Risk appetite returned to markets aided by some weak US data that supported expectations the Fed might soon call it a day on their rate hikes. The equity market rose 1.43% while the global fixed income index fell by 0.2%. MXUS rose 0.73% while MXEU surged by 3%. Despite China falling by 0.19%, MXEF (Emerging market) increased by 1.22%.

Figure 1: Major Indices Performance

Source: Bloomberg

Source: Bloomberg

US March core CPI rose 0.385% MoM, a touch below consensus of 0.4% and compared to the three-month average of 0.38%. The YoY rate rebounded a tenth to 5.6%. The most important aspect of the report was the sharp step down in shelter categories (rent +0.49% vs. +0.76% in February, OER +0.48% vs. +0.70%), which reflects a waning boost from existing tenant rents resetting higher post-pandemic, as well as the long-anticipated impact of slowing new tenant rental pricing. Core services prices excluding rent and OER rose a solid 0.40% on strength in categories with pent-up price pressures like car insurance (+1.2%) and daycare (+1.4%). Travel categories were stronger than expected (airfares +4.0%, lodging +2.7%) and could soften a bit in April. Auto prices were soft on net, with new car prices rising 0.4% and used car prices falling 0.9%, though the sharp rise in used car auction prices argues for at least some rebound in 2Q. Headline CPI rose 0.05%, as energy prices fell 3.5% and food prices were unchanged. Shelter has been one of the biggest inflation drivers in recent months, even though data on new leases show that rent increases have sharply slowed. In March, increases in rents for primary residences slowed to 0.5% MoM, down from 0.8% in February. Given the lags in the data, it's likely that rents will continue to slow over the course of 2023 thus suggesting that inflation would be slowing, and rate hikes would slow or pause soon. From the chart below, there appears to be a high correlation between the S&P500 and US Core CPI. as per seen in 2020 and 2021. With the assumption that inflation will slow, the possibility of S&P softening cannot be ruled out.

Figure 2: Core CPI and Core Service CPI vs S&P500

Source: Bloomberg

Source: Bloomberg

US producer price inflation is also cooling. The producer price index rose 2.7% YoY in March, down from 4.9% in February and the lowest since January 2021. On a month-over-month basis, the producer price index declined 0.5%. The softer data supports the perception that after raising rates by a total of 475 basis points in a little over a year, the Federal Reserve is nearing the end of its tightening cycle. But we still see reasons to remain cautious about the outlook for the US economy and corporate earnings. The minutes to the March FOMC meeting noted that “all” participants agreed that a 25bp hike was appropriate. “Many” participants noted that the recent bank stress had led them to “lower their assessments of the [funds rate] that would be sufficiently restrictive.” The Fed staff now expects the economy to enter “a mild recession” later this year, reflecting its “assessment of the potential economic effects of the recent banking-sector developments,” although it noted that the uncertainty around its growth projections “was much greater than at the time of the previous forecast.” FOMC participants expected GDP to grow “at a pace well below its long-run trend rate” in 2023, with risks “weighted to the downside.” Participants once again characterized inflation as “unacceptably high” and the minutes dropped February’s reference to a “welcome reduction” following upward price revisions and firmer monthly readings. Participants also observed “less evidence” of slowing inflation in core services ex-housing. US recession risks are rising, as also evidenced by the latest March ISM manufacturing PMI falling to 46.3, its lowest level since May 2020 and the fifth consecutive month in contraction territory. The US labor market is also starting to cool, with March nonfarm payrolls and February JOLTS data showing slower wage growth and lower job openings. According to the Dallas Fed Banking Conditions Survey conducted 21–27 March, commercial and industrial loans, real estate lending, and loan volumes have fallen while credit standards have continued to tighten. Historically, tighter credit conditions have been correlated with weaker corporate earnings.

Figure 3: Fed’s Rate Target

Source: Federal Reserve

Source: Federal Reserve

Global equities investors therefore took these data points as hints of a slowing economy and that the Fed will soon pause its rate hike while ignoring the fact that risk of a recession is rising. Furthermore, as we head into the US reporting season, expectations have been mixed with fear of margin compression. Expectations for large banks’ earnings such as JP Morgan and Citi however could beat market expectations suggesting that the banking crisis had limited impact on large financial companies.

