How to Construct an Alternatives Portfolio in 2025

For decades, the 60/40 portfolio—60% equities, 40% bonds—was the default investment blueprint. It balanced growth and income, risk and reward. However, the market environment of 2025 tells a different story: traditional models are under pressure. Rising rates, sticky inflation, and unexpected macro shocks have made a clear case for building beyond the old norm.

That’s where alternative investments come in. Once seen as niche or complex, they’re now mainstream tools for investors seeking greater portfolio resilience and long-term performance.

The 2025 Landscape: Why Alternatives Matter More Than Ever

Several trends have pushed alternatives from the fringes into the core of modern portfolios:

- Breakdown of equity-bond correlations has undermined the reliability of diversification in traditional portfolios.

- Higher inflation and interest rate volatility have made real assets and private credit more attractive.

- Technology-driven access is opening up private markets to a broader range of investors.

- Institutional models like those used by Yale and Harvard endowments are being simplified and adapted for individual investors.

In short, investors need new tools for a new reality. They’re for anyone looking to build a stronger, more flexible portfolio.

Key Components of an Alternatives Portfolio

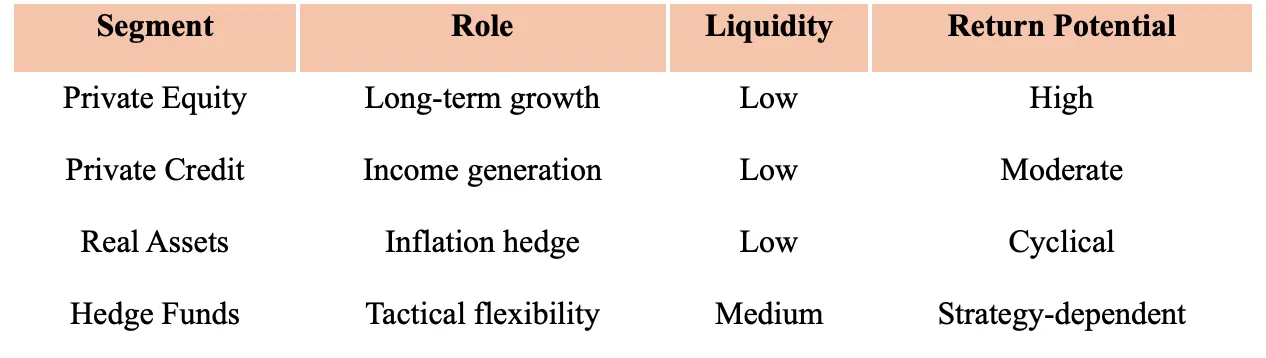

Alternative investments are a broad category. A well-balanced alternatives allocation should blend illiquid, long-term investments with more nimble, liquid strategies. Here are the main building blocks:

- Private Equity

Targets companies that are not listed on public markets—often early-stage, high-growth, or undergoing transformation.

- Role: Long-term capital appreciation

- Risks: Illiquidity, valuation volatility

- Upside: Historically strong returns, especially in venture and buyout strategies

- Private Credit

Includes direct lending, mezzanine debt, and distressed credit.

- Role: Income generation and portfolio stability

- Risks: Credit and default risks, illiquidity

- Upside: Attractive yields in a high-rate environment

- Real Assets

Covers real estate, infrastructure, timber, and farmland.

- Role: Inflation protection and diversification

- Risks: Cyclical exposure, development risk

- Upside: Tangible value, cash flow, inflation linkage

- Hedge Funds

Offer exposure to long/short equity, global macro, arbitrage, and other strategies.

- Role: Tactical flexibility, downside protection

- Risks: Manager selection, complexity, leverage

- Upside: Alpha generation, low correlation to traditional assets

How to Build the Portfolio: A Three-Part Framework

Step 1: Define Your Investment Strategy

Start with clarity:

- Return Objective: Are you seeking growth, income, or absolute returns?

- Liquidity Needs: Can you tolerate multi-year lockups, or do you need some liquidity?

