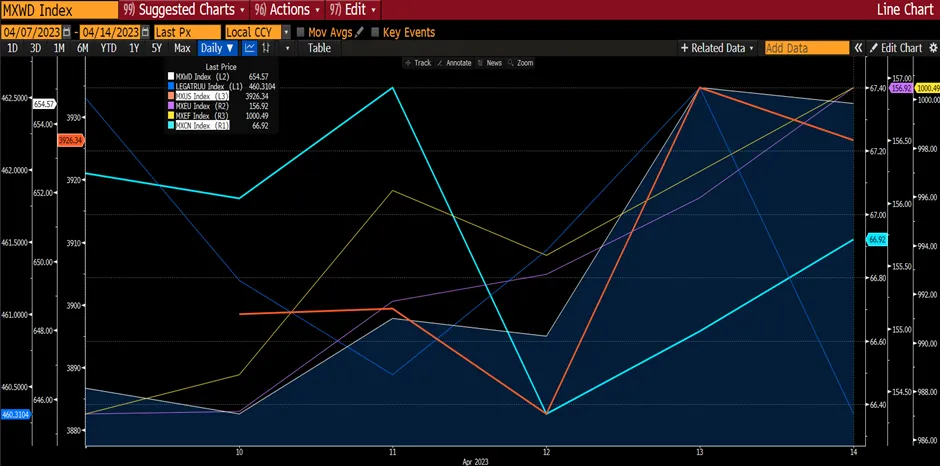

After a month of correction when investors started to fret and de-risk, good news surfaced and drove the global markets higher. Risky assets, MXWD, rose by 1.86%, outperforming the fixed income index which was flat. MXUS rose 2% while MXEU continued to surprise on the upside and rose by 2.25%. Emerging market (MXEF) increased by 1.68%, partly because of MXCN surging by 3.74%.

Figure 1: Major Indices Performance For The Week

Source: Bloomberg

Source: Bloomberg

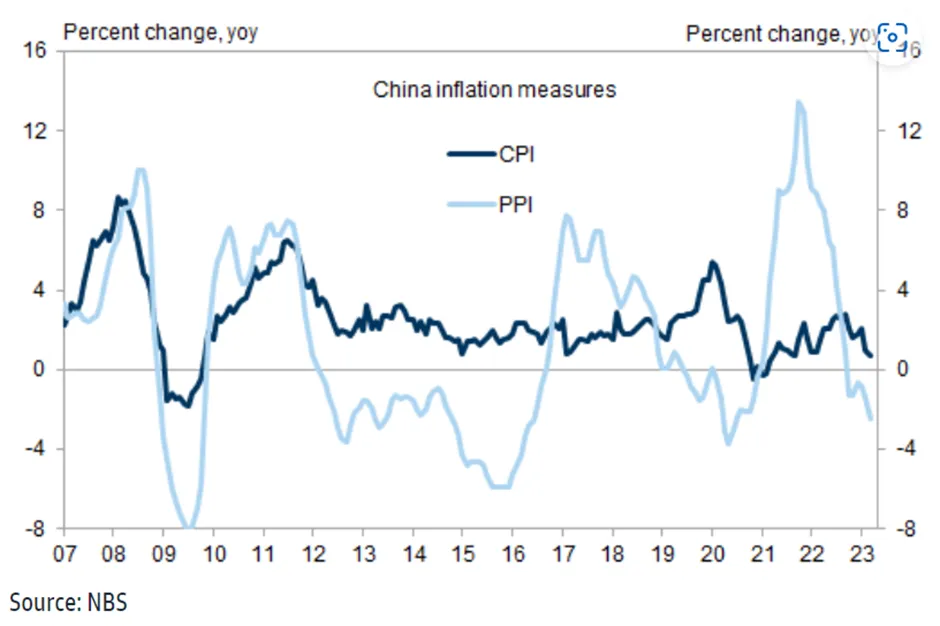

China manufacturing activity recorded its highest monthly improvement in more than a decade in February as factories reopened after the Lunar New Year holiday, giving more support to an economic recovery that has so far relied heavily on retail and services. The manufacturing PMI rose to 52.6 last month from 50.1 in January 2023. This is the highest reading since April 2012 and exceeded the economists’ mean estimate of 50.6. The non-manufacturing gauge – which measures activity in both the services and construction sectors – increased to 56.3 from 54.4 and better than the expectation of 54.9. NBS commented that business operations and customer demand accelerated on the dissipation of lunar new year impact and the removal of zero Covid policy. Overall, February data offer the most complete picture of how China’s economic recovery is shaping up. The government’s proclamation that Covid is “basically over” has spurred more travel and spending as movement curbs and other restrictions were removed. Top leaders have pledged to prioritize growth this year, placing an emphasis on domestic demand to drive the recovery. On that morning when the data was announced, HKCEI rose +5% on the back of this positive news as well as shorts were getting squeezed out. The cheering was however short lived with the index declining by 0.83% the next day.

