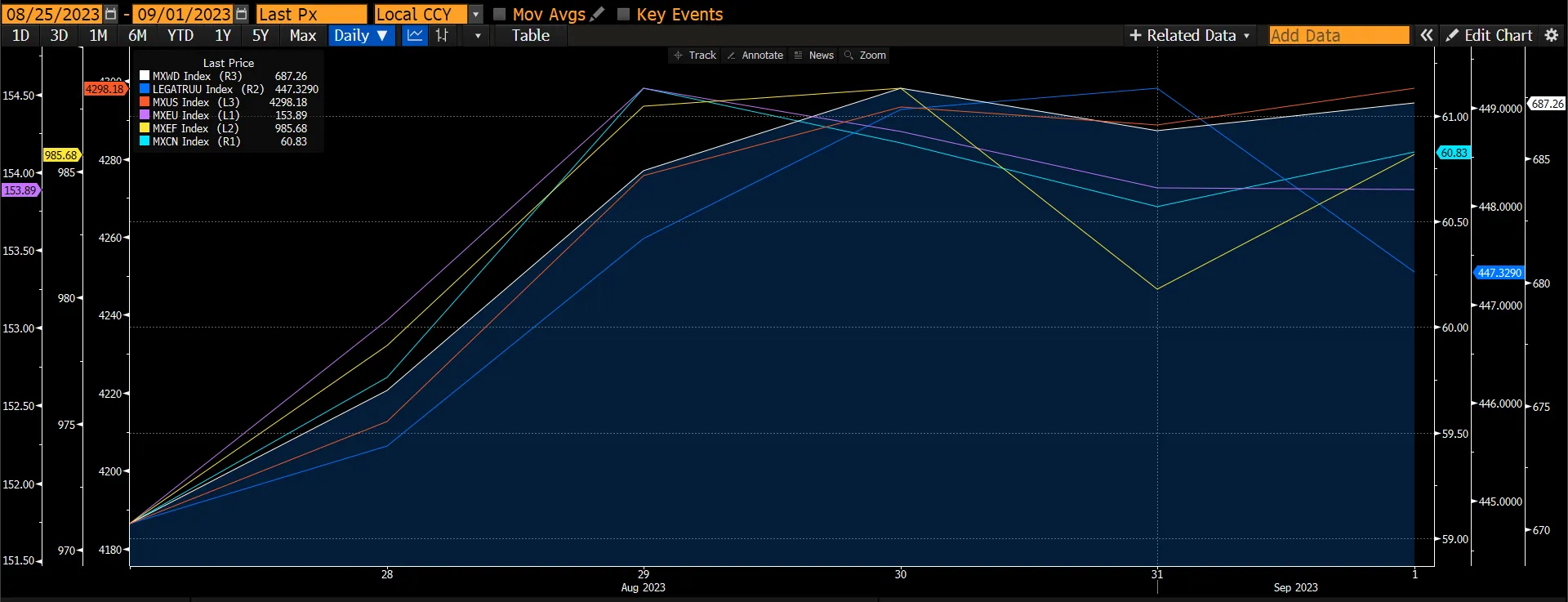

The global equity market continues to recover from the initial sell-off/correction in the first 2 weeks of August on the back 1) lower-than-expected US non-farm payroll, 2) higher unemployment, and 3) the Chinese government implementing two key policies to stimulate housing demand and Country Garden has temporary ease investor on default concerns by speculation of it having wired a coupon payment for its Malaysian Ringgit bonds. The global equity market rose 2.59% driven by China and the US rising by 2.97% and 2.72%. The European market also rose but at a slower pace of 1.32%. The global fixed-income market underperformed the global equity market by rising a mere 0.58%.

Figure 1: Major Indices Performance

Source: Bloomberg

Source: Bloomberg

Focus Topic – China Property Stimulus During the week, China moved to allow its largest cities to cut down payments for homebuyers and encouraged lenders to lower rates on existing mortgages in its latest attempt to halt a slide in the country’s residential property market.

The nationwide minimum down payment will be uniformly set at 20% for first-time buyers and 30% for second-time purchasers (vs 20-30%/40-80% adopted by major cities previously). The minimum mortgage rate for second homes is set at 20bps above 5-year LPR, down from previously 60bps above, and major cities’ prevailing rates of 60-105bps above. Furthermore, mortgage rate cuts can be negotiated between banks and customers to reduce the rates of their outstanding first home mortgages, via revising mortgage contracts or replacing existing loans with new ones (at a new rate no lower than the policy floor of the first home mortgage rate of the time when and where the mortgage was initially issued.