According to Goldman Sachs, 1Q S&P500 dividend per share growth has already registered +8% YoY as recent companies’ actions have pointed to a healthy dividend growth environment. S&P 500 companies have announced 135 dividend initiations or increases YTD vs 131 last year. As a result, Developed Market (DM) and Emerging Markets (EM) rose 1.3% and 1.2% respectively during the week.

Across the globe, macro data in China were strong in March: Loans and Total Social Financing (TSF) continued to surprise to the upside and trade growth was strong, especially on exports. The PBOC also reiterated a pro-growth stance with a continued focus on private investment. This is supportive of expectations for a strong rebound in 1Q23 real GDP growth (which will be released on Tuesday 18th).

Surprisingly, China's CPI inflation fell to +0.7% in March (vs. +1.0% in February) due to a high base. Consensus was expecting +1% YoY. On a month-on-month basis, the headline CPI increased 6.7% in March (vs. -10.5% in February). PPI inflation fell to -2.5% YoY in March from -1.4% YoY in February, primarily on a high base of commodity prices. As data have continued to surprise to the downside and companies appear to be reluctant to raise prices (to stay competitive). Looking ahead, we expect headline CPI inflation to accelerate modestly in the coming months on an economic rebound, though we would not be surprised if it exceeds PBOC’s 3% target.

In year-over-year terms, food inflation edged down to +2.4% YoY in March from +2.6% YoY in February, primarily due to a high base of vegetable prices from cold weather and Covid restrictions last year. Inflation in fresh vegetables fell to -11.1% YoY in March from -3.8% YoY in February, while inflation in pork prices rose to +9.6% in March from +3.9% in February.

Figure 4: China CPI and PPI Trend

Despite the strong macro backdrop and broad pick-up in both activity and consumer data, Chinese equities continue to trade at the inexpensive end of their historical range as onshore investors remain cautious on the strength of the consumption recovery and worried about geopolitical risks. We think that strong growth momentum in China might support a more material pick-up in China-related assets; and even though growth could likely to decelerate in the second half of the year.

