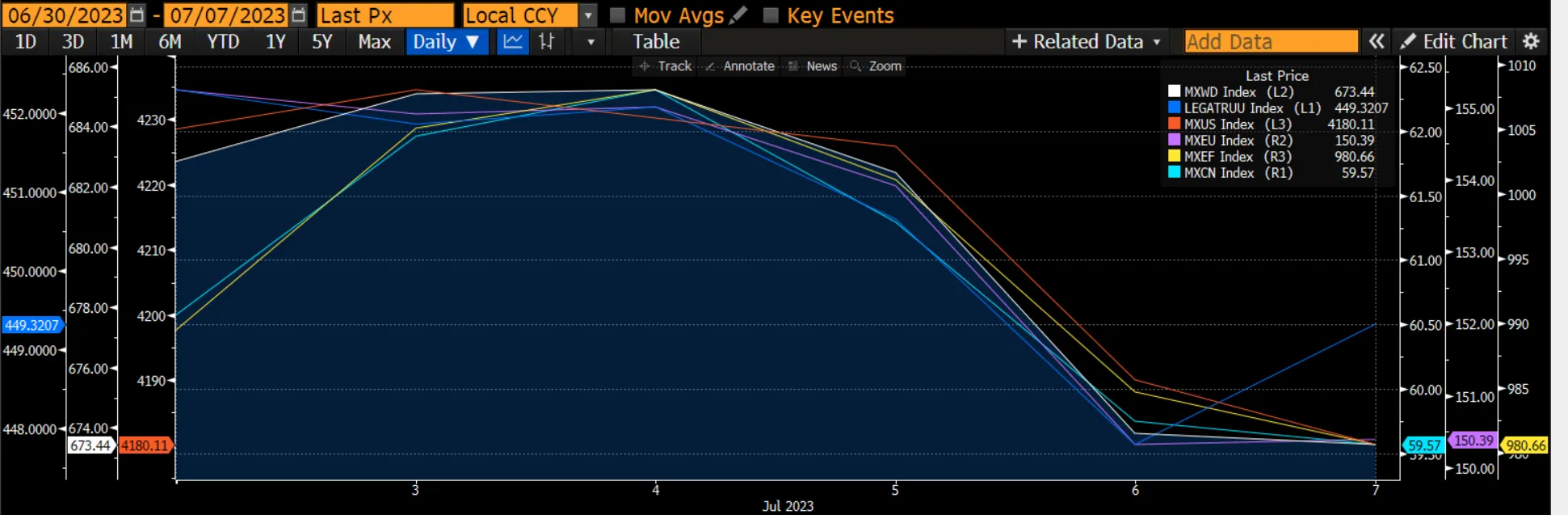

The global equity market tumbled by 1.31% on cooling growth signals, concerns about the upcoming earnings season, and geopolitical tension between US and China. Europe (MXEU) and US (MXUS) markets led the decline by 2.59% and 1.11% respectively. Emerging markets fell by a lesser extent of 0.6% despite the Chinese market dropping 0.86% for the week. The global fixed-income market outperformed the global equity markets by declining just 0.66%. The decline was due to indications of further rate hikes to come.

Figure 1: Major Indices Performances

Source: Bloomberg

Source: Bloomberg

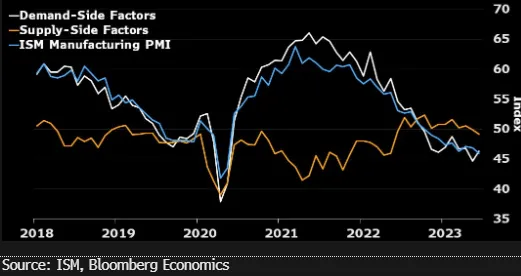

The headline US ISM purchasing managers' index fell to 46.0 in June - its lowest level since May 2020 - which bodes poorly for industrial production. Idiosyncratic boosts to industrial production growth - such as April's surge in auto production - have staved off negative year-on-year growth, but softening survey data suggest a contraction in annual production is imminent. A decline in manufacturing employment dragged down the headline PMI. The employment sub-index had been fluctuating in neutral territory, and we hesitate to read too deeply into a single data point. Still, with the June jobs report looming, the ISM data may begin incrementally weighing on payroll forecasts.

We think the data ultimately reflect softening demand for core goods. The question remains whether producers can avoid accumulating excess inventories, and - therefore - price cuts as demand continues to wane.

