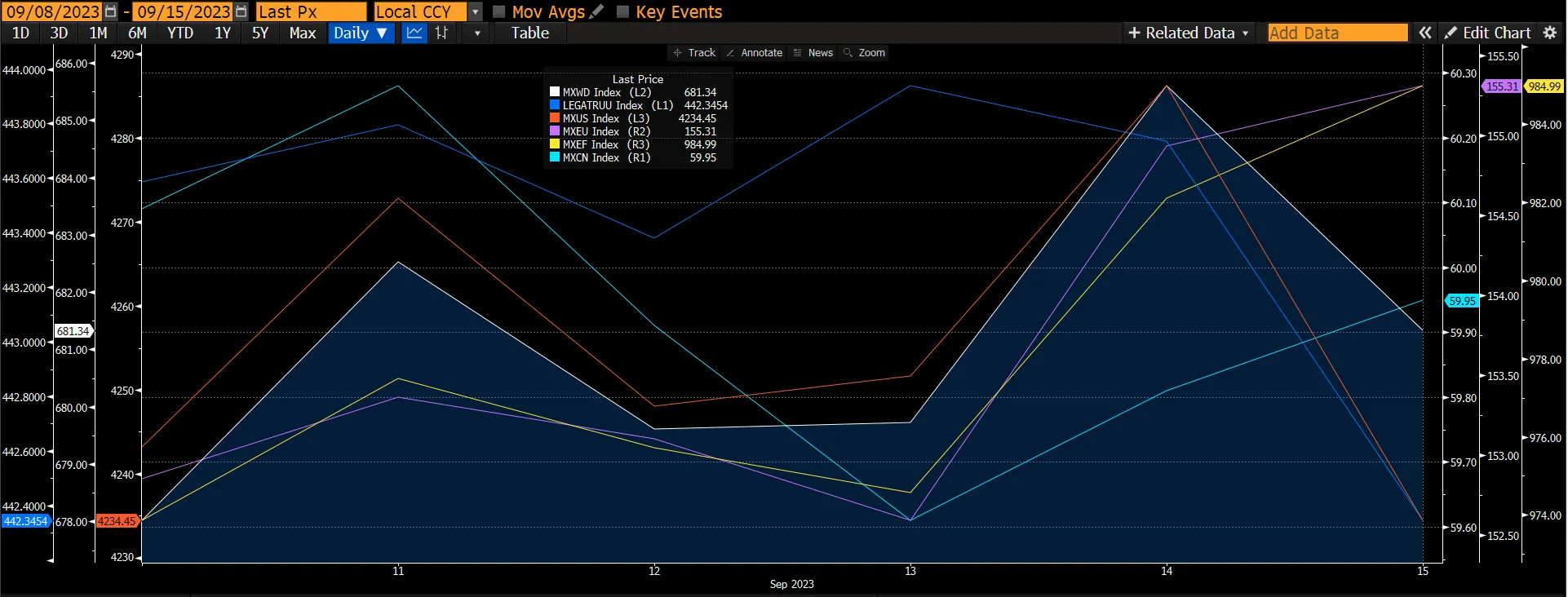

The Global Equity Index traded with cautious optimism ahead of the Central Bank Meetings by rebounding 0.29% this week led by the European and Emerging Markets that rose by 0.41% and 0.36% respectively. The European market rose on the back of higher oil prices resulting in better performance by the energy sector, and economists are expecting the raising of the policy rate of 25bps this week would be the last for this year. The Emerging Markets increased even though the Chinese equity market declined by 0.9% despite the PBOC announcing a 25bps RRR cut to support liquidity demand and better-than-expected activity data which appears to have bottomed in August. Industrial production and retail sales have shown sequential acceleration, and CPI is no longer in deflationary territory. The US market fell by 0.31% as investors digested the hotter-than-expected CPI and PPI which could potentially affect corporate margins/earnings and the Fed’s interest rate decision next week. The global fixed-income market fell by 0.31%.

Figure 1: Major Indices Performance

Source: Bloomberg

Source: Bloomberg

Spotlight topic - Central Banks: where we will see the rates.

For most of the past 12-18M the narrative across central banks has been broadly similar: the large inflation shock required a strong policy rate response with aggressive tightening. As central banks have reached sufficiently restrictive levels of monetary policy and as idiosyncratic macro dynamics start to emerge some policy differentiation is expected to emerge at the late stage of the tightening cycle.

While economies faced similar supply chain disruption post pandemic and suffered from a shock in energy prices as result of the Russia/Ukraine war the resiliency of the growth outlook, the dynamic of the labour market and wages. Broadly speaking it is believed that most DM central banks are completing a journey where the focus will likely shift from the discussion about the peak in the terminal policy rate to the length of the tightening cycle.

Across developed markets central banks, it seems that the ECB last week reached the RBA and Fed in the spectrum of central banks that are close to their peak in the policy rates, with the objective of letting the long and variable lag of monetary policy work to take eventually inflation back to target. It is believed though that the BoE, the Norges Bank and Riksbank are likely to be on the other side of the spectrum, with one additional hike to be delivered in addition to the 25bp expected for this week.

The ECB met last week and delivered a dovish 25bp hike, likely the last of their tightening cycle. This week will also be pivotal for rates markets as central bank meetings are scheduled for the Fed (20 September), the Bank of England (21 September), Bank of Japan (22 September), Norges Bank (21 September) and Risksbank (21 September). The broad message expected from these meetings is that the peak of the tightening cycle is being reached, but pressure for more restriction remains due to persistent inflation.

