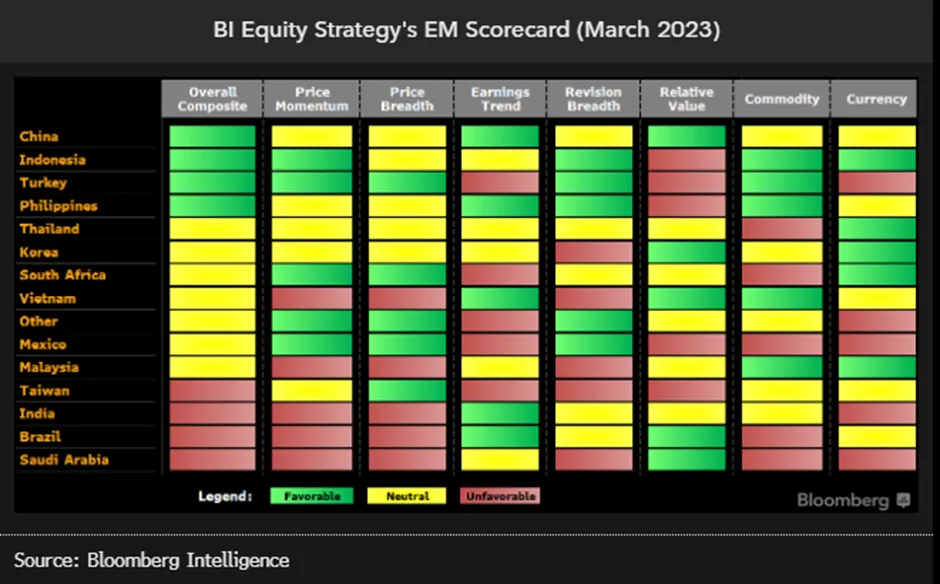

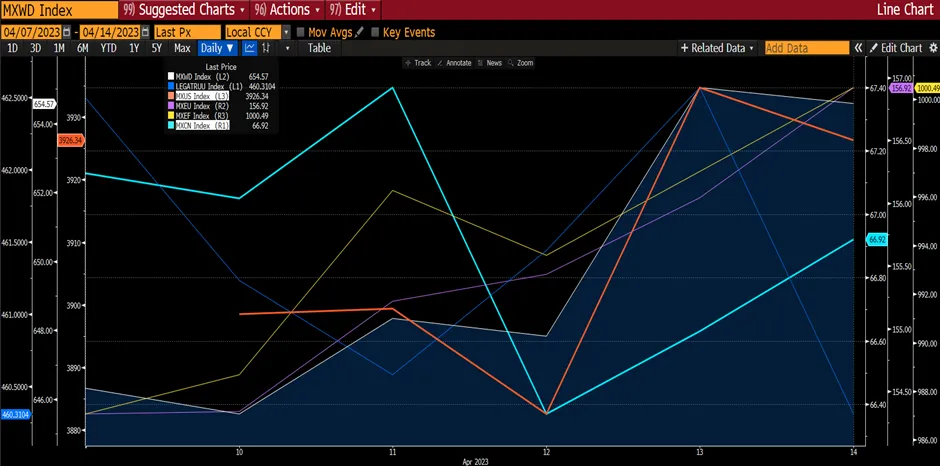

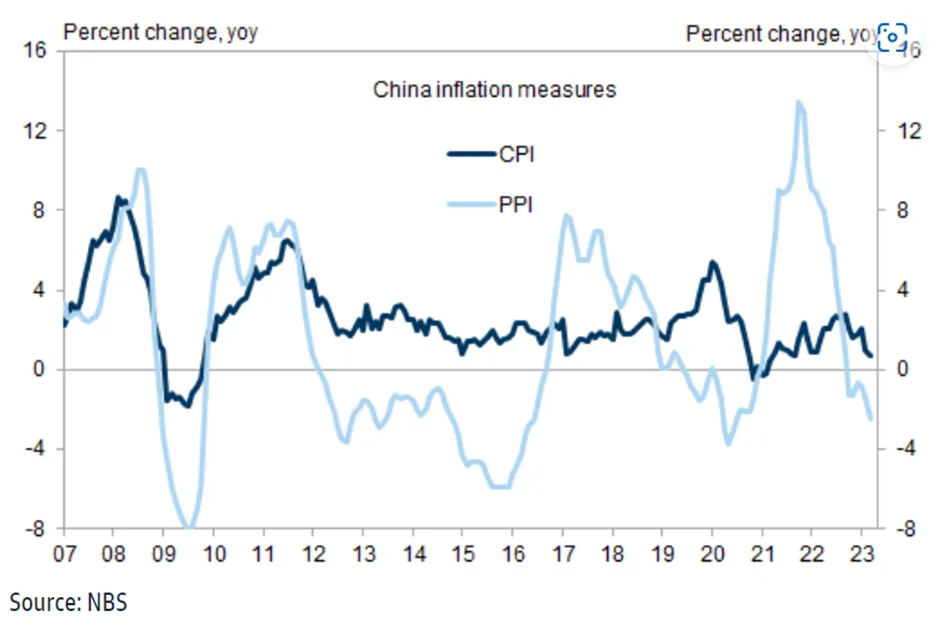

A volatile week for global markets on concern of interest rates remaining higher for longer stemming from a stubbornly high non-farm payroll and strong job growth, Fed remarks of no rate cuts this year, weak corporate results, and tension between US and China escalates. Global markets fell across the board with MXWD declining by 1.39%, albeit outperforming the Fixed Income Index that fell 1.63%. MXUS fell by 1.18% and MXEU declined by 1.97%. MXEF (Emerging Markets) also declined (-2.4%) partly because MXCN fell, for the second week in a row, by 2.9%. We believe the weakness of the China market is due to rising tension between US and China following the shooting down of China’s supposedly “spy” balloon.

Figure 1: Major Indices Performance

Source: Bloomberg

Source: Bloomberg

Following the shooting down of China’s alleged “spy” balloon over the weekend by the US, investors were concerned of potential rising tension between the US and China. This led to global markets on the first day of the week (6 Feb 2023) falling by 1.11%. Biden had ordered the military to down the balloon, after the Chinese said it was a civilian climate research balloon that unexpectedly drifted over American