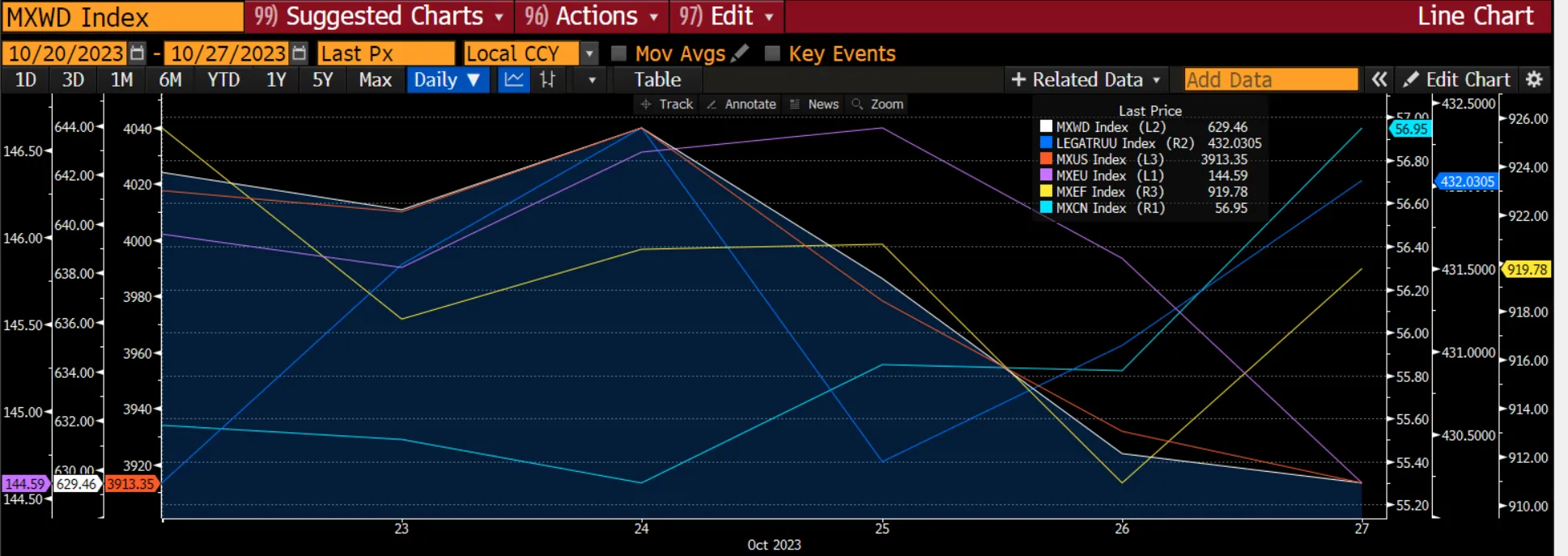

The global equities markets fell by 1.95%, the second consecutive week of decline. The decline is attributed to downside earnings surprises (Alphabet and TSLA) and the risk of the Israel-Hamas war intensifying. Despite better-than-expected 3Q US GDP and lowered PCE, the US market fell by 2.59% while the European market fell by 1.03% as it was affected by the European Central Bank (ECB) higher-for-longer rates sentiment. The S&P 500 is now in correction territory. The emerging markets fell by 0.61% despite the Chinese market bucking the trend by rising 2.52% for the week. The strength in the Chinese market was largely due to the NPC standing committee approving a RMB1t additional Central government bond issuance quota to support infrastructure investment and increasing its budget deficit from 3.0% of GDP to ~3.8% to support the economy while Hong Kong relaxed measures for residential property. The global fixed-income market rose 0.42% due to risk-off sentiments and the 10-year yield declined from 4.91% to 4.83%.

Figure 1: Major Indices Performance

Source: Bloomberg

Source: Bloomberg

Topic in focus – EM local bonds

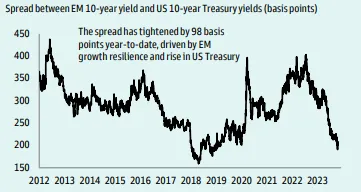

EM local bond valuations have turned less compelling. The main reason is the central banks’ ongoing process of disinflation that led to further gains of emerging market (EM) local bonds as more central banks participated in the rate-cutting cycles. The sharp rise in US 10-year yields has compressed the differential with EM local bond yields, but we see continued opportunities, in particularly for active management.

