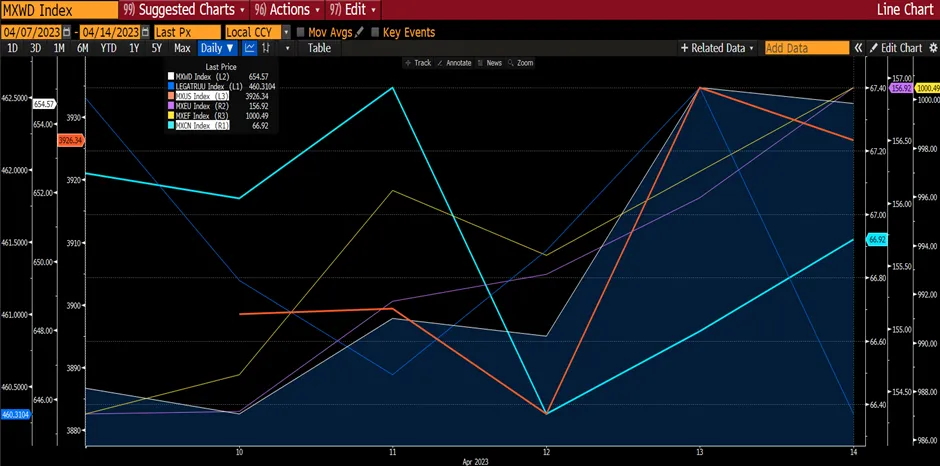

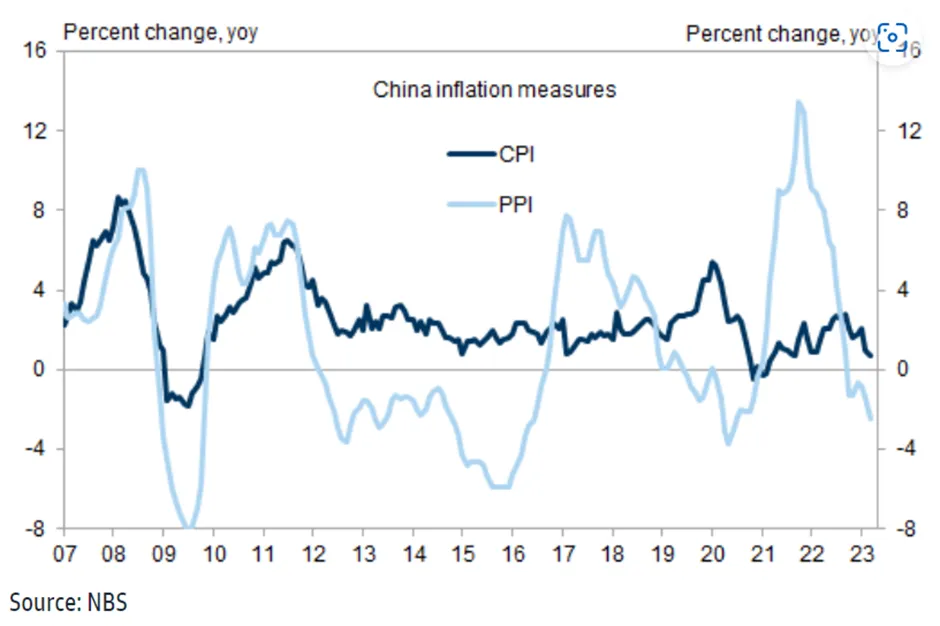

Fears of a recession continue to hamper the market following the Fed, ECB and BOE citing that rate will continue to trend higher to fight the stubbornly high inflation across the globe. Because of the volume thinning out to the run-up of the festive seasons and the lack of major news flow, liquidity has shrunk and has therefore amplified the rate of decline in global markets. It is clear that Central Banks will continue to hike interest rates for at least the next 3-6 months. In our opinion, they have turned less hawkish or in this sense could be dovish. But a pivot will unlikely happen until the recession arrives or after they have paused their rate hikes in 2H23. For the time being, one should invest under the scenario of slower rate of interest rate hike and higher risk of a recession. For the week, MXWD fell by 0.27% with MXCN rising by 0.14% and MXUS declining by 0.81%. MXJP, although fell 2.34% in local currency terms, rose 0.64% in USD terms.

