USA

Equity indexes generally moved higher during a week shortened by the Presidents’ Day holiday on Monday, although the small-cap Russell 2000 Index lost ground. The S&P 500 Index hit new intraday highs, as did the Nasdaq Composite Index, which posted its biggest daily gain in about a year on Thursday, when NVIDIA added a record USD 277 billion to its market capitalization. After Wednesday’s trading session, the chipmaker reported strong quarterly revenue and earnings that topped Wall Street estimates. The company also increased its full-year guidance on robust demand for its chips, which are used in artificial intelligence applications.

The week featured a relatively light economic calendar, with most data coming in roughly in line with expectations.

Europe

STOXX Europe 600 Index climbed to a record level, ending the week 1.15% higher. The benchmark rose as stellar quarterly results from NVIDIA stoked a global rally and demand for technology stocks. France’s CAC 40 Index gained 2.56%, Italy’s FTSE MIB added 3.05%, and Germany’s DAX advanced 1.76%. The UK’s FTSE 100 Index was little changed, reflecting weakness in mining and energy stocks.

European government bond yields broadly rose as investors trimmed bets on the number of interest rate cuts this year after stronger-than-expected purchasing managers’ surveys.

Japan

In a shortened week, Japanese equities ended Thursday at a new all-time high, with the Nikkei 225 Index breaking the previous record set more than 30 years ago in December 1989. The broader TOPIX also finished at its highest level since February 1999, as Japan’s return to steady growth and corporate profitability both continued to underpin confidence. However, it was not all plain sailing, and it took a Thursday rally, ahead of the Emperor’s Birthday holiday, to snap a four-day losing streak.

In the fixed income market, 10-year Japanese government bond yields finished the week at 0.711%, down slightly from 0.725% the previous Friday.

China

Chinese equities rallied as recovery hopes rose following buoyant holiday spending during the prior week’s Lunar New Year holiday. The Shanghai Composite Index rose 4.85%, while the blue-chip CSI 300 gained 3.71%. In Hong Kong, the benchmark Hang Seng Index advanced 2.36%.

Topic of the week – Asian economy prospects in 2024

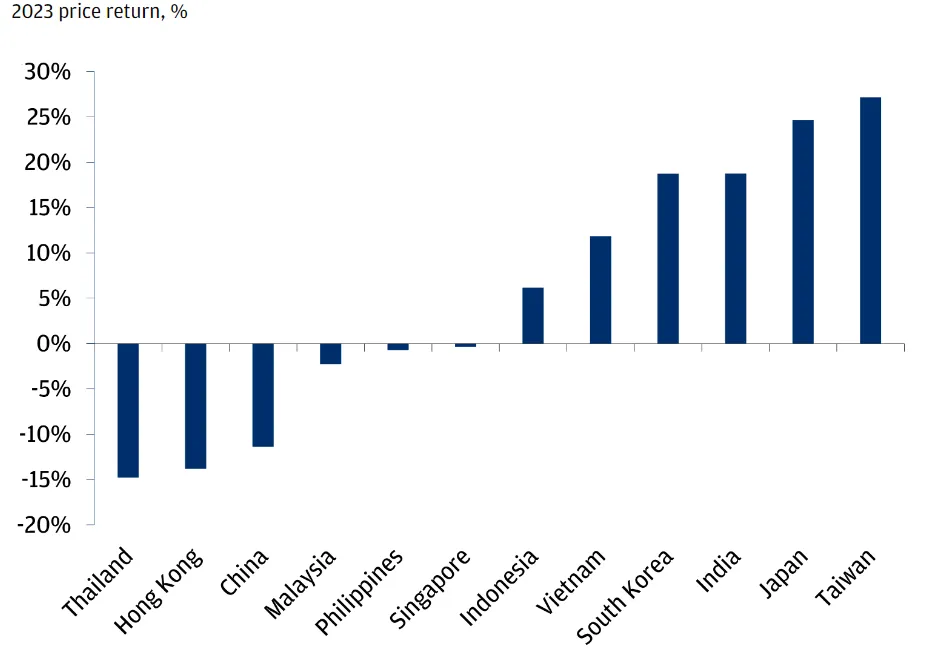

Asian economies faced numerous challenges in 2023 – ranging from aggressive U.S. rate hikes to disappointing growth in China. Against a tough economic backdrop and lingering geopolitical risks, financial market performances were mixed amidst subdued capital flows. Local currencies generally weakened versus the dollar, even as many regional central banks shadowed the Fed’s hawkish stance. That said, the region still had some star performers in 2023. Equity markets in South Korea, Taiwan, India, and Japan saw strong double-digit gains, supported by secular tailwinds and favourable fund flows.

Figure 1. Equity price return for some Asian markets

Source: Bloomberg

Source: Bloomberg

It is expected that 2024 will be a transitional year, with hopes of stability paving the way for a more sustained recovery in 2025. As growth in the developed world, particularly the U.S., is likely to slow into a soft landing, regional export growth could stay challenged in the near-term. A broad-based export recovery may have to wait until global growth can re-accelerate, possibly in late 2024 or 2025.

