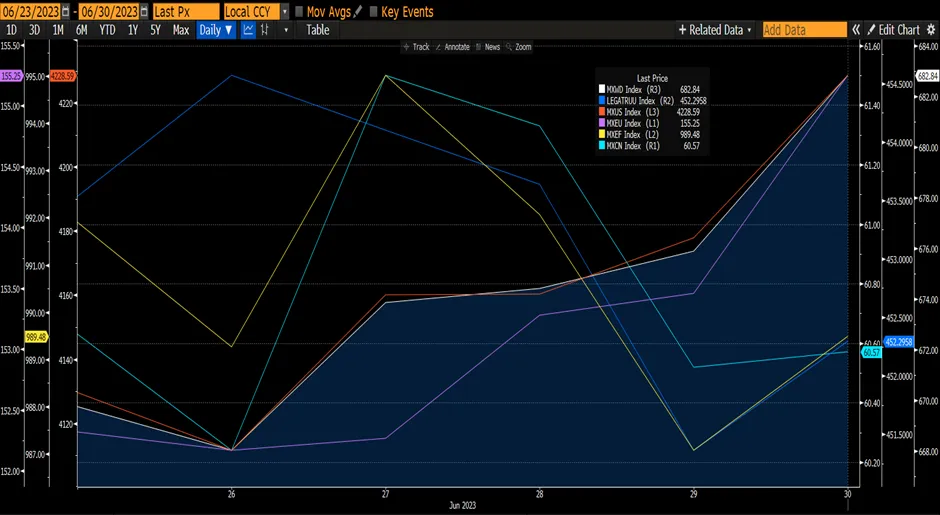

The global equity market continues to rally after last week’s breather as the Fed has temporarily paused its rate hike, inflation is moderating, and US data pointing towards a better economy than expected. The global equity market rose 2%, led by the US (MXUS) and Europe (MXEU) rising by 2.42% and 2.23% respectively. Emerging markets fell by -0.24% partly due to further weakness in China where the MXCN declined by 0.18%, the second consecutive week of decline. The global fixed income index underperformed the global equity market, by declining 0.48% as central banks have stated that they will continue to hike rates this year and the rate will remain high for longer.

Figure 1: Major Indices Performance

Source: Bloomberg

Source: Bloomberg

After last week’s decline, the US equity market rebounded by 2.42% as investors saw economic resilience from the decline in the US unemployment benefits applications, stronger than expected consumer confidence, and a rise in new home sales compared to expectations of a decline.

Initial jobless claims decreased by 26,000 to 239,000 in the week ended 24 June, which included the Juneteenth holiday. Continuing claims, including those who have received unemployment benefits for more than one week, dropped to 1.7m. Despite the drop in claims, worker demand has been easing slowly as more than a year’s worth of interest-rate hikes works through the economy. The Fed Chair Jerome Powell said the labour market has been cooling in a way the central bank would have hoped, which if sustained, could limit job losses down the line.

Figure 2: Employment Market Still Robust

A separate report showed that US first quarter GDP was revised to a 2% annualized advance. The stronger number reflected upward adjustments to exports and consumer spending. Consumer spending, the engine of the US economy, rose at an annualized 4.2%, the strongest pace in nearly two years.