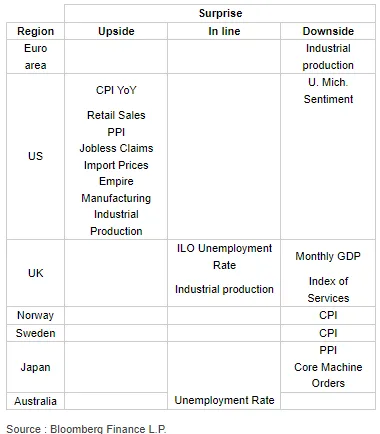

Figure 2: Data releases over the week were mostly tilted to the downside, except for the USA, where data surprised on the positive side.

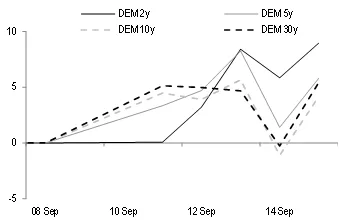

In the Euro area, at last week’s meeting, the ECB raised policy rates by 25bp (tenth consecutive rate hike) and signaled that rates have now reached a level that, kept for a “sufficiently long” period, will make a “substantial contribution to the timely return of inflation to target”. The emphasis in the press conference on the substantial contribution coming from the current monetary policy stance is a clear indication that the ECB is starting its higher-for-longer stance. On future decisions, while they remain in a data-dependent and risk-management mode the strong signal is for policy rates to stay on hold for the foreseeable future and this week’s delivery implies that the bar for a further hike is now higher.

Figure 3: German yields rallied on ECB’s dovish hike delivery on Thursday before retracing back mostly on Friday

Source: Goldman Sachs

Source: Goldman Sachs

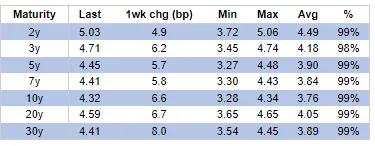

In the US we expect no further rate hike at this week’s meeting and no major changes in forward guidance. The focus will be on the dots – dots are still more likely to show an additional hike, albeit with a smaller margin than in June. It should be also noted, however, that there is also non-negligible risk that dots will show that the Fed has eventually reached the peak. Treasury yields rose 5-8bp last week with the long end underperforming in the process, and yields have retraced to their local and cycle highs seen in late-August. The proximate cause of the move higher was the ongoing strength of the US economy.

Figure 4: Treasury yield are back to high.

Source: J.P.Morgan

Source: J.P.Morgan

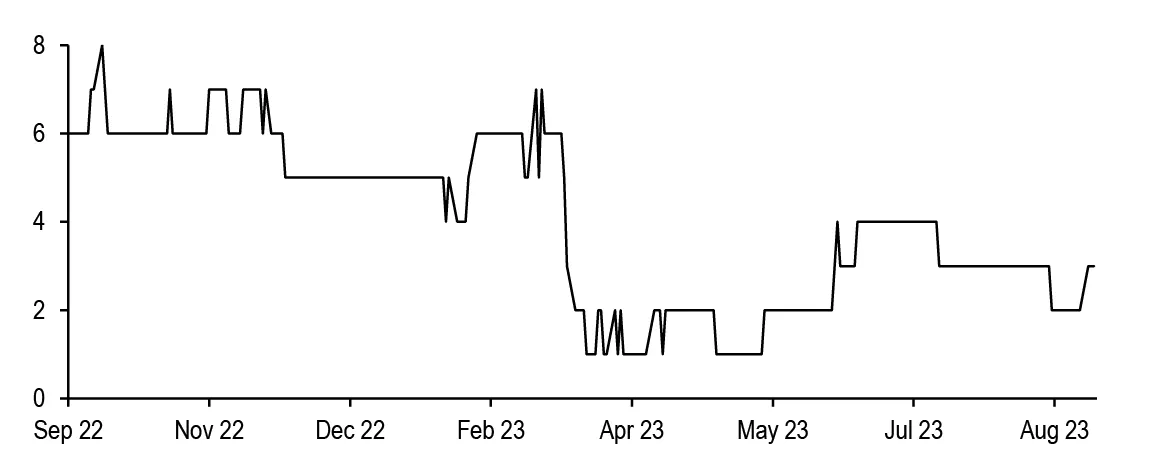

Figure 5: Market believe that time to expected peak in Fed funds effective rate is 3 months (derived by OIS FOMC meeting forwards)

Source: J.P.Morgan

Source: J.P.Morgan

In the UK, it is expected the BoE will fade the noisy activity data and focus on inflation worries, delivering a 25bp hike next week. Indeed, two of the three indicators the MPC is most focused on greater inflation persistence and would point at a 25bp hike. It is believed that there will be unchanged guidance on rates, with the BoE remaining data-dependent and retaining a tightening bias if there is more evidence of inflation persistence.

In Japan, it is expected that the BoJ will keep the current policy setting unchanged at the September meeting, but with a less dovish messaging. Indeed, with inflation remaining elevated, the BoJ will try to balance the risks of remaining behind the curve and moving too early. Forward guidance would likely be revised at the October meeting along with a further upward revision of the inflation outlook.

In Norway, we are convinced that a 25bps hike in September is a done deal. This should be, in our view, the last hike for Norges Bank in the current tightening cycle (terminal rate at 4.25%), although the Committee is likely to leave the door open for a further hike in 4Q – the main driver being the concerns over NOK weakness.

In Sweden, markets are calling that the Riksbank will also deliver a 25bp rate hike in September bringing the policy rate to 4.0%. Similarly, to Norges Bank, Riksbank are likely to leave the door open for another hike in November, avoiding opting for a “high for long” commitment in their communication. The Krona is again the main reason, although the recent (small) rebound in some price indicators is also a concern.