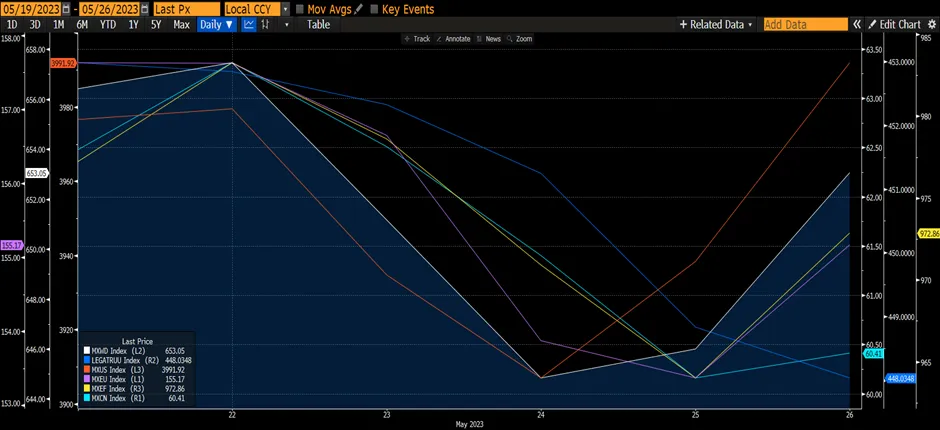

In the latter part of the week, 25-26 May, global markets recouped most of their losses earlier in the week on talks that the US debt ceiling charade is done, and the debt ceiling will be raised yet again (79th time since 1960), as well as positive earnings and guidance from Nvidia. The World Equity Index (MXWD) fell 0.47% despite the MXUS relief rally that allowed it to rise by 0.41%. MXEU (Europe) declined by 2.35% while MXEF (Emerging Markets) fell by 0.41% despite a 3.5% collapse in MXCN (China). Because of the return of the risk-on trade, the Global Fixed Income Indices underperformed Global Equities by declining 1.09%. MXCN saw significant selling pressure as geopolitics remained in focus after the conclusion of the G7 meeting, and concerns over China’s growth weighed on investor sentiments.

Figure 1: Major Indices Performances

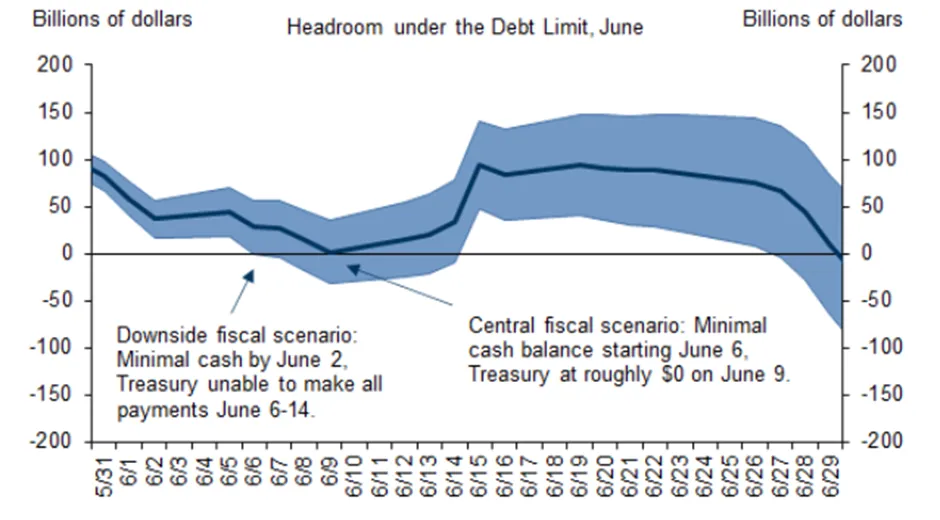

Earlier in the week, in a letter to lawmakers, Treasury Secretary Yellen said “I am writing a note that we estimate it is highly likely that Treasury will no longer be able to satisfy all the government’s obligations if Congress has not acted to raise or suspend the debt limit by early June, and potentially as early as 1 June”. This raised concerns that the government could be heading into a lockdown coupled with operational delays. Nevertheless, negotiators appear to be closing in on an agreement. While it is hard to predict when an announcement could come, the odds are highest that a deal is announced this weekend. If so, this would likely allow a House vote late on either 30 May or 31 May. The Senate also needs to pass the deal, though procedural obstacles there are unlikely to be what prevent timely enactment.