The data suggests China's economy is recovering faster than top officials had expected. Seeing how nicely the economy is recovering, market fears that Chinese leaders could restrain on its stimulus packages that are expected to be announced during the National’s People Congress (NPC) meeting on Sunday onwards. Many are expecting monetary and fiscal policy to remain supportive nonetheless this year, although the chance of a big stimulus package would be low.

Figure 2: China’s PMI Surprise Economist

Over the weekend at the widely watched NPC meeting (5 March), President Xi announced that China’s GDP target for 2023 would be around 5%, the lowest in history (besides 2022 3% growth and below pre-Covid guidance of 5.5%). This is also slower than some bulge bracket economists’ expectation of mid 5%, which is somewhat disappointing given that PMI was surging giving an initial outlook of the economy.

Many questions will be asked and are concerning such as why is Xi’s administration setting such a low bar and being conservative? Does it mean the regulatory restraints are not yet over? China will curb disorderly expansion in the property sector. Is US curbs (CHIPS policy, adding more Chinese companies to the entity list) affecting China's economy harder than expected? Anecdotal evidence like the anti-corruption drive in the state-owned financial services industry picked up pace, ensnaring star bankers and deal makers. Essentially, in our opinion, we believe China is merely regulating and controlling its growth target and the bulk of the 5% would be led by domestic demand. During the meeting, Premier Li said boosting domestic demand, a reference to consumer spending and business investment, would be the government’s top priority this year, while imports and exports would steadily increase.

Figure 3: China GDP and Forecast Trend

The national budget released on Sunday suggests fiscal support would be restrained. The target for the headline deficit- based on a narrow definition of government revenue and spending – was raised to 3% of GDP for this year from 2.8% last year. However, local governments are likely to scale back major investments, with a smaller quota for special local bonds, used mainly to finance infrastructure projects. We believe this could slow infrastructure spending and it will impact global commodities demand and industries like steel and cement.

On China’s property market, which drives as much as 20% of China’s GDP, Premier Li hinted that Beijing would continue to support housing market while also regulating the sector more tightly and prevent “unregulated expansion of the market”. He also vowed to support privately owned businesses, encourage foreign investment and “boost market expectations and confidence” – a pledge that may appease investors after confidence plummeted last year following repeated Covid lockdowns and the fallout from unpredicted regulatory crackdowns on sector such as education, Internet platforms, and real estate. That said, we noted that the crackdowns for Internet platforms have somewhat eased but reviving competition, which is expected to intensify.

As the NPC meeting continues into next week, many will re-assess the comments and guidance provided. We believe during this period, MXCN would likely be volatile.

