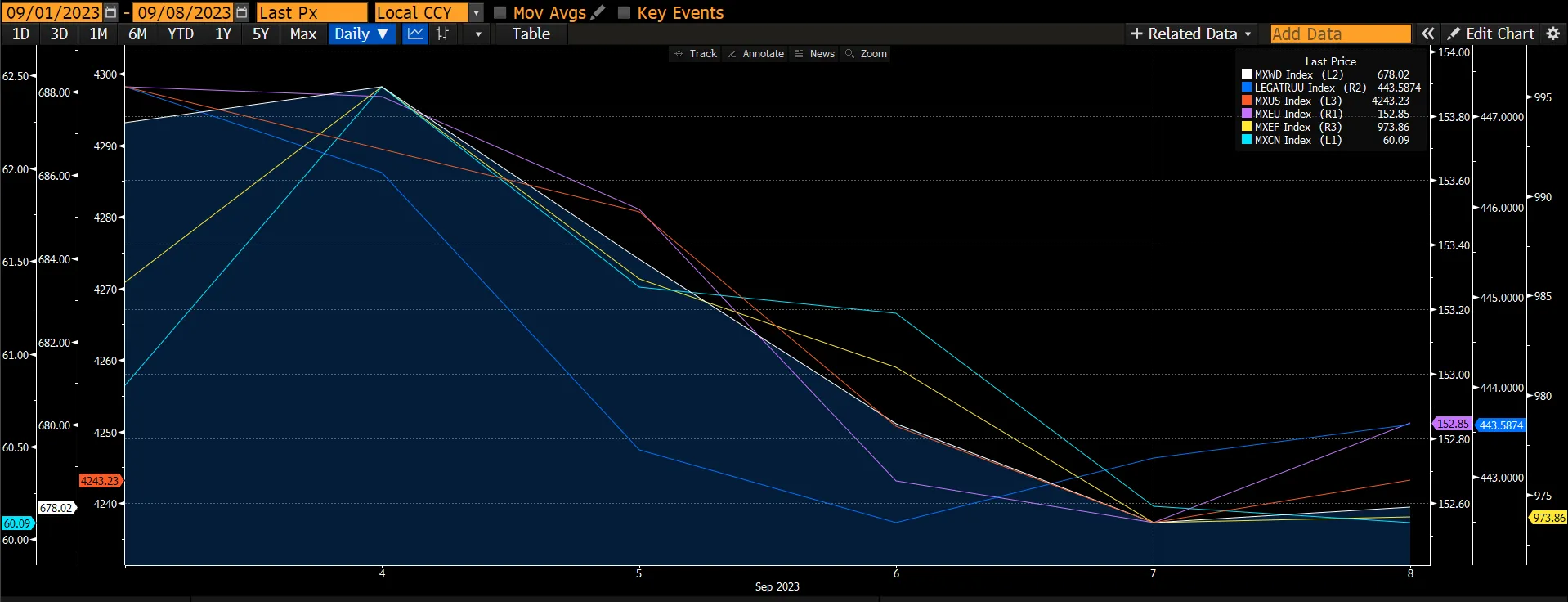

The global equity markets declined by 1.31% due to surging oil prices (+1.7% for the week) and mixed economic data dampening hopes of a dovish stance from the Fed, coupled with China’s ban on iPhone usage in government agencies. The European market declined at a faster rate compared to other developed markets by 1.4% while the US market fell by 1.25%. With the US 10-year rate rising by only 2bps to 4.26% stemming from US ISM PMI hitting six-month high and oil prices hitting YTD high raises the chance of another interest rate hike in the September meeting. The global fixed-income market fell by 0.84%. Despite news of Country Garden avoiding default, NDRC setting up the Private Economy Development Bureau to support the private sector, and Huawei launching the Mate 60 Pro+ smartphone with locally made chips, the China market declined by 1.08%. We believe the decline resulted from continued concerns of China’s sluggish economy as China’s Caixin PMI services came in lower than expected (51.8 vs 53.5 consensus).