territory. When the Chinese got wind of the balloon being shot down, China issued its first public remarks and threatened that it “reserves the right to take necessary measures to deal with similar situations”. The statement also stated that “under such circumstances, the US use of force is a clear overreaction and a serious violation of international practice”. Later that day, Chinese state newspaper China Today accused the US of using the balloon as an excuse to postpone Secretary of State Antony Blinken’s trip to Beijing and of “hyping up” the balloon. That said, President Joe Biden has denied that relations with Beijing have suffered a “serious blow” and yet the MXCN declined for the week.

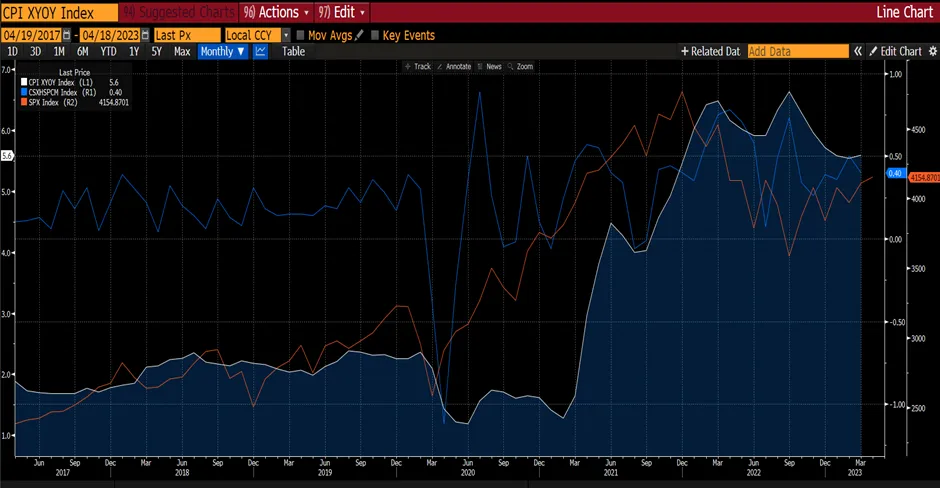

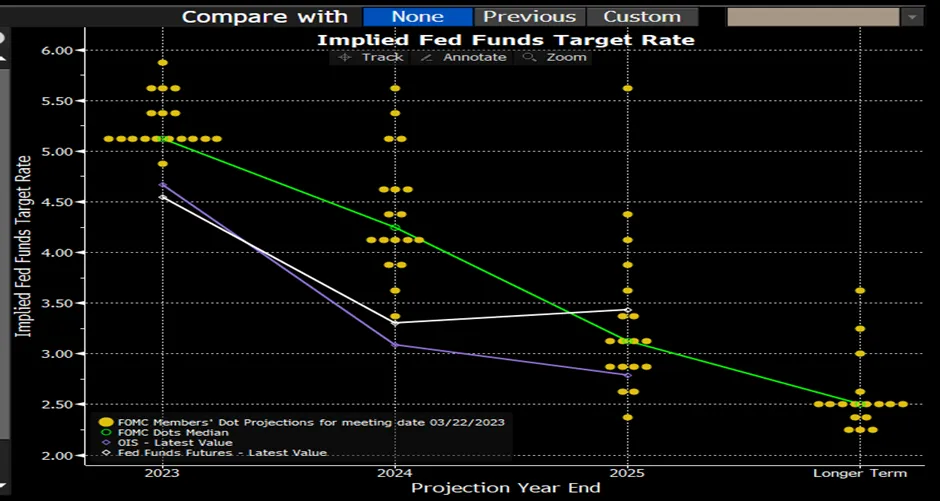

Furthermore, investors were also anxiously awaiting the Federal Reserve Chair Jerome Powell’s Q&A session with David Rubenstein. During the meeting, Powell persisted that higher interest rates are necessary to combat inflation and hinted that borrowing costs may rise faster than traders and policy makers expect. The higher-for-longer rate scenario is largely on the back of the stronger than expected job market where Powell cited it to be “extraordinarily strong” and thinks that Fed is going to need to do further rate increase.