Figure 2: Goldman Sachs Believes That The Treasury’s Room Under The Debt Limit Will Barely Exceed $30b By 2 June

Source: US Treasury, Goldman Sachs

Source: US Treasury, Goldman Sachs

Dampening of the markets further were comments from two hawkish Federal Reserve Presidents that backed two more increases in rates this year, and “if the central bank does pause, it should signal tightening isn’t over”. On the other hand, Mary Daly, the Federal Reserve Bank of San Francisco President, said tighter credit conditions in the wake of recent bank failures in the US may be equivalent to “a couple of rate hikes”. “We do see institutions pulling back on loan volumes and raising loan standards”, suggesting that the economy is slowing and with the risk of a recession rising.

The US markets only recovered on Thursday and Friday (25-26 May) when House Speaker Kevin McCarthy’s optimism that the White House and GOP negotiators would reach a deal in time to avert a potentially catastrophic default and it didn’t mollify analysts as the US was put on a rating watch late Wednesday by Fitch Ratings. McCarthy cited that after a meeting with negotiators and President Biden that “an agreement would be reached and get it done” before the deadline. The market then took the cue and the relief rally started.

Meanwhile, on the back of Fitch’s report, the selling of US government bonds accelerated. The yield on the 2-year and 10-year Treasury notes rose to levels not seen since mid-March, during the depths of the banking crisis. Rates on Treasury bills due 1 June briefly surpassed 7%, comparable to the yield on junk debt.

The US market risk sentiment also turned positive during the latter part of the week following strong earnings and guidance by Nvidia. The company’s 1QFY24 (April) beat the consensus EPS by 18% and more notable, the company’s 2QFY24 (July) revenue guide of $11b (+64% YoY and +53% vs consensus) implying a near-doubling in its Data Centre business on a sequential basis. Management expects growth in the upcoming quarter to be driven primarily by the Data Centre business, and particularly a sharp increase in demand for training/deploying Generative AI and Large Language Models. Investors took this news positively which resulted in Nvidia’s share price surging by 25% in a day.

Figure 3: Nvidia’s Share Price Vs World Semiconductor Index

Source: Bloomberg

Source: Bloomberg

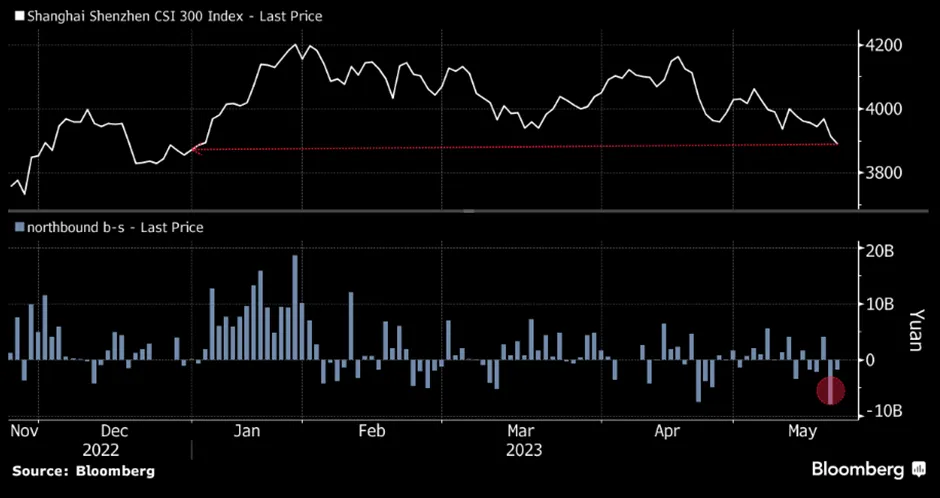

the year, as a weaker yuan and developers’ debt woes added to persistent worries over growth and geopolitics. Chinese stocks have steadily fallen out of favour since a reopening rally fizzled at the end of January. Weaker-than-expected economic data have prompted a slew of Wall Street banks to slash their growth forecasts, while worries over worsening ties with Western countries have also hurt sentiment.

