategists are beginning to question if this rally is sustainable. We believe it is sustainable for reasons that 1) China’s recovery is still in question as recent data suggest that recovery is waning; 2) the realisation of the AI trend is still in the early stages which many have underestimated its capabilities; 3) S&P 500 earnings revisions have troughed, and 4) S&P 500 valuations are below historical averages. The tailwind should continue to drive momentum, eventhough it may not be from the tech sector.

Figure 6: US Equities Trending Up

Source: Bloomberg

Source: Bloomberg

Figure 7: S&P Earnings Revision Has Trough

Source: Bloomberg

Source: Bloomberg

Figure 8: S&P500 Still Trading At Below Its Historical Average

Source: Bloomberg

Source: Bloomberg