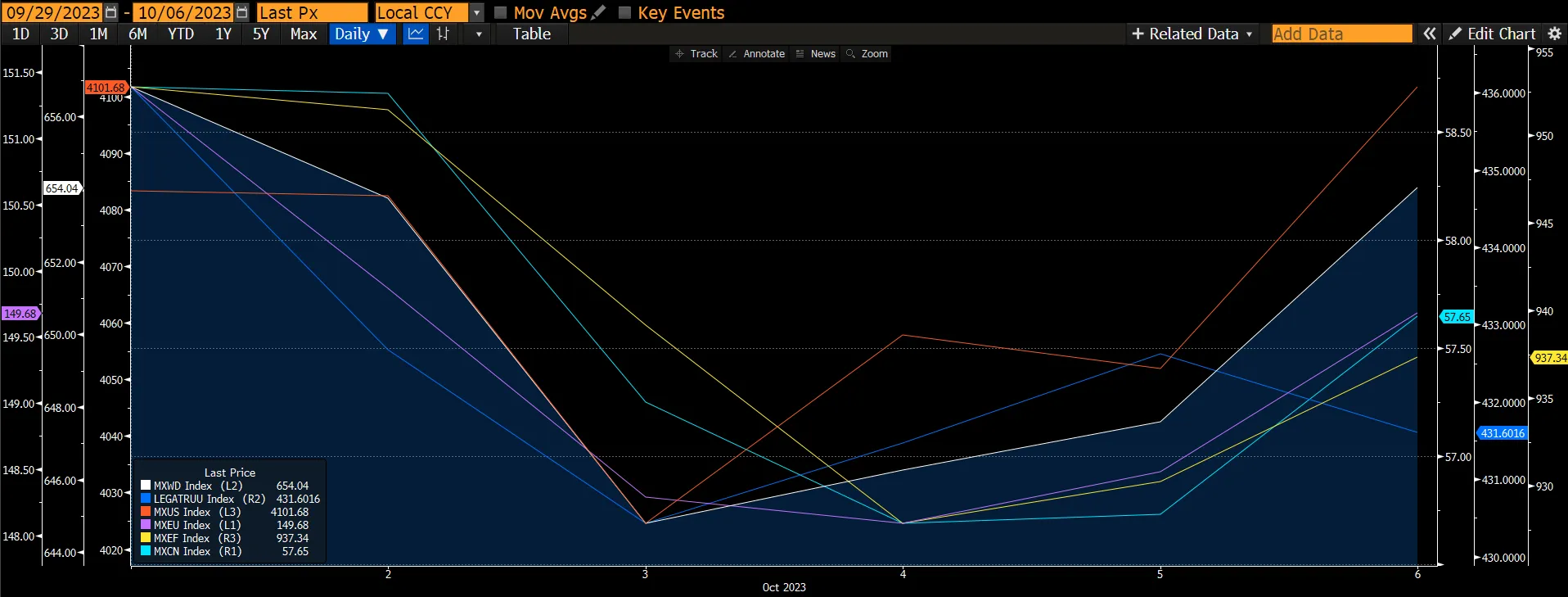

The global equities markets fell by 0.39%, a third week of decline, as the 10-year yield hit a 16-year high (4.8-4.9%) amid hotter-than-expected non-farm payrolls despite softer ADP employment and ISM services data reported earlier. This has led to most major equities markets falling for the week except for the US market which staged an impressive rebound (+0.49%) on the back of unexpected robust job additions of 336k in September vs expectations of 170k additions. The European market fell by 1.12% while emerging markets declined by 1.61% led partly by the Chinese market (-1.81%) despite seeing a pent-up travel demand during the Golden Week holiday and both official NBS PMIs rose in September, in contrast to a moderating Caixin manufacturing & services PMIs. The Bond markets continued to weaken as yields rose, following stronger-than-expected data in the US. The 10-year Treasury yield exceeded 4.8% while the German 10-year bund yield almost reached 3%, its highest level for twelve years. Generally hawkish comments from Federal Reserve policymakers added to upward pressure on yields. The global fixed income index fell by 1.03% for the week.