Figure 5: MXCN Valuation Band

Source: Bloomberg

Source: Bloomberg

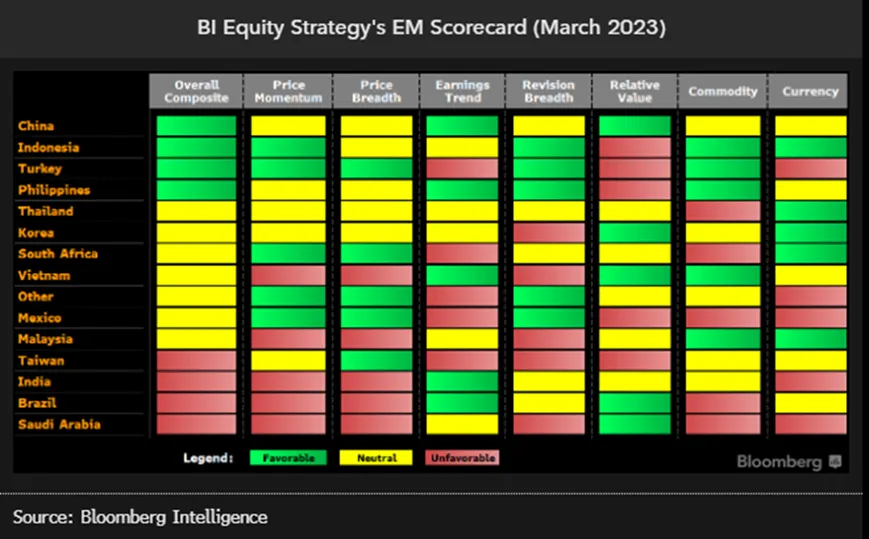

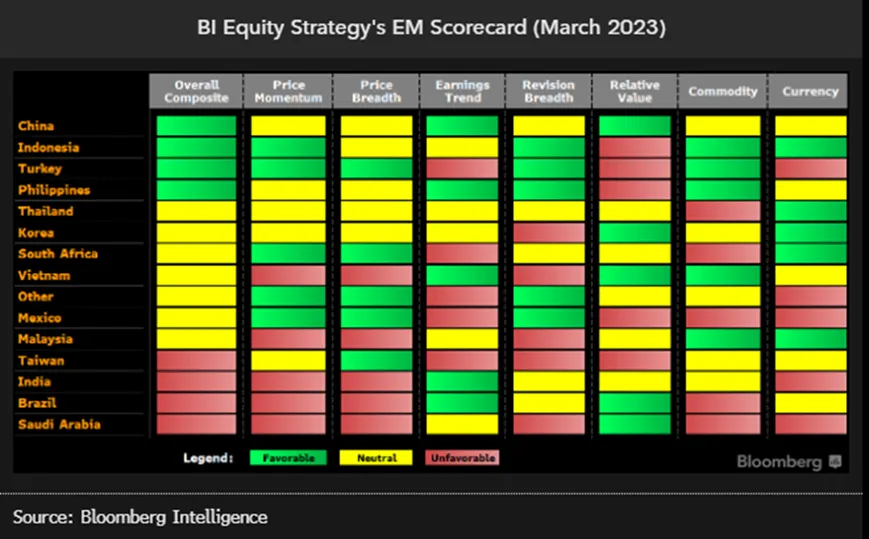

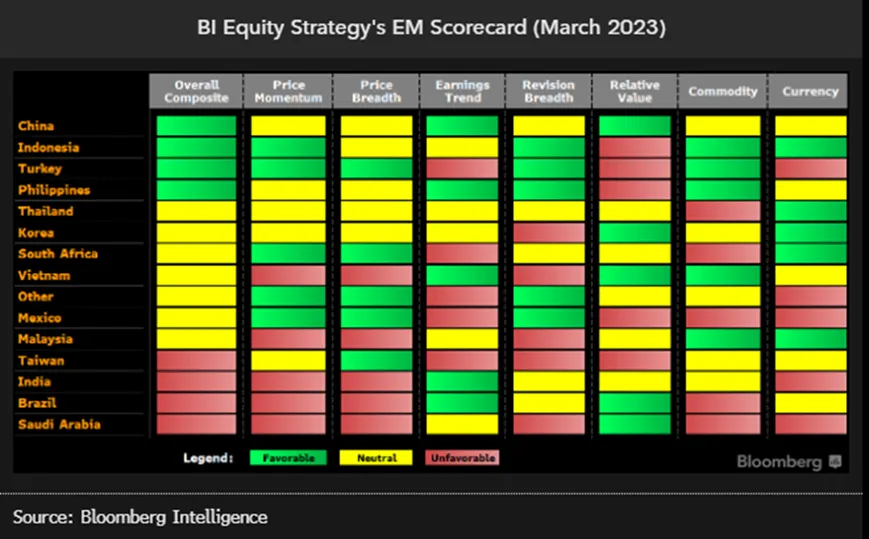