Notwithstanding a narrower rate differential between EM local bonds and US Treasuries, we believe there are still value propositions for EM local bonds. This view is based on the combination of high starting real rates and the progress of disinflation which signifies more policy easing in certain EM local bond markets than what is currently priced in. Also, further fiscal tightening could reinforce disinflation and thus support front-end EM local bond performance. In some economies, tighter fiscal policy in early 2024 may also reinforce disinflation by slowing growth, thereby creating more room for rate cuts in the second half of next year. The IMF projected that many EM economies will hike rates early next year - Hungary, Colombia, Czech Republic, Chile, and Brazil. That said, it can be recognised that domestic political pressures may challenge the IMF’s estimates. Furthermore, some EM economies like Poland and Romania are projected to see relatively limited fiscal tightening, while others such as Mexico are set to engage in fiscal loosening. These divergent paths underscore the importance of the need for active management.

Figure 2: Spread Between EM And DM Is Tight

Source: Goldman Sachs

Source: Goldman Sachs

Risk premium remains attractive in certain long-end EM local bonds. While the cyclical direction of fiscal policy can have implications at the front end of the EM curves, medium-term fiscal dynamics tend to drive yields further out of the curve. The fiscal standing in some EM economies is concerning, such as South Africa and Brazil, where high debt levels are expected to be higher in the coming years. Elsewhere, debt levels that may be low presently are set to rise as well. However, there are also economies like Hungary where debt levels are likely to decline and combined with disinflation and improving the balance of payment dynamics, these should support local bond performance relative to other economies in Central Eastern Europe.

The Israel and Palestine conflict has added additional uncertainties, as markets weigh in on whether this would have a broader implication for global economies or merely it will be contained locally. It is assumed that this will remain locally contained, but armed conflicts are inherently uncertain and headlines and developments over the coming days and weeks would keep markets on edge.

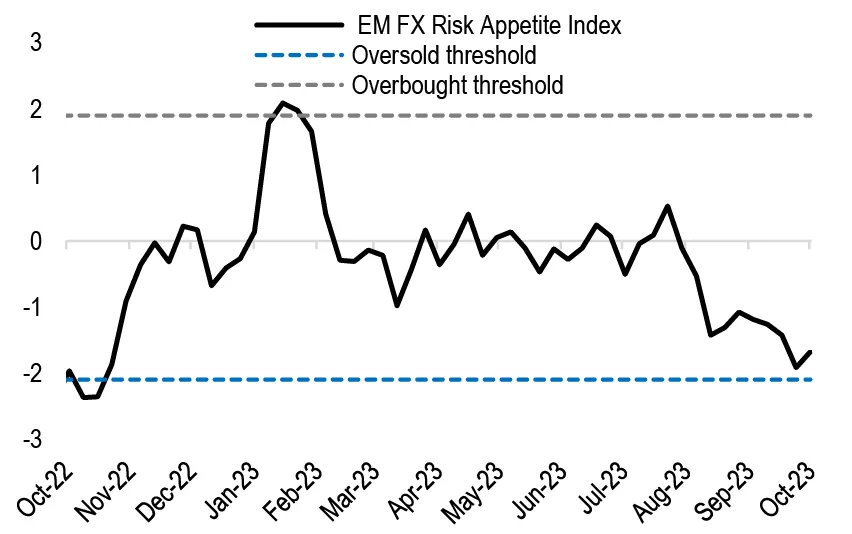

EM FX appears to be oversold; hence we expect them to converge back to average levels in the coming months. The 2024 EM fiscal budget estimate is projected to be 4% (down from 4.4% currently), whilst the expected US government budget deficit is standing at 7% according to the IMF. We, therefore, believe the above-mentioned factors would make EM local bonds attractive despite recent spread tightening.

Figure 3: EM FX Appears To Be Oversold

Source: Goldman Sachs

Source: Goldman Sachs