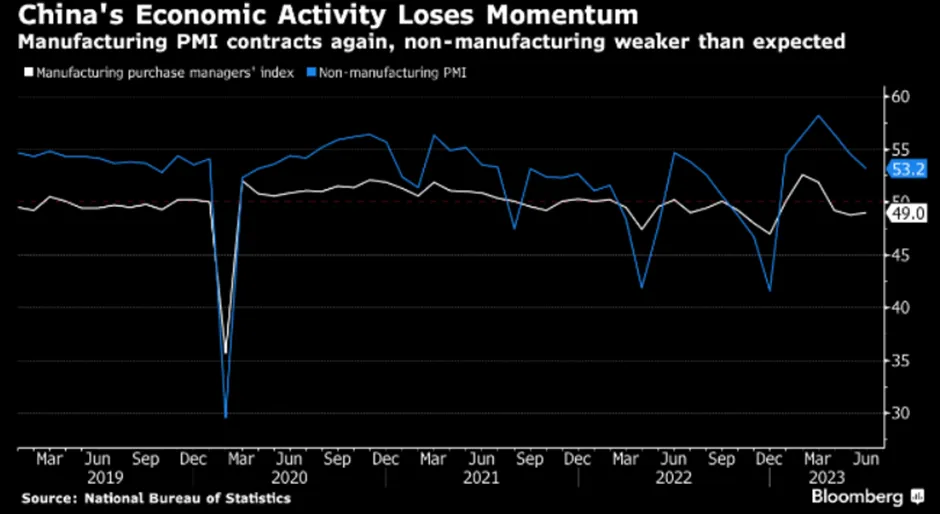

Despite the Fed having raised rates by 500bps since March 2022, the fastest pace since the early 1980s, the monetary policy is only moderately restrictive. Growth is expected to slow in the second half, but it is unclear if the economy will fall into a recession. Current growth momentum is strong enough that it is unlikely that a recession would be before late 4Q, notwithstanding an adverse supply shock or credit event. The likelihood of a recession hinges most on monetary policy becoming more restrictive and eventually causing consumer spending to fall. That may take at least two more Fed rate hikes, but there is also the possibility that monetary policy is operating with an extended lag this cycle, and the tightening thus far will be sufficient to cause spending to crack. In our last weekly report, we noted that the present gains in the US market have been concentrated on a small number of growth stocks (Big Cap Tech). However, we believe this will change as the market drivers broaden into other sectors such as consumer discretionary and even communication sectors. Meanwhile, more evidence is surfacing that reinforces the slowing momentum of China’s economic recovery. This week, China’s manufacturing activity contracted again, and the services and construction sectors missed expectations, adding to the urgency of more policy support.

The official manufacturing purchasing managers’ index for June was 49, barely higher than May’s reading of 48.8. Although it is in line with consensus expectations, it reflects signs of contraction and continued weakness in China’s economy. The non-manufacturing gauge of activity in the services and construction sectors slipped to 53.2 from 54.5 in the previous month, weaker than expected. Essentially, we view that China’s post-Covid economic recovery has indeed lost steam. Consumer spending is slowing after a burst of activity in 1Q23, the housing rebound has fizzled, exports have weakened, and infrastructure investment has slowed. Furthermore, consumer and business confidence has been muted, with youth unemployment remaining at record highs and companies grappling with falling profits. Deflation risks are also threatening to drag growth down further.

Figure 3: China’s Economic Activity

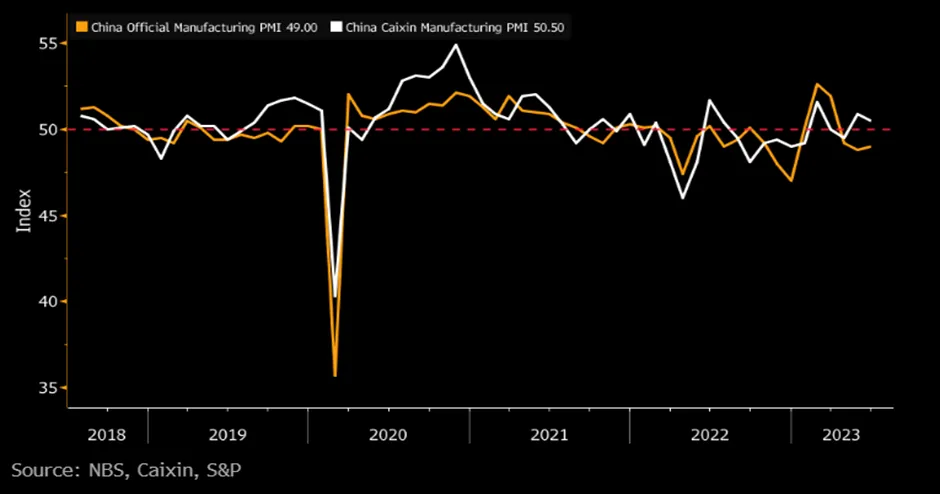

The Caixin PMI index, which fell to 50.5 from 50.9 in May, once again surprised on the upside, albeit reflecting a slower PMI reading. Many economists were expecting the index to fall below 50. The expansionary reading doesn’t align with the official PMI, which suggested the manufacturing extended a contraction in June. What’s more, as the survey focuses on small private firms, the message of expansion looks decidedly off when compared to the official survey’s finding that small firms slipped deeper into contraction. The discrepancy once again has blurred China’s current economic outlook.

Figure 4: China’s Manufacturing PMI – Official vs Caixin

Based on recent data releases, a growing chorus of experts are projecting China to announce moderate stimulus this year. Beijing’s monetary and fiscal support scope has been constrained as cash-strapped local governments struggle to repay debt. More rate cuts would further widen the yield gap with the US, adding downward pressure on the yuan.

Another piece of evidence of the slowing Chinese economy is China’s industrial profits which contracted by 11.9% YoY in May but reflected a rise of 3.7% MoM. The sequential improvement was likely related to ongoing policy support for the manufacturing sector.