Figure 1: Major Indices Performance

Source: Bloomberg

Source: Bloomberg

Focus Topic – China Recovery?

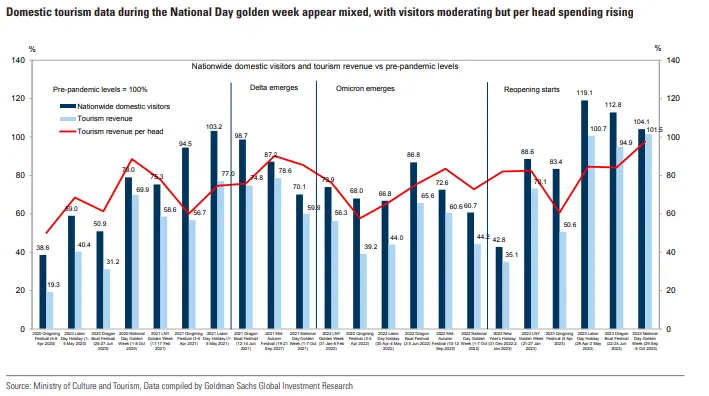

The tourism data from the National Day Golden Week holiday showed that (1) the number of visitors softened relative to the Labor Day Golden Week holiday in May (i.e., fading pent-up demand for moving around), but (2) the per visitor spending climbed to the highest level since the onset of the pandemic (i.e., continued recovery in consumption). Separately, one month after the concentrated set of easing measures announced in late August, we still have not seen compelling evidence that these easing measures significantly boosted new property sales. Given the close link between property and consumption, we believe more policy efforts are needed to stabilize the property market and to facilitate further increases in consumer spending.

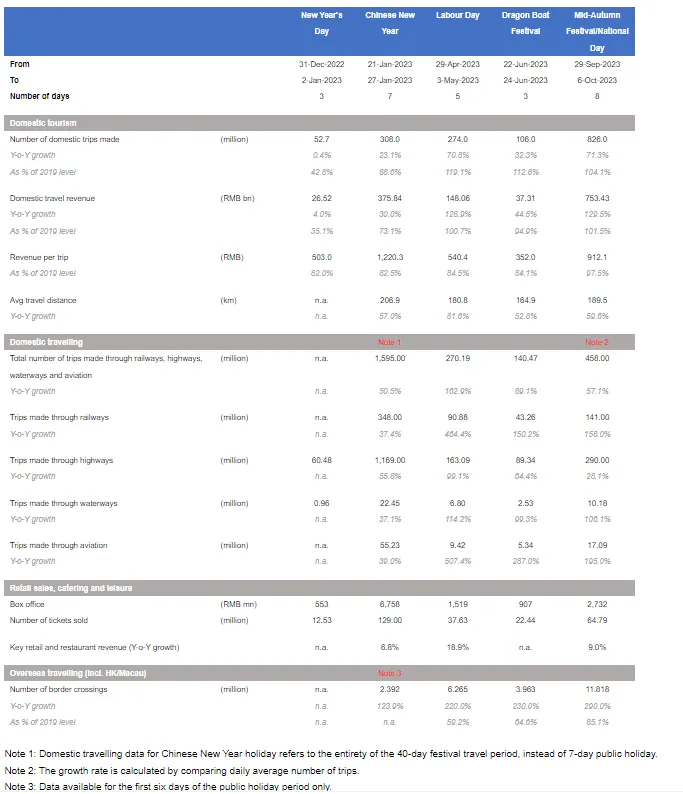

Key data during the 8-day Golden Week in China

Domestic tourism: According to the Ministry of Culture and Tourism, a total of 826m people travelled domestically from Sept 29th to Oct 6th (vs. government target of 896m), translating to a daily run-rate of 103mn or 104% of pre-COVID19 levels, less than government targets of 113%, and 119% recorded during the Labor Day holidays in May. Tourism revenue of RMB753b at 102% of pre-COVID19 level would imply each traveller still spent about 2% less than they used to before the pandemic, though an improvement from -15% in May.

Retail sales: During the first seven days, retail sales of key retail and catering enterprises rose around 9% YoY.