Figure 1: Major Indices Performance

Source: Bloomberg

Source: Bloomberg

Spotlight Topic – Apple

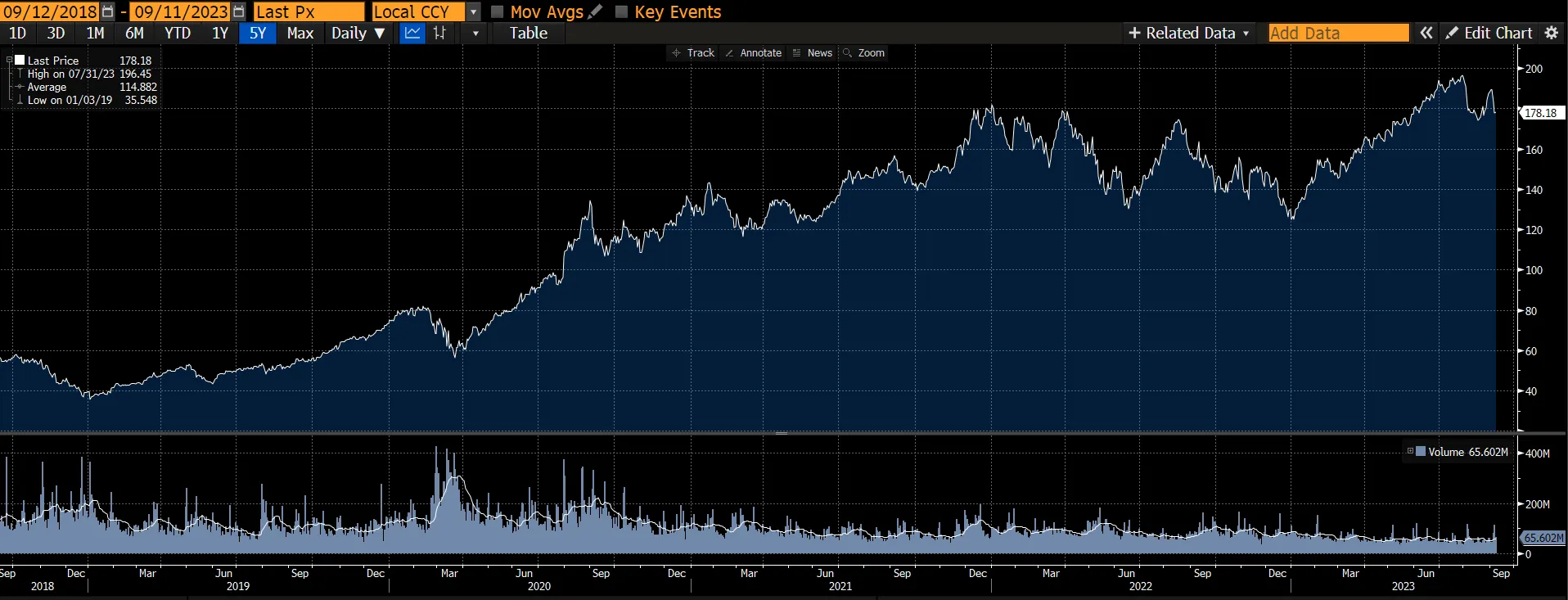

Apple stock historically performs well ahead of the launch of a new iPhone event which is scheduled to be on 12 September. But it's not every year that China shoots down the pre-launch hype. The Wall Street Journal reported on Wednesday 6 September, that Beijing ordered government officials not to use Apple’s iPhones, or other foreign-branded devices, for work. To add fuel to the fire, Bloomberg cited that the restrictions could also be extended to include state-owned companies the next day. Over the two days, Apple’s share price fell by 6.4% before recovering by a mere 0.35% on the third day.