Figure 4: Economic Data Comparison

Source: Bloomberg

Source: Bloomberg

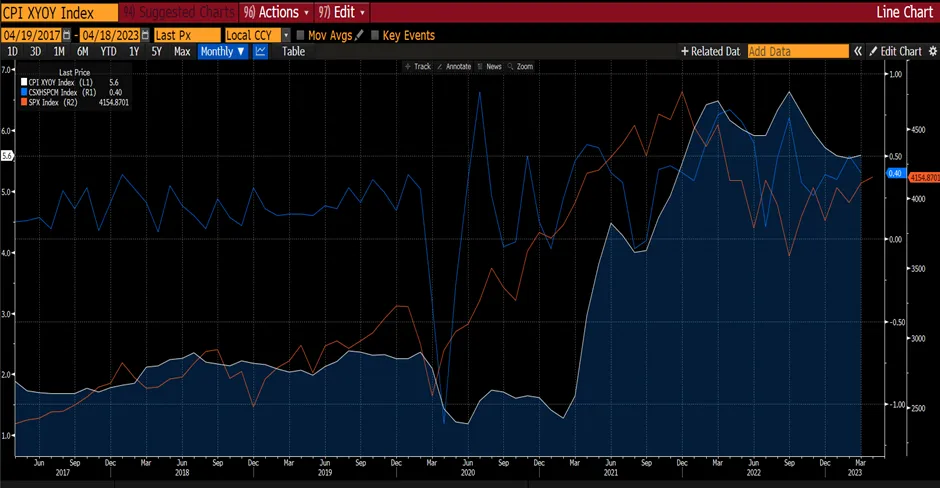

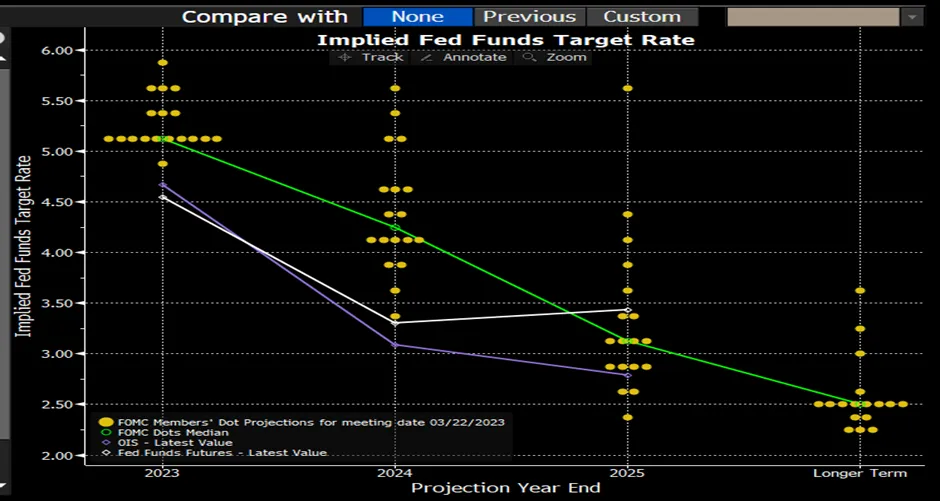

Meanwhile across the globe, US equities ended on a positive note as market sentiments shifted towards a 25bps interest rate hike instead of previously feared the Fed reverting to 50bps hike in March. Labour market data will be a key focus this week with hiring expected to cool, prompting the Fed to maintain a smaller rate hike pace.

On 2 March, the US Department of Commerce added another nearly 30 Chinese entities to the “Entity List”. Once a company is added to the entity list, its US suppliers must seek a special license to ship even low-tech items to it. This on-going feud between US/China will likely continue for the foreseeable future creating geopolitical tension and hampering markets. Nevertheless, we see the impact on the US and China to be limited at this point of time as the companies that are added onto the list thus far are relatively small and pose no threat to the index. Moreover, President Xi has vowed to boost high end manufacturing in face of US pressure – “the manufacturing industry must always be a pillar of strength for China”. China wants to ensure its self-reliance in technology, fostering small and medium sized enterprises and build global centres for innovation.

In a recent survey by Bloomberg, two-thirds of the 404 professionals and retail investors surveyed suggest that cash in their portfolio would bolster rather than drag to their portfolio this year. That cash holds such allure says a lot about the unsettled financial and economic environment. Fear of a potential bear market, continued rate hikes, and a looming recession have investors nervous and worried that 2023 could be a reprise of 2022’s brutal hit to portfolios. Morgan Stanley’s chief US equity strategist told Bloomberg that the S&P 500 Index could fall around 20% due to weak corporate earnings. Against this backdrop, cash is indeed a safe haven, in particular with recent yields on short term Treasury Bill high enough to beat the classic 60/40 portfolio of stocks and bonds. Even high yield saving accounts have interest rate close to 4% now thus making cash deposit more attractive at this point of time. However, S&P 500 has since corrected by a mere 5% since its peak on 2 Feb 23. We believe these side-lined cash would eventually return to the market on better fundamental and economic outlook to drive the market higher.

Figure 5: Investors Prefers Cash To Ride Out The Correction

In summary, investors would be re-assessing China’s “conservative” GDP target and hence performance would likely be volatile next week. Nevertheless, the target and the policy stance are broadly supportive for the equity market. The key objectives set out in the NPC meeting appear to be positive for the manufacturing, internet, and consumer related sectors while slightly negative for the banking sector which may need to lower profit margins and further support the property sector. The telecom, automation and software sectors may also benefit from the increase in focus on the digital economy and in transforming the supply chain. As the market corrects after a strong run from October 2022 till January 2023, and the economy is forecast to continue to grow at a faster rate in 2023, it does present a good opportunity to be constructively positive on the China market.