US

Stocks ended mostly higher over the holiday-shortened week, although the advance was narrow—an equally weighted version of the S&P 500 Index recorded a modest loss—and heavily focused on growth stocks. Information technology stocks outperformed, helped by a rally in semiconductor shares. Artificial intelligence (AI) chip giant NVIDIA was particularly strong, as was rival Advanced Micro Devices (AMD). Markets were closed Monday in observance of the Martin Luther King, Jr., holiday.

On Tuesday, shares of Dow Jones Industrial Average component Boeing fell sharply after the company reported earnings following an analyst downgrade warning of possible delivery delays in case regulators discover more safety issues surrounding the company’s 737 MAX airliners. The stock recovered most of its decline later in the week, however.

Expectations for rate cuts in 2024 fell sharply over the week, with futures markets pricing only a 13.1% chance of seven or more rate cuts in 2024 as of the close of trading on Friday versus 61.5% the week before, according to the CME FedWatch Tool. Chances of a rate cut in March fell from 81.0% to 47.4%. The decline appeared due in part to comments Tuesday by Fed Governor Christopher Waller, who told a virtual conference that “I see no reason to move as quickly or cut as rapidly as in the past” given the healthy state of the economy.

Europe

STOXX Europe 600 Index ended the week 1.58% lower as comments from central bank policymakers prompted financial markets to scale back bets on an early reduction in interest rates. Major stock indexes were mainly softer. France’s CAC 40 Index fell 1.25%, Germany’s DAX declined 0.89%, Italy’s FTSE MIB eased 0.61%, and the UK’s FTSE 100 Index lost 2.14%.

European government bonds were generally weaker. Yields on Germany’s two-year sovereign note climbed to more than 2.7%, while the yield on Italy’s two-year note increased to 3.2%. In the UK, the yield on the two-year gilt reached 4.2% after data indicated that inflation had accelerated, dousing hopes for a reduction in interest rates.

Japan

As yen weakness prompted strong performance from exporters, Japan’s stock markets rose over the week, with the Nikkei 225 Index gaining 1.1% to reach a 34-year high and the broader TOPIX Index up 0.6%. Further signs of easing inflationary pressure dampened expectations about any shift in the Bank of Japan’s (BoJ’s) monetary policy stance at its January 22–23 meeting. The likelihood of the BoJ exiting its negative rates policy in the near term had already been reduced due to the economic impact of the deadly earthquake that struck Japan’s Noto Peninsula on New Year's Day.

As the chances of an imminent interest rate hike in Japan appeared to recede, the yen weakened to around JPY 148 against the U.S. dollar, from the prior week’s high-144 range. The yen’s rapid decline prompted fresh verbal intervention by Finance Minister Shunichi Suzuki, who said that the government was watching currency moves carefully and that currencies should move stably reflecting fundamentals.

In the fixed income markets, as U.S. Federal Reserve officials adopted a more hawkish tone, the yield on the 10-year Japanese government bond rose to 0.66% from 0.59% at the end of the previous week, tracking U.S. Treasury yields higher.

China

Stocks in China slumped as the latest indicators underscored the weak outlook for the economy. The Shanghai Composite Index, which is popular among domestic investors, fell 1.72%, its eighth weekly drop in the past nine, according to Bloomberg. The blue chip CSI 300 gave up 0.44%, its ninth weekly drop in the past 10 weeks. In Hong Kong, the benchmark Hang Seng Index plunged 5.76%, according to FactSet.

China’s gross domestic product expanded 5.2% in the fourth quarter over a year earlier and for the full year of 2023, meeting Beijing’s official annual growth target. On a quarterly basis, the economy grew 1.0%, up from the third quarter’s 0.8% expansion. Quarterly readings provide a better reflection of China’s underlying growth than comparisons from a year ago, when major cities were still under pandemic lockdown.