Figure 2: Apple’s Share Price

Source: Bloomberg

Source: Bloomberg

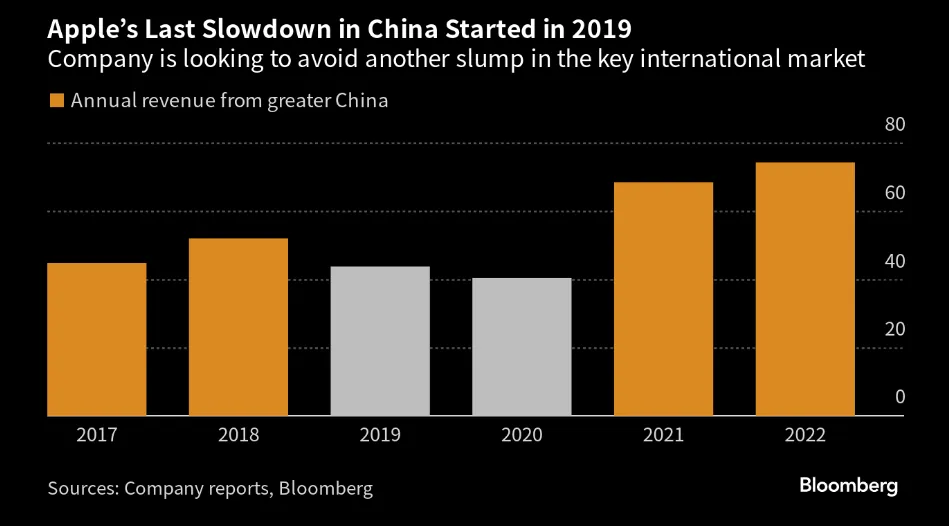

Apple achieved a revenue of US$394b in FY2022 of which about 19% is derived from Greater China. However, 26% of operating income is from Greater China. This suggests that operating margins are higher in China (42%) compared to say America (16%). Although the numbers do suggest that the impact would be significant, we believe the impact is relatively smaller than what is reflected.

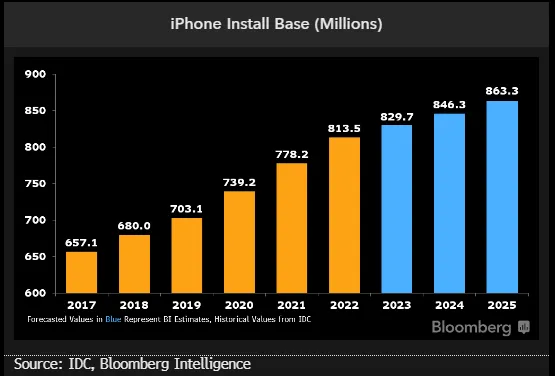

Figure 3: iPhone Global Install Base

We believe the impact would be smaller because,

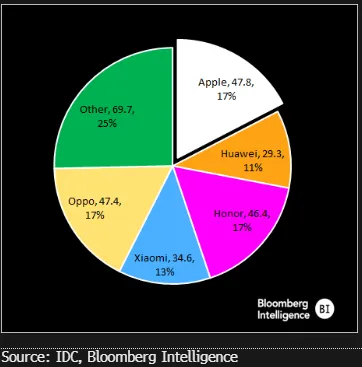

1.The ban is only an at-work ban thus far. It is not hard to imagine consumers feeling under pressure to follow their government’s lead but to assume that the impact of 20% of earnings is merely inaccurate. Moreover, the ban announcement came just days before Huawei released its new high-speed phone where pre-sale demand is high.

2.It is unclear how China would enforce the ban, as some entities may forbid employees from using iPhones just in the work setting while others could opt to ban their usage entirely. Nevertheless, we believe Apple users are “captive” customers.

3.Depending on how deep the ban would be, actions from Chinese officials already signal an escalation of tension with the US, many of which have been playing out in the technological sphere. The US, for example, has moved to limit the sales of some artificial intelligence chips to China. We hold the opinion that China would not want more tit-for-tat measures from the US and Apple.

4.Recall back in May 2022, Beijing ordered central government agencies and state-backed corporations to replace foreign-branded personal computers with domestic alternatives within 2 years, marking one of the most aggressive efforts to eradicate key overseas technology from within its sensitive organs. Apple’s share price fell 17% before recovering meaningfully (10%). Furthermore, it took slightly just over 2 months for the share price to recover back to the same level as before the announcement.

Figure 4: Apple Revenue From China

5.The share price movement over the initial 2 trading days appears to be unwarranted relative to the 4% revenue and 3% EPS downside if Apple were to cede all the share it has gained from Huawei in the high end ($500+ ASP) Chinese smartphone market over the last 3 years or about 18m units.