Recently, the four mega tier-1 cities also issued mortgage easing measures: Guangzhou announced it would determine buyers' mortgage qualification based on the number of homes owned not mortgage incurred; Shenzhen issued a similar notice to disregard past mortgage records when deciding whether to buy a first or second home. Shanghai and Beijing both announced they would follow suit the next day.

Figure 2: Chinese Housing Sales Fell In August

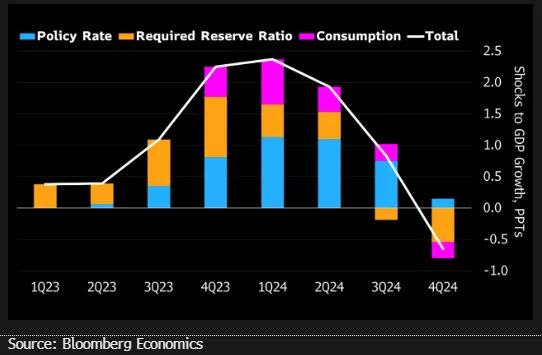

According to some analysts, the mortgage rate cuts announced by China's regulators are bigger than envisaged and are well designed to stimulate consumption while avoiding inflating more property bubbles. The new guidance sets the floor for mortgage rates on a household’s first property at the loan prime rate minus 20 bps. On average the mortgage rate will fall by 80 bps, according to the newspaper affiliated to the PBOC.

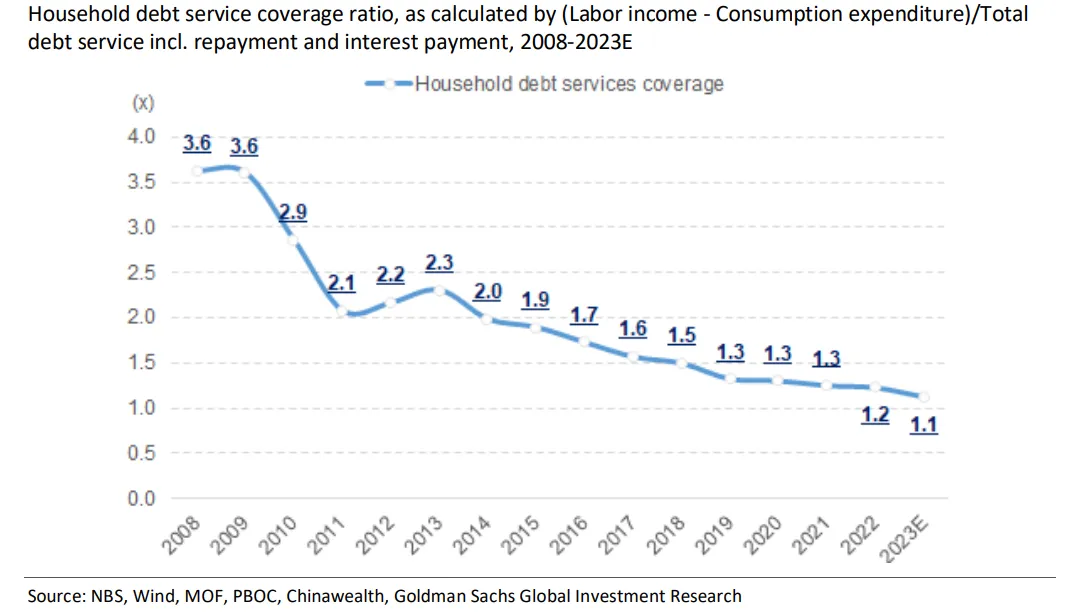

The moves will also likely boost property sales, alleviate buyers' liquidity pressure, and improve market sentiments. Although we view these moves as favourable, we are inclined to believe these stimuli are merely just “kicking the can down the road” and expect more policy stimuli to come. Nevertheless, it is evident that the government is making a clear effort to rescue the housing market. According to Bloomberg Economists, they estimate that the measures can release household purchasing power of around 0.24% of GDP - equivalent to a 15bps cut in the policy rate.”

The stimuli have however also sparked conflicting interpretations on their effectiveness, as economists gauge President Xi’s willingness to strengthen stimulus measures to combat a downturn that’s put Beijing’s 5% growth target at risk. China’s real estate market, once the emblem of robust growth, is currently facing notable challenges. Country Garden, a leading property developer in China, recently reported significant financial loss and missed bond payments, sparking industry-wide concerns. We have been seeing numerous economists revising their GDP forecasts down to about 5% in recent months suggesting pessimism in the economic growth.

Figure 3: Rates And Consumption

Figure 4: Household Debt Service Cap

How should one position in China? We would advise investors to remain cautious and be selective in China. Invest in quality companies with a strong business model and strategy. We like companies in the consumer sector and would avoid the property and banking sectors for now. Furthermore, sentiments for China are still relatively weak as suggested by the selling of China (Northbound) shares by foreigners.