Topic on focus – Chinese internet stocks and outlook for 2024

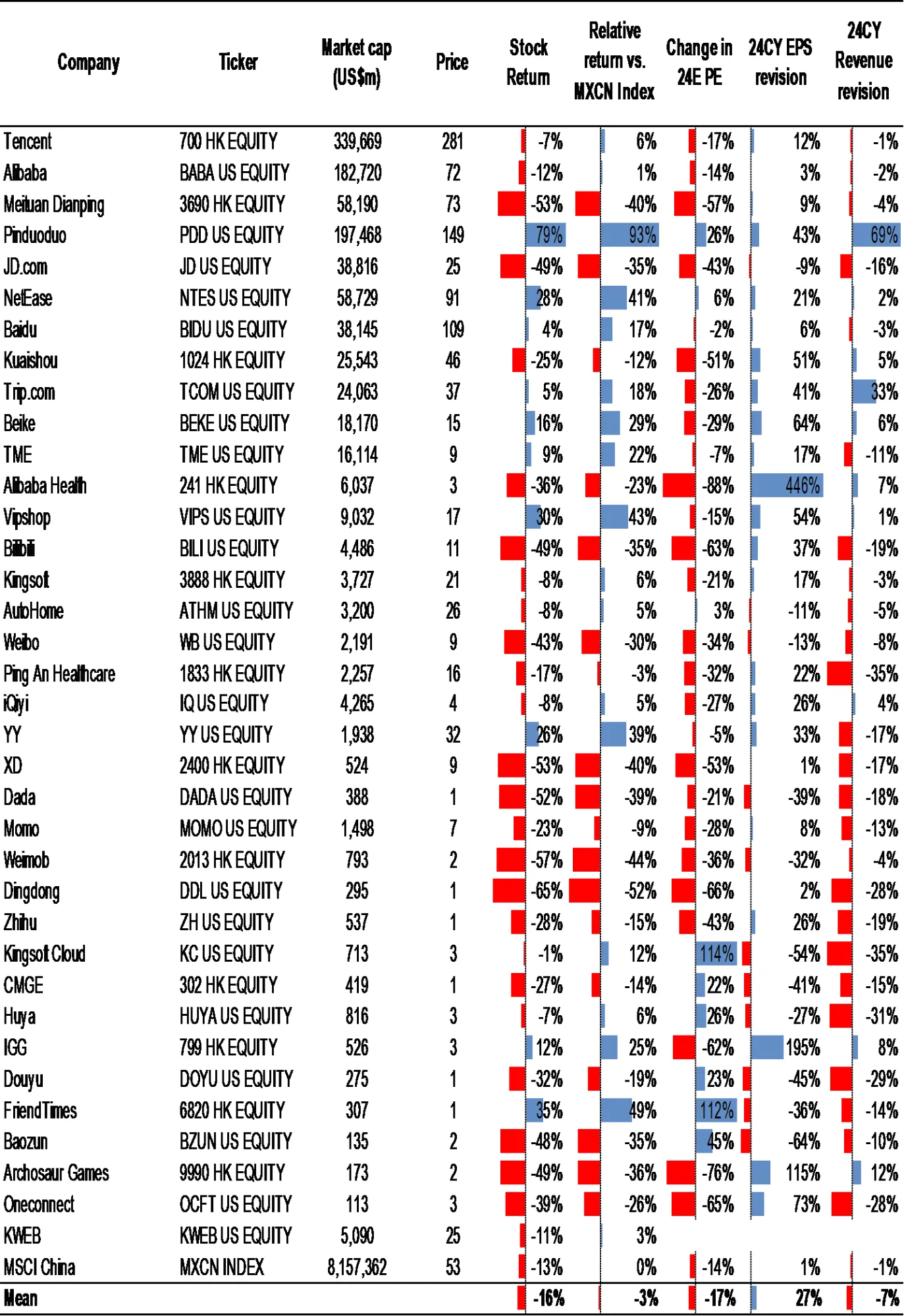

In 2023, China Internet sector share prices were driven more by multiple de-rating than estimate revisions, given the fact that sector average stock return was -16%, on the back of an average 2024E PE multiple de-rating of 17%. Meanwhile, MSCI China de-rated by 14% in 2023. Aside from a general sector-wide de-rating as a result of fund outflow, change in individual stock narrative and investor positioning also played an important role in terms of PE multiple trajectory in 2023.

The sector-wide valuation de-rating could be attributed to:

-

sector-wide fund outflow (i.e. market beta) as a result of weak China macro

-

change in company earnings quality, sustainability or risk (i.e. company alpha)

It is believed that the diverging company alpha significantly widened the stock performance gap in 2023, leading to substantial alpha-driven investment opportunities. We believe such an alpha-driven investment strategy will continue to deliver good risk/reward in 2024.