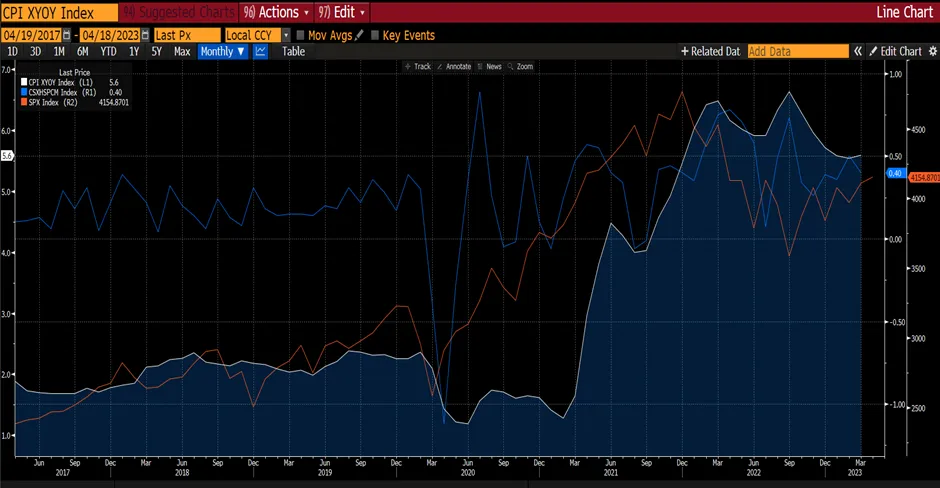

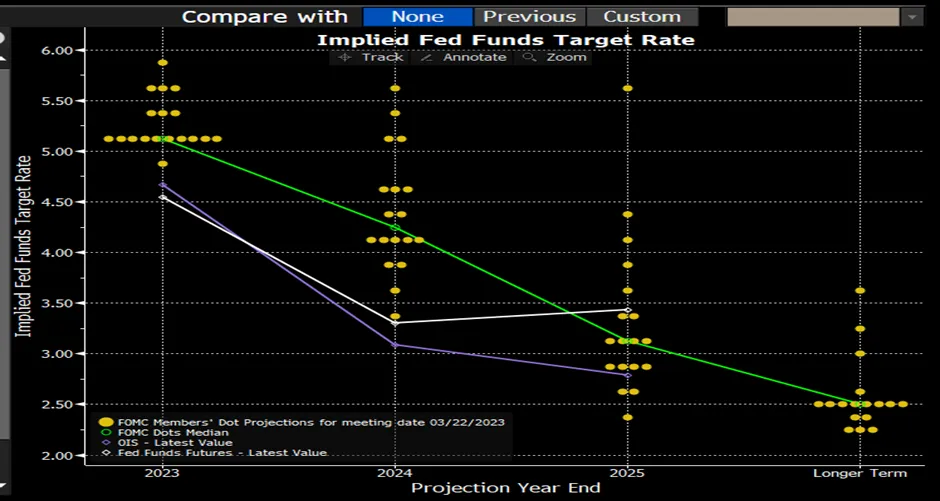

Despite the ample warnings and comments made by the 3 major central banks, investors weren’t getting the message. Futures markets still suggest a peak Fed rate of less than 5%, about 20bp lower than Fed’s projections with rate cuts beginning next summer. Why the scepticism? We believe it's because 1) markets doubt the Fed’s guidance and expect it to capitulate as soon as the unemployment rate moves higher 2) market participants expect economic growth to be slower and inflation to moderate more quickly. Moreover, investors are paying more attention to improvement in headline inflation than to labour market tightness.

Figure 1: Performance of Major Indices.

Source: Bloomberg

Source: Bloomberg

On Friday (23rd December), the strength of the labour market reaffirmed Fed concern on the stickiness of inflation when initial jobless claims rose to 216,000 from 211,000 in the previous week and less than forecast (222,000), for the week of 17 December. Moreover, 3Q22 GDP was revised up to 3.2% (compared to previously reported 2.9%) on firmer spending underlying the continued strength of the labour market and the propensity to consume. Driving markets these days is the back-and-forth rhetoric on recession fears and consumer confidence.

Furthermore, surprising news from the Bank of Japan shocked global markets on Tuesday (20 Dec 2022) by raising Japan’s central bank’s yield curve control program. The BOJ will now allow Japan’s 10-year bond yields to rise to around 0.5%, up from the previous upper limit of 0.25% on its movement range. Also in the announcement, the central bank had kept its target on the yield unchanged at around zero percent and left its short-term interest rate at -0.1%. BOJ would also significantly increase its bond purchases to 9 trillion yen (US$67.5b) per month compared with the current planned 7.3 trillion yen.

The rationale for widening the band as explained by BOJ are as follows: Bond market functioning has worsened significantly and given that JGB yields serve as the basis for interest rates on corporate bonds, loans and similar instruments, the BOJ is concerned that corporate bond issuance could be negatively impacted if this situation were to persist. Therefore, BOJ believes that enhancing the positive effects of monetary easing by widening the tolerable band will contribute to policy sustainability and be beneficial for the economy. Although the timing of the announcement remains questionable, the Financial Times quoted Mohamed EI-Erian stating that “the BOJ is trying to do an orderly, slow exit from an unstainable monetary policy regime and to increase QE with no immediate testing of the yield ceiling as well as BOJ have chosen a low liquidity period to do this''.

Figure 2: JGB Yield Curve

Source: Bloomberg,SG

The yen strengthened to as much as 133.11 against the US dollar, compared with 137.1 immediately before the announcement and the 10-year yield jumped to 0.46% from 0.25% of the decision. Global equity and bond markets saw their hopes of a year-end rally dissipate. Nikkei fell by 2.5%, a fourth consecutive day of decline. However, there was one bright spot. The banking sector leapt for joy at the prospect of a steeper yield curve allowing the net interest margins to widen and the Yen appreciation is partly due to the influx of money returning to Japan.

