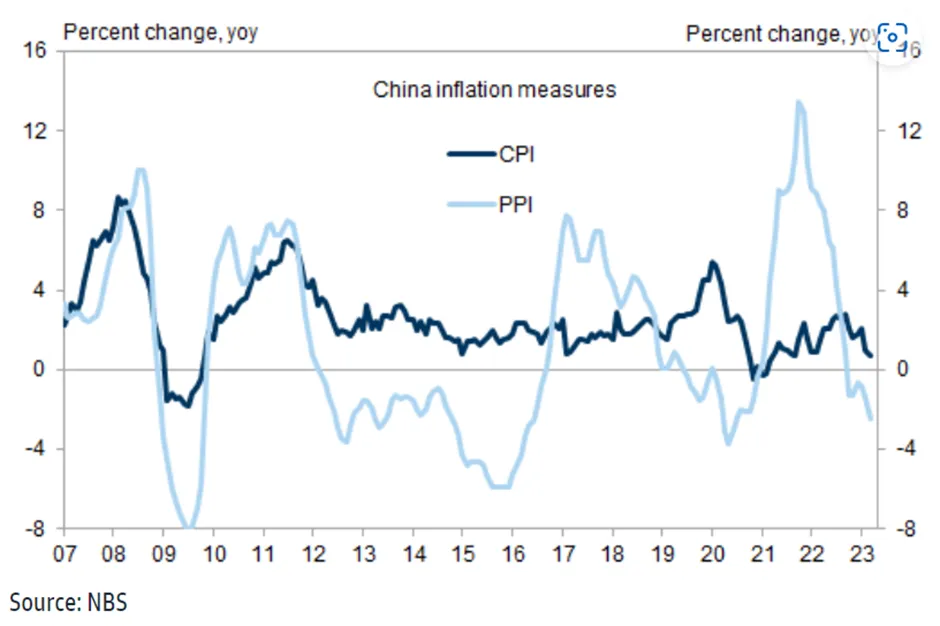

The new year started off with a bang with China market continuing to surge on re-opening of its economy and gradually tapering its zero Covid policy. On the other hand, US market decline as Tesla and Apple highlighted slowing demand, stoking concern about what lies ahead for growth stocks and the US economy as Fed gears up to keep raising interest rates. Furthermore, William Dudley, former FED president, cited on Tuesday that “a recession is pretty likely” but the imminent slowdown won’t be severe. Although it’s a new year, the narrative within the market remains largely the same (e.g. recession, inflation, interest rates, strong US dollar, Russia/Ukraine war, and spike in China covid cases and further easing of China zero covid policy).

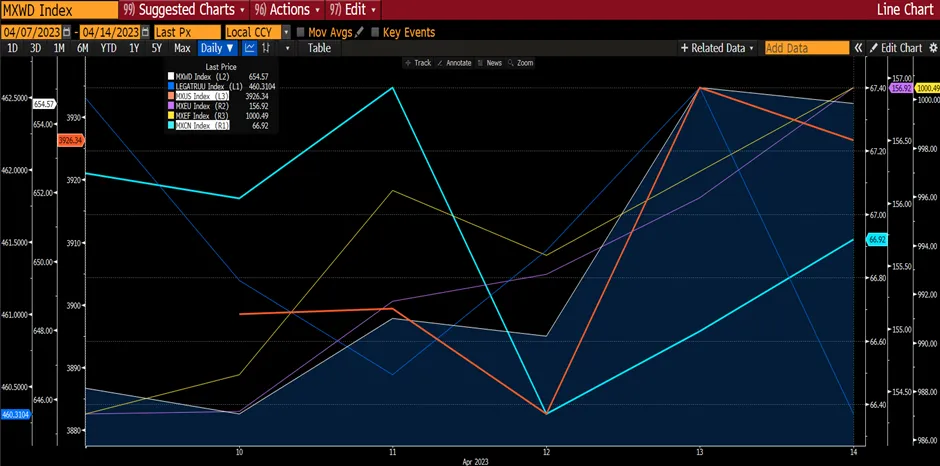

Figure 1: Major Market Indices Performance

Source: Bloomberg

Source: Bloomberg

Tesla’s shares kicked off 2023 with a thud, plunging 12% on growing worries about weakening demand and logistical problems in 2022 stemming from 1) missing delivery guidance for previous 2 quarters; 2) production restriction and weak demand in China; 3) margin concerns as prices of components were on the rise; and 4) concern that Elon Musk is losing his focus on Tesla following his personal acquisition of Twitter.

On 3 January, Tesla reported preliminary 4Q22 vehicle deliveries of about 405k (+18% QoQ; +31% YoY). Deliveries were below the lowered consensus target of 421k. Bulk of the deliveries with Model 3/Y which made up about 388k units (+19% QoQ; +31% YoY) and Model S/X delivered was about 17k (-8% QoQ; +46% YoY). Production for the quarter was about 440k vehicles. For the full year, shipments of 1.31m were up 40% YoY. Recall that Tesla had said on its 3Q22 earnings call that it expects shipment to be a little under 50% growth in 2022. Because of the miss, the market had penalized Tesla with a 12% decline in share price at the start of the trading year.

The selloff came after Tesla missed market expectations for 4Q deliveries despite shipping a record number of vehicles. Share price of Tesla had already declined by 65%.