Positive earnings revisions failed to drive positive share price returns in 2023

At the sector level, in 2023, Bloomberg consensus 2024 earnings forecasts for China Internet stocks were revised higher by an average of 27%, compared to an average revenue revision of -7%. However, the sector-wide positive earnings revisions did not lead to sector-wide positive share price returns, partly due to a valuation multiple de-rating, and partly to diverging share price reaction to earnings revisions vs. revenue revisions, in our view.

Figure 1: In 2023, mid to large-cap China Internet stocks collectively de-rated by 30% against average 57% positive earnings revision for 2024

Source: J.P. Morgan

Source: J.P. Morgan

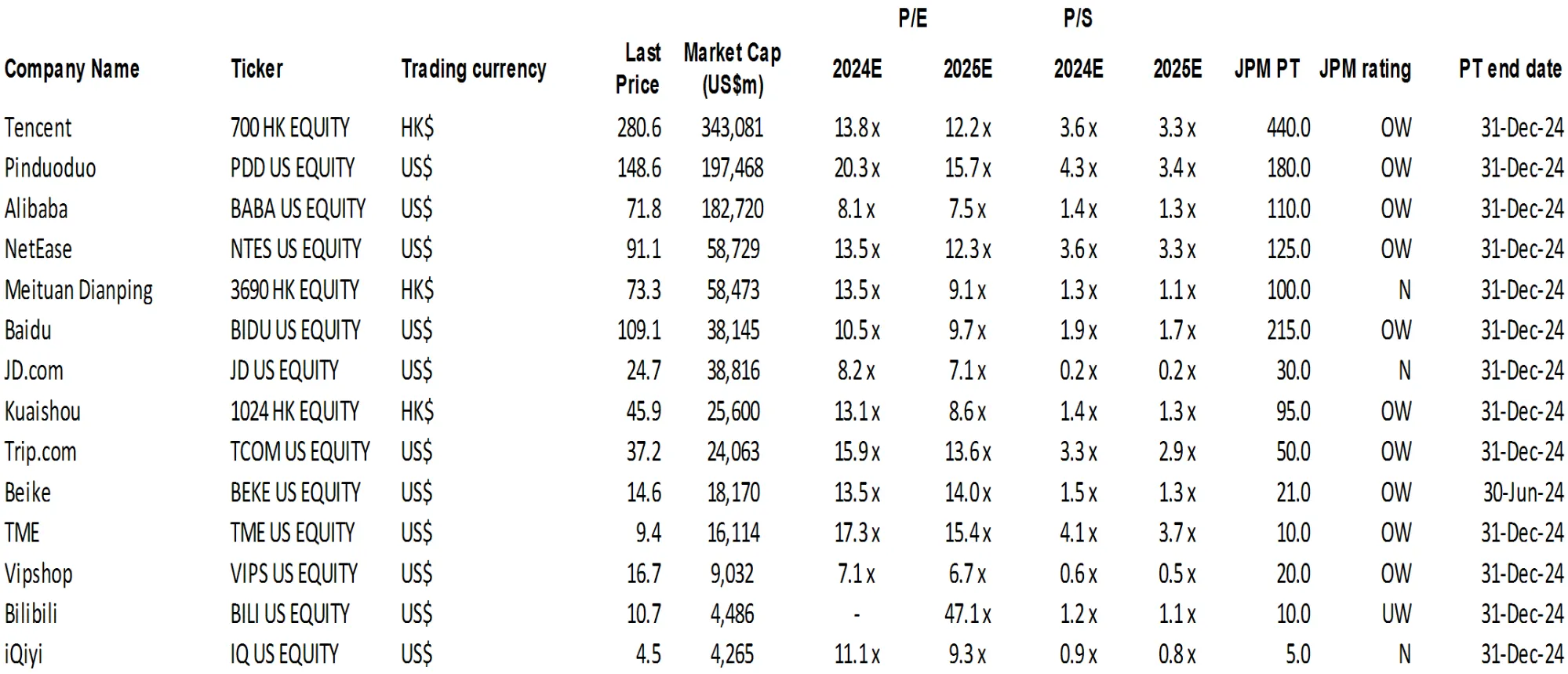