- Risk Appetite: What level of volatility or drawdown is acceptable?

- Time Horizon: Are you planning for a 5-year cycle or 30 years of compounding?

These factors determine your optimal exposure—many sophisticated investors allocate 20–40% to alternatives, depending on their goals.

Step 2: Blend Illiquid and Liquid Strategies

Balance is key. Illiquid assets provide long-term upside, but liquid strategies like hedge funds let you pivot when market conditions shift.

Step 3: Use a Core-Satellite Approach

- Core: Multi-strategy or fund-of-fund platforms provide broad diversification.

- Satellite: High-conviction, single-strategy funds (e.g., tech-focused VC or distressed debt) can drive alpha. This structure offers both stability and upside potential.

Risk Management in Alternatives

Alternative assets offer higher return potential—but with different and often greater risks. Smart investors manage them head-on:

- Commitment pacing: For private equity and credit, capital is often called and deployed over 3–5 years. Without reinvestment, exposure can decline.

- Manager selection: Performance dispersion is wide. Top-quartile managers significantly outperform the median.

- Leverage: Hedge funds and private credit often use borrowed capital. Understand the leverage profile and associated downside risks.

- Transparency: Not all funds report positions or changes. Favor managers with clear communication and institutional-grade reporting.

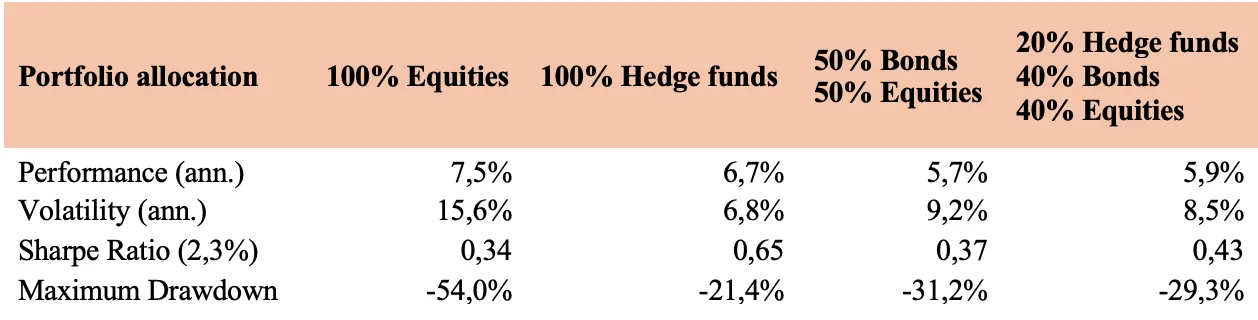

Performance Analysis of Different Portfolio Allocations (1997–2024)

To understand the role of alternatives, it helps to compare how different portfolio mixes have historically performed. The table below illustrates the trade-offs between equities, hedge funds, and blended allocations:

*Source: HFR, Bloomberg; as of January 2025. Note: Indices used include MSCI World TR, Barclays Global Aggregate Bond TR and HFRI Fund Weighted Index.

*

Hedge funds historically delivered higher risk-adjusted returns than global equities, producing competitive annualized performance (6,7% vs. 7,5% for equities) but with less than half the volatility (6,8% vs. 15,6%) and far smaller drawdowns (-21,4% vs. -54%).

*Source: HFR, Bloomberg; as of January 2025. Note: Indices used include MSCI World TR, Barclays Global Aggregate Bond TR and HFRI Fund Weighted Index.

*

Hedge funds historically delivered higher risk-adjusted returns than global equities, producing competitive annualized performance (6,7% vs. 7,5% for equities) but with less than half the volatility (6,8% vs. 15,6%) and far smaller drawdowns (-21,4% vs. -54%).

The Alternatives Portfolio for 2025

A static 60/40 portfolio may no longer cut it in an economy shaped by inflation uncertainty, geopolitical volatility, and fast-changing markets. A well-constructed alternatives allocation offers a path forward—providing diversification, risk mitigation, and potential for superior long-term returns.