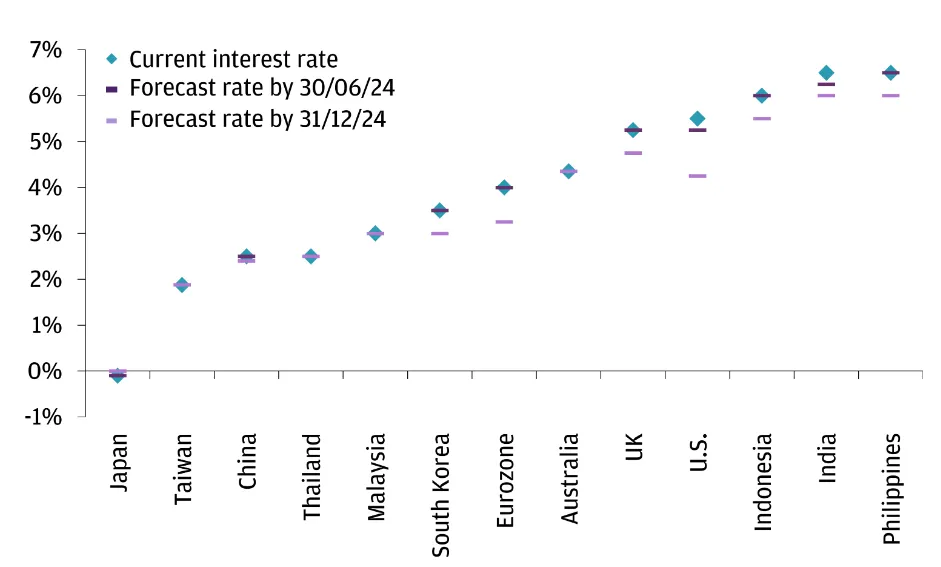

Another potential turning point may come when the Fed starts to ease monetary policy and cut interest rates. This will likely translate into easier financial conditions, and expectations for a potentially weaker USD may help lead capital flows back to emerging markets (EM). Once the Fed is on a durable cutting path, central banks in Asia will likely also have more leeway to ease policy slightly to give local growth a bit more support. India and Southeast Asia to some degree can benefit more in this scenario.

Figure 2. Forecasted change in central bank policy rates

Source: Bloomberg

Source: Bloomberg

In this environment, Emerging Asian currencies may see some additional support as headwinds from elevated energy prices and weak global trade gradually wane. Global financial conditions will likely also ease from highly restrictive levels as major central banks begin moving into a synchronized easing cycle. That said, we may need to wait until the second half of 2024 to see more sustained strength against the dollar.

What about China?

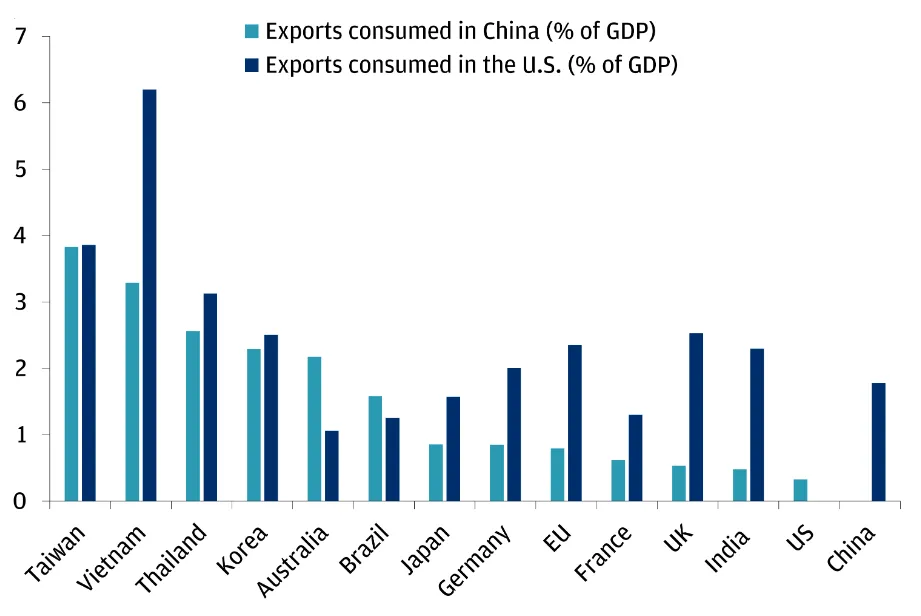

China’s lacklustre growth is a problem for the Asian powerhouse, but also for closely linked economies, particularly Hong Kong. In 2024 China will likely try to manage a transition away from real estate and into other sectors. There still exist a large trade exposure to China.

Figure 3. Trade exposure to US and China as % of GDP

Over the longer term, ongoing shifts in global trade flows that diversify out of China can continue to benefit the region’s economy through increased foreign direct investment and gains in global export market share, particularly for some Southeast Asian economies like Vietnam and Indonesia.

Any assessment of 2024 would naturally involve the spectre of geopolitics and its impact on the region’s economy and markets. Although oil prices have remained relatively contained on the back of strong supply, recent conflicts in the Middle East have led to spikes in shipping rates and concerns of a broader escalation engulfing the region, prompting fears that inflation may yet rear its ugly head again. While the ongoing Russian invasion of Ukraine simmers somewhat in the background, any escalation there could also impact broader commodity prices, in turn re-introducing inflation risks for importers such as India and Japan.