As Tesla’s shares continue to slide and where the bottom is unclear, its market capitalization is still way ahead of battery giant CATL, whose $142b market value places it second among equities with the highest exposure to EVs. However, when compared to traditional automakers such as Ford, GM, Toyota and even Hyundai who are trading at single digit valuation, Tesla isn’t cheap at 26.6x. BYD is currently trading at 35.5x. However, we view that Tesla should not be compared to traditional automakers given its first mover advantage, innovative technologies, and other businesses to expand its addressable market by providing end-to-end solutions (charging stations, solar).

Figure 2: Tesla Price Chart

Source: Bloomberg

Source: Bloomberg

While Tesla has had a headline-grabbing rough year, that shouldn’t overshadow the fact that the other companies in the top 10 have seen a poor 12 months as well – some $153b has been wiped off their combined market value over the course of 2022. The turbulence also means the top 10 list looks quite different to a year ago, with EV makers among the biggest losers. China’s Li Auto Inc. and Nio Inc. managed to cling on, but the struggles of Rivian Automotive Inc., Lucid Motors Inc. and XPeng Inc. saw them drop out of the list entirely. Rivian’s shares have marched downward in 2022, with the most recent hit coming after the EV startup called off plans to make electric vans with Mercedes-Benz AG in Europe.

Figure 3: Musk’s Twitter Takeover

Figure 4: Top 10 Most Valuable EV Related Stocks

Figure 5: Most EV Related Companies Lost Value in 2022

According to Bloomberg analyst, Tesla probably needs more new models instead of another round of price cuts to boost its slipping BEV market share in China -- at 11% in the first 10 months of 2022 vs. 16% for all of 2020. A thin lineup of two locally built models is threatening its competitiveness, as global automakers have stuffed the China market with more than 200 BEVs vs. about 120 models at year-end 2019 when Tesla's Shanghai factory launched production. Its most affordable, rear-wheel drive Model 3 and Y are already in showrooms and facing fierce competition, while there's still no sign of the next $25,000 car. On the other hand, BYD is snagging market share with its new Ocean lineups, and Volkswagen with its three ID. BEVs launched last year. Smaller rivals such as Nio, Xpeng and GAC's Aion have also doubled their product offerings vs. 2020.

Figure 6: BYD Has Sold More Electric Cars Compared To Tesla (up to Sep 2022)

Figure 7: Deliveries and Production Spread Widens

Figure 8: Margin Compression

Source: Bloomberg

Source: Bloomberg

Musk has previously warned that Tesla might go bankrupt. But based on its current balance sheet strength where the company is in a large net cash position (cash on hand > debt) and its Debt to Equity ratio is at just 0.15x, there should not be any major concerns of the company going bust in the short-term.

Figure 9: Debt to Equity

Although 4Q22 shipments were somewhat negative and comments made of slowing demand is concerning, we however believe a growth of 40% in unit shipments is still very respectable. We believe the key debates from here will be on whether deliveries can reaccelerate, margins and, how strong is the Tesla’s brand. As competition is intensifying (numerous entrants), the reacceleration of deliveries might be impeded. Extending its discount period to spur sales in China, could affect margins. Nevertheless, given its strong brand name, early mover advantage, easing of bottlenecks (component and production issues) and rising acceptance of EV over ICE, we should continue to see revenue growth in excess of 30% over the next two years (as per market consensus). Margins in fact in 2023 are expected to decline by only a marginal amount. Tesla for most part of its success has been selling the leading-edge technology, highly differentiated business model, innovations and visionary future in the auto industry. These factors should continue to drive Tesla to outperform its competitors. Volumes will pick up from the ramp up of its new factories in Texas and Germany and we believe newer models will be launched.

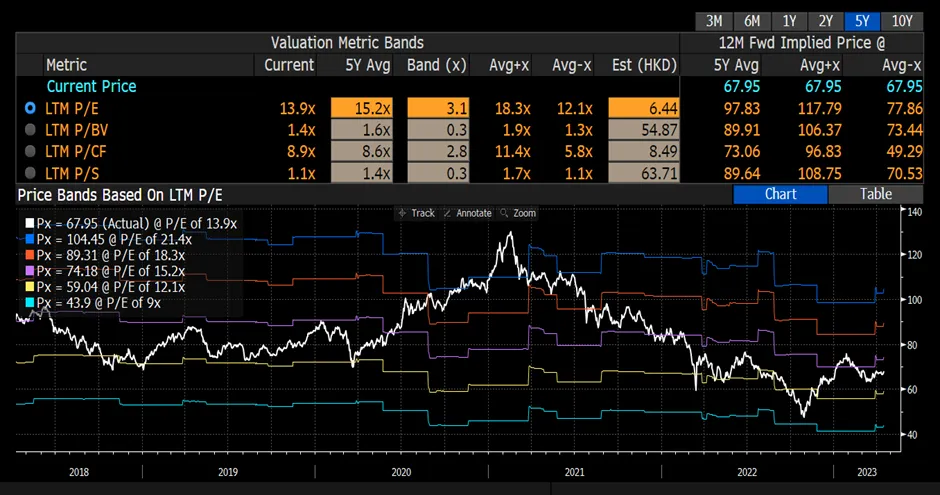

Several Wall Street analysts have said they expected more pressure on the stock in coming months as it faces competition from other automakers and weaker global demand as evident from the downward earnings revisions. But it appears that the price decline has run ahead of the earnings revision as reflective by the valuation. Furthermore, another significant downward earnings revision should not result in another sharp share price decline as Tesla is currently trading at its lowest valuation band over the past 2 years.

Figure 10: Earnings Revision

Source: Bloomberg

Source: Bloomberg

Figure 11: PE Band

Source: Bloomberg

Source: Bloomberg