Transportation: Data released by the Ministry of Transport showed that the total number of trips made nationwide through railways, highways, waterways, and aviation reached 458m. On average, 57.3m trips were made per day, implying a YoY increase of 57.1% compared to the same period of last year. Among these, trips made through railways and aviation rose 158% and 195% YoY respectively.

Figure 2: Domestic Tourism

Box office: Nationwide box office was RMB2.73b, rising 81.7% YoY, and the total number of tickets sold was 64.8m. However, the box office revenue was lower than the same period of 2019 to 2021, which ranged from Rmb3.94-4.37b. The weakness at the box office was mainly due to the substitution effect of tourism and the lack of blockbuster names. Year to date, the box office registered a solid recovery, especially during the summer vacation.

Rebound in hotel demand from Sept low. H-World and Jinjiang’s domestic RevPar exceeded the 2019 level by +20-25%/27%. Though not performing as strongly as during the Labor Day holidays (130+% of FY19 levels), both H World and Jinjiang saw their domestic RevPar bounce back from its Sept low of ~100-110% to 120-125% and 127% respectively during the Golden Week holidays, comparable with 132%/~128% and 116%/111% in Jul/Aug during the summer holidays.

Air traffic volume recovery was broadly in line with the authority's previous targets. Airfares retreated from 33% above 2019 levels in mid-September to 13% during the holidays. According to the Ministry of Transport, total daily transport passengers fell -34% vs FY19 levels during the National Day holidays, dragged by a -48% decline in highways (i.e., inter-city buses) since many travellers opted to drive themselves as reflected by the +22% vehicle volume increase on expressways. Total air flight passengers exceeded the FY19 level by 13%. In terms of the breakdown between domestic and outbound travel, according to Flight Master, the number of flights (as a proxy for passenger trends) were tracking at 115% and 58% respectively, broadly in line with CAAC (Civil Aviation Administration of China)'s estimates of 117% and ~60% prior to the holidays. Average air ticket prices for domestic routes normalized to 13% above pre-COVID-19 levels (vs. 33% in mid-Sept) slightly below airlines' guidance of 15-20% due to more supply of flights redeployed from international routes.

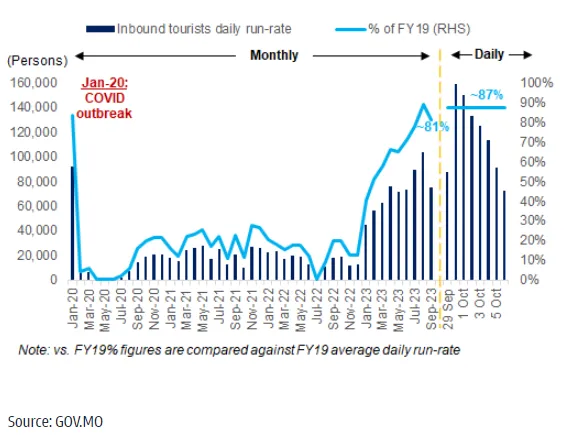

Macau's overall visitation was steady at 87% of 2019 levels led by HK offset by fewer travellers from mainland China. Selective operators saw a steady GGR trend vs. prior weeks. Macau started off the Golden Week with relatively weak visitation (i.e., 88k on Sept 29th) due to overlapping with the Mid-Autumn Festival when people tend to stay at home for family gatherings, but picked up sharply to 159k on Sept 30th. The number held up at above 110k until the last two days (Oct 5-6th). Overall, total inbound visitation added up to 117k or 87% of 2019 level on a per-day basis, in line with the momentum seen in Aug and slightly better than July.

Figure 3: Macau Inbound Visitation Daily Run Rate

Figure 4: Activity Data Comparison

Source: CGS CIMB

Source: CGS CIMB

Overall, the holiday consumption data pointed to a solid start to the 4Q23 economic recovery. It also showed that Chinese consumers are still willing to “spend on experience” after three years of stringent lockdowns, and we expect the release of pent-up demand for leisure activities from the pandemic era could be sustained. We also expect outbound travel, which remained well below pre-pandemic levels, to catch up as we head into next year, particularly during the Chinese New Year (Feb) as well as the further relaxation of visa applications. We continue to like the domestic consumption sector.