Figure 2: US ISM PMI Slowing

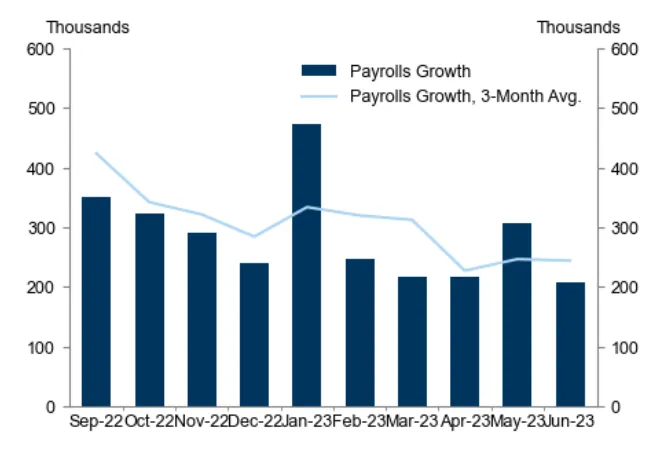

The effects of raising interest rates should begin to have an impact on the labour market. Nonfarm payrolls rose 209k in June, 21k below consensus and the first miss in fifteen months. Revisions were negative as well, and the three-month average pace now stands at +244k, down from +283k as previously reported. The household survey was somewhat stronger, with the unemployment rate retracing one-tenth of the May increase to 3.6%, driven by a 273k gain in household employment. However, the underemployment rate surprisingly rose two-tenths to 6.9%. Average hourly earnings surprised on the upside at 4.4% YoY (vs. 4.2% expected). We would expect the FOMC to hike by 25bp in July despite signs of weakness in the labour market.

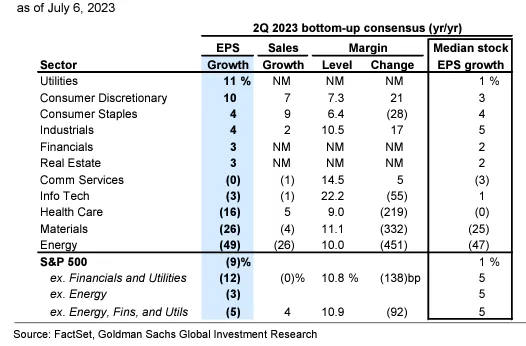

The earnings season will begin next week, and consensus expects a 9% YoY decline in S&P 500 EPS driven by flat sales growth and margin compression. Nevertheless, negative EPS revisions for 2023 and 2024 appear to have bottomed and revision sentiment has improved. Key areas to look out for this quarter's earnings season would be 1) margins, 2) the impact of the banking crisis on credit and lending, 3) AI, and 4) consumer demand.

Figure 3: Payroll Growth Slowing

Source: Department of Labour

Source: Department of Labour

Figure 4: S&P500 2Q23 Earnings Expectations

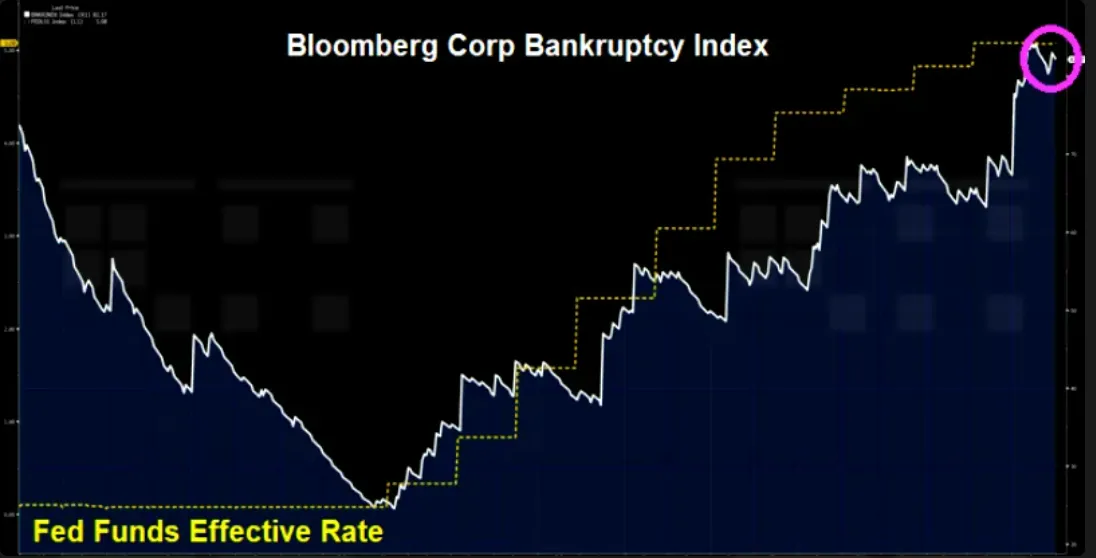

Figure 5: Bankruptcy Index

Source: Bloomberg

Source: Bloomberg

The minutes of the June FOMC meeting noted that “almost all” participants judged that keeping the federal funds rate unchanged was “appropriate or acceptable,” while “some” participants either preferred or “could have supported” a 25bp hike in June. “Many” participants judged that “a further moderation in the pace of policy firming was appropriate” to allow the Committee to gather more information on the “effects of cumulative tightening” and “assess their implications for policy.” The Fed staff continued to expect the economy to enter “a mild recession,” although it now saw the possibility of the economy avoiding a recession as “almost as likely as the mild-recession baseline.” Participants noted that “banking stresses had receded and conditions in the banking sector were much improved since early March,” although they continued to expect tighter credit conditions to “weigh further on economic activity.” Participants again characterized inflation as “unacceptably high” and stressed that declines in core inflation measures had been slower than expected. Thus, it has become increasingly clear that the Fed will continue to hike rates in the second half of the year, with consensus expectations set at two more hikes, taking the Fed funds rate to 5.5%-5.75%, with the ‘dot plot’ (the average rate forecast of Fed officials) sitting at 5.6%.