Figure 2: Valuations comparison

Source: J.P. Morgan

Source: J.P. Morgan

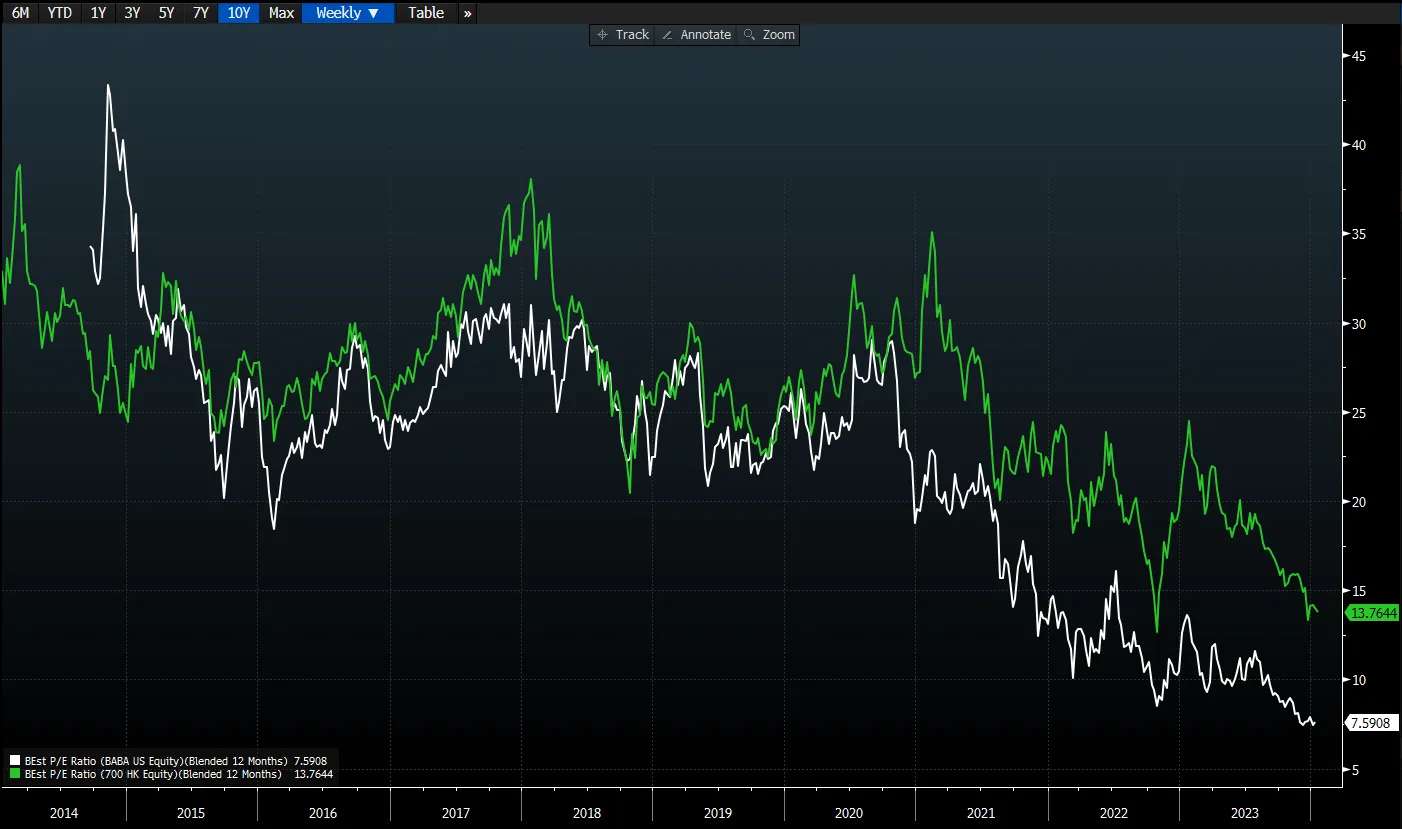

Many of the stocks in the sector have been de-rated to or near historical trough valuations. For example, Alibaba’s forward PE is at a historical trough, and Tencent’s forward PE is 6% higher than its historical trough, based on Bloomberg consensus.

Figure 3: Alibaba trades at historical trough 7.6x forward PE while Tencent trades mere 6% above historical trough valuation

Source: Bloomberg

Source: Bloomberg

Based on fundamentals and possibility of alpha generation Tencent, NetEase, PDD and Baidu look attractive. On the other hand, we believe that Meituan and JD will offer less sound investment results in 2024.