Source: Bloomberg,SG

The yen strengthened to as much as 133.11 against the US dollar, compared with 137.1 immediately before the announcement and the 10-year yield jumped to 0.46% from 0.25% of the decision. Global equity and bond markets saw their hopes of a year-end rally dissipate. Nikkei fell by 2.5%, a fourth consecutive day of decline. However, there was one bright spot. The banking sector leapt for joy at the prospect of a steeper yield curve allowing the net interest margins to widen and the Yen appreciation is partly due to the influx of money returning to Japan.

According to Goldman Sachs, the decision to widen the 10-year yield band aimed at improving the bond market functioning may be the last action taken by the BOJ in this regard. The BOJ is already allowing yields to fluctuate by 100bp, and any further widening would undermine the rationale for the 10-year yield target of 0%. GS believes the next policy decision the BOJ takes will likely be a major one (such as changing long/short term policy rate targets or terminating YCC), and this will depend on the risk of global economic slowdown in 2023 that both the government and BOJ have cautioned against and whether the 2% inflation target can be achieved in a sustainable and stable manner.

It will take a bit more time for markets to digest the BOJ’s move and to figure out how far interest rates could possibly rise further for Japan. But in terms of yield levels, 1.5% on 30-year bonds appears to be more investable than the past few years. Nippon Life Insurance was cited to be considering buying more Japanese bonds as yields have climbed to a relatively attractive level as benchmark 10- year sovereign yields have almost doubled to 0.48%. We believe not only Nippon Life, other insurers and investors will be looking to increase their investments in Japan as yield becomes more attractive which reduces the exorbitant hedging costs that made investments in foreign bonds unattractive.

The cost that Japanese investors incur to hedge against a weak dollar for three months stands at 4.9%, about 120bp higher than the Treasury 10-year yield. As such money managers had offloaded a record $126b of US sovereign bonds this year. “It makes no economic sense to buy Treasuries when currency hedging costs exceed their yield”.

The yen strengthened to as much as 133.11 against the US dollar, compared with 137.1 immediately before the announcement and the 10-year yield jumped to 0.46% from 0.25% of the decision. Global equity and bond markets saw their hopes of a year-end rally dissipate. Nikkei fell by 2.5%, a fourth consecutive day of decline. However, there was one bright spot. The banking sector leapt for joy at the prospect of a steeper yield curve allowing the net interest margins to widen and the Yen appreciation is partly due to the influx of money returning to Japan.

According to Goldman Sachs, the decision to widen the 10-year yield band aimed at improving the bond market functioning may be the last action taken by the BOJ in this regard. The BOJ is already allowing yields to fluctuate by 100bp, and any further widening would undermine the rationale for the 10-year yield target of 0%. GS believes the next policy decision the BOJ takes will likely be a major one (such as changing long/short term policy rate targets or terminating YCC), and this will depend on the risk of global economic slowdown in 2023 that both the government and BOJ have cautioned against and whether the 2% inflation target can be achieved in a sustainable and stable manner.

It will take a bit more time for markets to digest the BOJ’s move and to figure out how far interest rates could possibly rise further for Japan. But in terms of yield levels, 1.5% on 30-year bonds appears to be more investable than the past few years. Nippon Life Insurance was cited to be considering buying more Japanese bonds as yields have climbed to a relatively attractive level as benchmark 10- year sovereign yields have almost doubled to 0.48%. We believe not only Nippon Life, other insurers and investors will be looking to increase their investments in Japan as yield becomes more attractive which reduces the exorbitant hedging costs that made investments in foreign bonds unattractive.

The cost that Japanese investors incur to hedge against a weak dollar for three months stands at 4.9%, about 120bp higher than the Treasury 10-year yield. As such money managers had offloaded a record $126b of US sovereign bonds this year. “It makes no economic sense to buy Treasuries when currency hedging costs exceed their yield”.

Figure 3: Japan Flows

Figure 4: JPY Strengthen Sharply Upon Announcement

While many investors were still pondering and analyzing over the surprise policy shift by BOJ, the market (MXWD) had staged a 2-day rally on the back of 1) FedEx and Nike’s earnings exceeding estimates and 2) US consumer confidence rose to 108.3 for December vs 100.2 in the prior month. This is more than the forecast of 101. Furthermore, continuing the rally, HK/China technology and property companies led the charge in the Asia rally after a slew of comments from regulators on supporting the Chinese economy and real estate developers. However, the rally was short lived when Micron said it is seeing the worst industry glut caused by slowing demand for PCs in more than a decade and it will be difficult to return to profitability in 2023. As such, Micron has reduced this quarter revenue and sees the turnaround to be in 2H23. It also will be cutting 10% of its workforce to help with cost

The scrooge of Christmas has likely spoiled the chance of a year-end rally this year.