We see the tension between US and China continue to intensify despite recent visits by Anthony Blinken and Janet Yellen to China yielding positive talks. Earlier in the week, according to an article in the Wall Street Journal, the US was preparing to bar US firms from providing cloud services that use advanced AI processors to Chinese customers. The Biden administration has already banned the export of advanced chips used in the development and training of AI from export to China, as part of the ongoing trade war. In response, China imposed restrictions on exporting two metals that are crucial to parts of the semiconductor, telecommunications, and electric-vehicle industries in an escalation of the country’s tit-for-tat trade war on technology with the US and Europe. According to the article, the potential cloud computing restrictions are viewed by national security experts as the closure of a loophole that would have let Chinese companies obviate export restrictions on the chops themselves by paying for access to them via cloud service.

The two metals, Gallium and germanium, along with their chemical compounds, will be subject to export controls meant to protect Chinese national security starting Aug. 1, China’s Ministry of Commerce said in a statement Monday. Exporters for the two metals will need to apply for licenses from the commerce ministry if they want to start or continue to ship them out of the country and will be required to report details of the overseas buyers and their applications. China is the dominant global producer of both metals that have applications for electric vehicle makers, the defence industry, and displays. Gallium and germanium play a role in producing several compound semiconductors, which combine multiple elements to improve transmission speed and efficiency. China accounts for about 94% of the world’s gallium production, according to the UK Critical Minerals Intelligence Centre.

Still, the metals aren’t particularly rare or difficult to find, though China’s kept them cheap, and they can be a relatively high cost to extract. Both metals are byproducts from processing other commodities such as coal and bauxite, the base for aluminum production. With restricted supply, higher prices could draw out production from elsewhere.

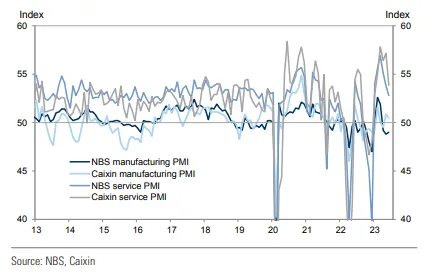

Chinese data continues to show slowing economic growth. China’s Caixin service PMI fell notably from 57.1 in May to 53.9 in June. Nevertheless, by historical standards, this reading indicates a still healthy rate of growth. But compared to the previous few months, the deceleration is considerable. After averaging the NBS and Caixin numbers, the gap between services and manufacturing PMIs has shrunk from a peak of 6.4 in April to 3.6 in June.

Figure 6: Service And Manufacturing PMIs Gap Narrowing

Next week, we will see June inflation (Monday), trade (Thursday), and money/credit data (Friday). The market is expecting inflation to remain weak (headline CPI 0.1% YoY), exports to stay under pressure (-9.5% YoY), and total social financing (TSF) growth to decelerate further (TSF new flows of RMB 3.3t and TSF stock growth of 8.7% YoY). If the data are in line with expectations, it would suggest more policy easing is warranted given the anemic aggregate.

On the fixed income front, the US, UK, and eurozone government bond yields rose sharply over the week as bonds weakened. At 10-year maturities, US Treasury yields rose 19 basis points to breach the 4% level for the first time since early March. German bund yields increased more, rising 22bps to 2.61%, while UK gilt yields rose 27bps to above the levels reached during the crisis in October 2022.

The inversion between US short and long rates widens to its greatest level for over 40 years. The negative yield gap, or inversion, between two-year and 10-year Treasuries, increased to over 110 bp during trading on Monday, its highest level since 1981 and above the level breached in March during the mini-banking crisis., with two-year yields increasing more than 10-year yields. The widely watched measure is regarded as a bellwether indicator of the likelihood of recession and its widening reflects the market’s increased concerns for recession ahead.

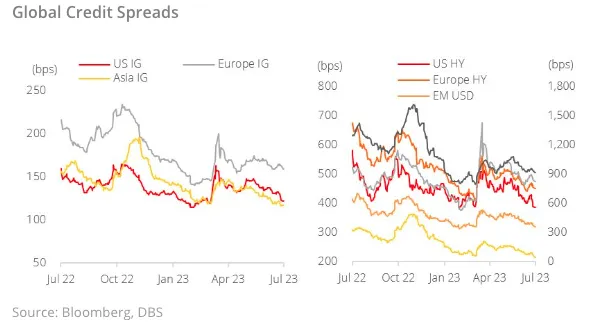

The week saw credit spreads tightening across major bond indices, reversing the previous week’s widening. Credit spreads tightened most notably in HY markets (Asia, US, Europe), against resilient economic data from the US. IG spreads remained relatively flat week-on-week.

Figure 7: Global Credit Spreads

For fixed income, we, therefore, recommend overweight to short-dated bonds. We remain defensive in our credit positioning and higher in credit quality. We expect that credit spreads will widen to account for slowing growth and recession risks.