Figure 2: Job Growth Remains Strong

His remarks suggest that the 5.1% interest-rate peak forecast by officials in December, according to their median projection, is a soft ceiling. Powell appears willing to follow the data and move higher if necessary.

The mixed sentiment followed a down day on Wall Street when hawkish comments from Fed officials prompted investors to rethink expectations about US peak rates. Treasury 10-year notes held the gains from a rally in the wake of a strong auction. Also, the knock to risk sentiment hinged on comments from 4 Fed officials who spoke at separate events and reinforced a shared message that the fight against inflation is not yet won.

That said, market narratives have grown more optimistic about the chances of a soft landing after January’s spectacular jobs report. Goldman Sachs recently reduced the probability of a recession over the next 12 months to 25% (from 35% previously) because the labour market remains strong and business surveys are showing early signs of improvement. Bloomberg Economics, who tracks a suite of models, however, still shows elevated risk of recession where Powell’s preferred yield curve indicator shows the chance of recession in the next 12 months rose sharply in January. In their latest updates incorporating January, the yield curve modes – which take as their sole input the spreads between 2 year/10 year, 3 month/10 year, and 3 month/18 month forward US Treasury yields – all showed a jump in recession probability in January. The latest reading showed the likelihood of recession rising to 66-77% from 51-62% previously.

Figure 3: All Models Show Elevated or Increased Recession Risk

Source: Bloomberg Economics

Source: Bloomberg Economics

Figure 4: Investors Increasingly Aligning With The Fed Rate Projection

We believe the current strength in the labour market has yet to fully reflect the recent large jump in corporate layoff. The release of initial jobless rate claims showed it rose by 13,000 to 196,000 applications in a week, beating estimates of 190,000 applicants. This data comes a week after a separate government report showed payroll unexpectedly surged last month. According to Bloomberg Economist, the initial jobless claims data was the fourth week of claims below 200,000, underscoring the tightness of the labour market and implying that it will take some time to tamp down price pressure.

Figure 5: US Jobless Claims Rise For First Time In 6 Weeks

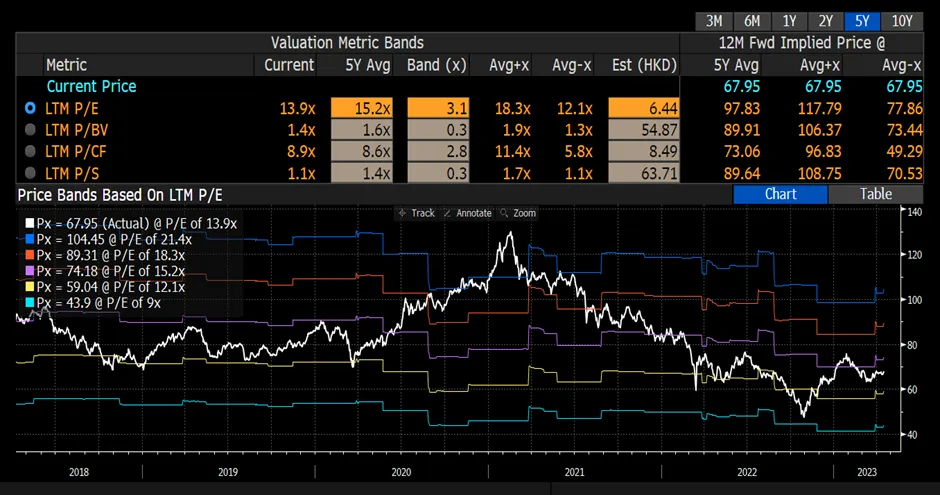

Despite the recent run up in global markets (YTD), we still see positive upside for the market till the end of the year. This recent weakness in the market should be viewed as a mere correction as the market reset its expectations on interest rates and economic growth. Although some parts of the market will reach inflection before others, meaning dispersion between geographical and sectors are likely to be elevated, we do see the MXWD valuation is still relatively cheap compared to the past 5 years. Our strategy is to focus on quality and growth at a reasonable price that would provide upside while adding downside protection if economies do slip into a recession. In equities, China should continue to benefit from the recovery of economic growth stemming from the reopening of its economy. In fixed income, we would adopt the same strategy and have a preference for high grade and investment grade bonds, given continued near-term risks to global growth along with attractive all-in yields.

Figure 6: MXWD Valuation Still Trading Below Five-Year Average