Developers’ financial woes were again in focus with a number of local government financing vehicles struggling to repay debt on time. According to Bloomberg’s gauge, Chinese developers shed more than 2%, falling for the 11th straight session. During the week, a last-minute payment on a bond by a local government-owned firm in southwest China added to concerns about the debt of Chinese property companies. The last-minute payment indicated that Kunming local government financing vehicles’ debt-servicing abilities are weak, and that future on-time repayment of public bonds may not be easy.

Figure 4: China Stocks Slump As Foreigners Flee

The tension between China and the US has heated up again as Beijing banned purchases of Micron Technology’s products on national security grounds. This has sparked further selling of mainland shares by foreign investors after they offloaded more than $1b via trading links with Hong Kong. Investors this year have turned to more thematic trades as the macro environment deteriorated. State-owned enterprises have however witnessed eye-popping gains after regulators called for building a valuation system with Chinese characteristics, a term some interpreted as a signal to boost valuation. AI-related companies also saw frenzied trading earlier this year before enthusiasm cooled.

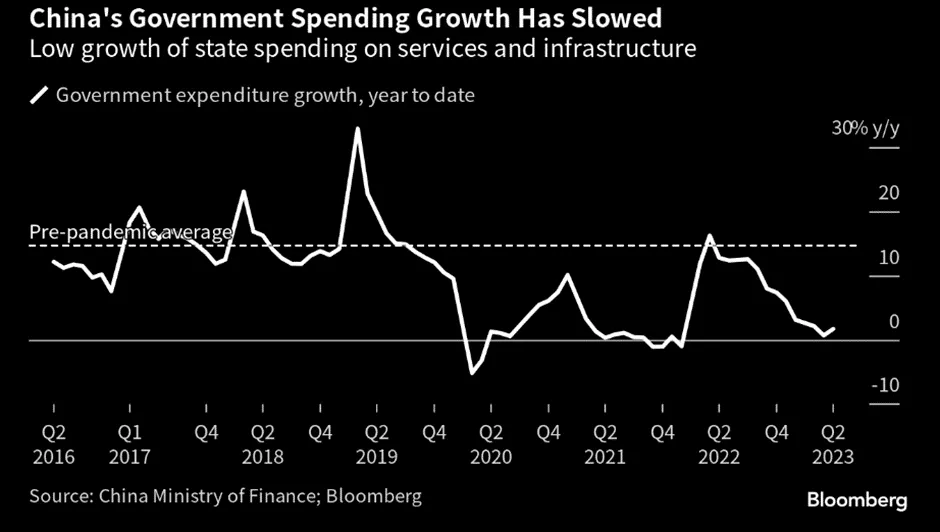

Investors are pegging back their expectations as worries mount that its recovery from pandemic restrictions has lost momentum. Other data suggest that its GDP growth this year will be closer to the government’s target of about 5%, contrary to expectations of a large overshoot formed earlier in the year. The figures also show a lopsided rebound that’s being led by consumer services, while industrial activity lags. Yet economists have raised their GDP forecasts for China to as high as 6% for 2023.

In the crisis-ridden property market, sales are slowing after an initial rebound. Combined with the persistent financial troubles of real estate developers, that’s hampering new projects in a sector that accounts for about 20% of China’s GDP after including related sectors. Infrastructure spending is being constrained by the hefty debt loads of local government. Until adequate liquidity is provided, disappointing construction activity will likely persist in the near future. As such, we also see construction materials and global commodities to be affected.

Figure 5: Commodity Prices Are Softening Due to Concern Of China Demand.

Figure 6: Growth Slowing For Government Spending

In summary, we believe the weakness of the China market will persist, while the US market would see a relief rally as an agreement to raise the US debt ceiling again would be reached before the deadline. All eyes would be on the Fed meeting on 14 June and there is a 59% probability of a rate hike.