6.Huawei's 5G smartphone shipments will be greatly limited by supply constraints (and potential further technology restrictions), and iPhone curbs by the Chinese government aren't necessarily new, reportedly having begun as far back as 2020. Apple is also a critical contributor to China's economy, employing - directly and indirectly - millions of Chinese workers through device production, app development, and has helped build an entire supply chain. Said differently, while China is critical to Apple's success, Apple is also critical to the Chinese economy, and therefore while the potential for a broad decoupling between Apple and China in this multipolar world clearly exists, we don't believe recent headlines are necessarily foreshadowing this "worst case" scenario. As a result, we'd conclude Apple's recent stock move is indeed overdone as it implies Apple loses ~70% of its iPhone shipments in China, a highly draconian and unlikely scenario.

Figure 5: China Smartphone Shipment Share

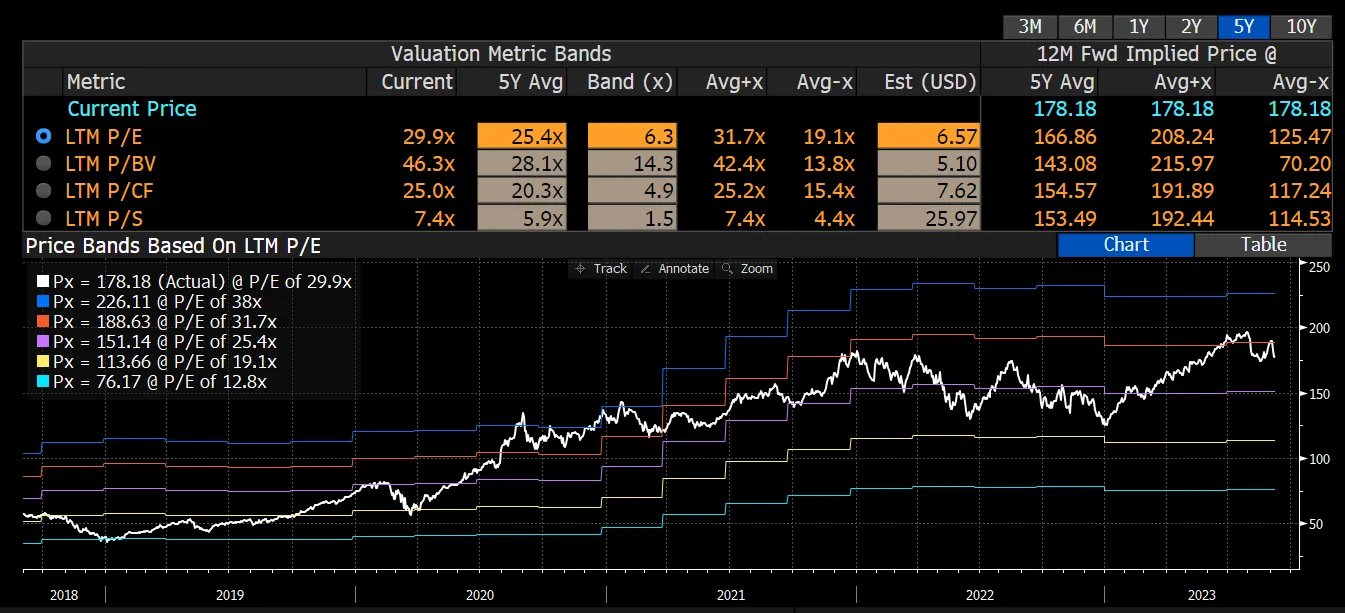

Although the valuation is higher at 30x compared to its 5-year historical average of 25x PE, we see numerous drivers to move the share price higher 1) high investment into AI to provide additional growth avenue, 2) the potential launch of iPhone 15 with a higher selling price, 3) its significant cash hoard, 4) designing category-defining and innovative products, 5) protecting digital privacy, 6) delivering premium services and experience, and 7) strong brand name. We believe that the market’s focus on slower product revenue growth masks the strength of Apple’s ecosystem and associated revenue durability and visibility. Services would be the key driver for Apple going forward, which in our opinion should warrant a higher valuation.

Figure 6: Valuations

Source: Bloomberg

Source: Bloomberg