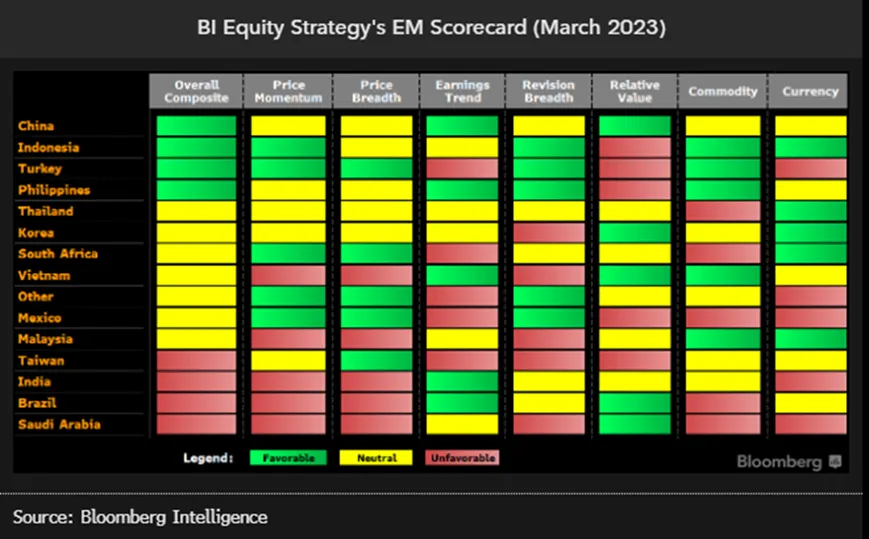

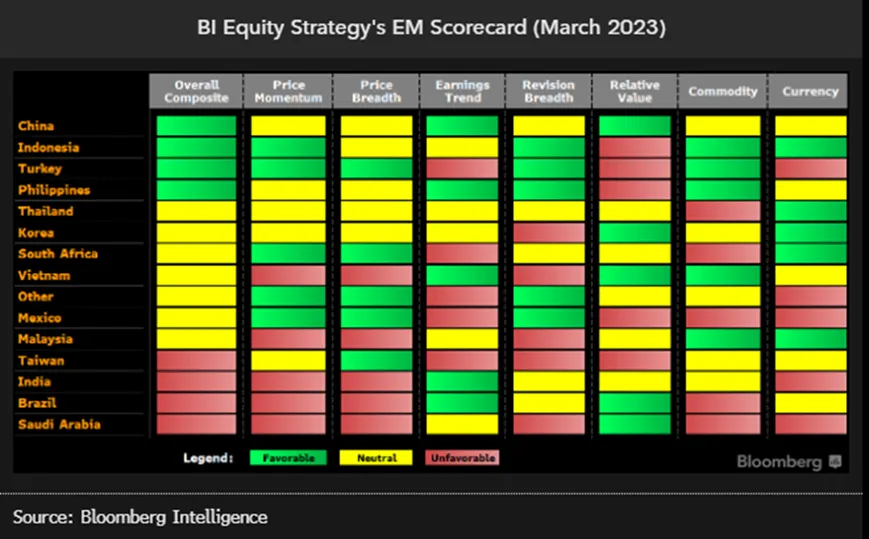

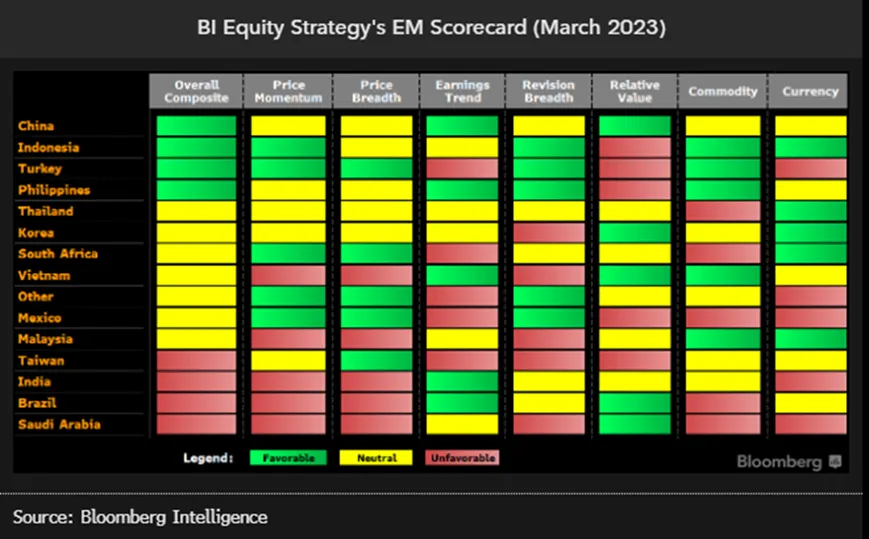

Figure 6: China Tops BI Scorecard