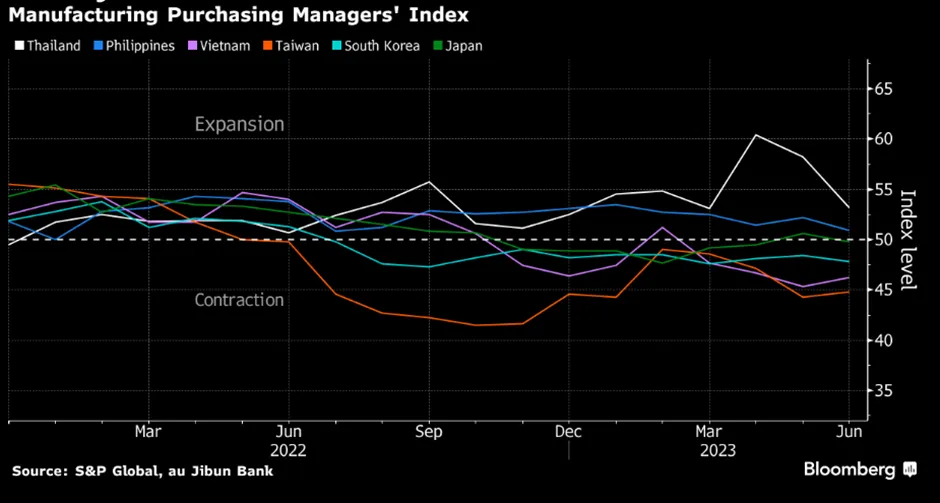

That said, manufacturing across most of Asia deteriorated further in June as a weak Chinese economy sapped demand for the region’s goods. Factory activity remained stuck in contraction in South Korea, Japan, and Taiwan. Much of Asia’s manufacturing sector had pinned its hopes on a strong Chinese post-pandemic rebound, only to see weaker-than-expected trade with China. With a similarly sluggish global economy damped by high borrowing costs and elevated inflation, factories are struggling to find a catalyst for growth in Asia. South Korea’s PMI fell further to 47.8 in June while Japan’s PMI slipped back below 50 to 49.8 in May. Taiwan’s PMI, however, inched up slightly but still marked a 13th straight month of shrinking activity.

Figure 5: Factory Conditions Deteriorate Further

We, therefore, continue to prefer developed markets over emerging markets. Our preference is well supported by the strength in recent economic data coupled with slowing inflation. Until we see clear evidence of policy support to strengthen the recovery of the economy, we will remain selective in China.

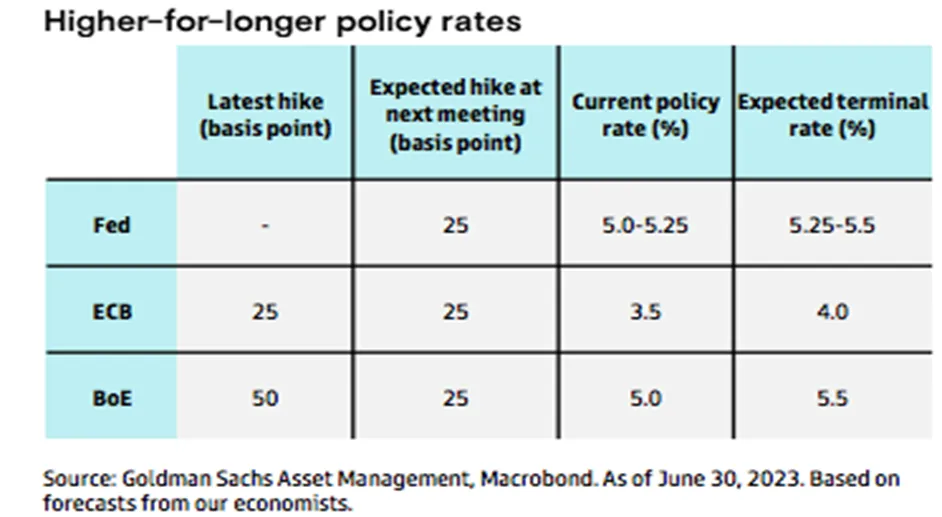

On the fixed income front, the market dynamics were mainly dictated by macro and central banks’ tone. From 26-28 June, central bank officials participated in the ECB Central Banking Forum in Portugal. Key takeaways from central banks were:

Fed – Elevated inflation and a tight labour market led Chair Powell to suggest hiking rates “at consecutive meetings is not off the table.” The Fed expects to deliver a 25bps hike in July but acknowledges risks are skewed towards further tightening.

ECB– The central bank suggested rates will remain elevated “for as long as necessary” given second-round inflation effects and elevated wage growth. ECB has raised its terminal rate projection from 3.75% to 4.0%.

BoE– Governor Bailey hinted interest rates could remain higher for longer than market-implied terminal rate pricing, posing upside risks to BOE’s terminal rate forecast.

Figure 6: Central Bank trajectory overview

The US short- and medium-term bond yields rose to their highest levels since March, partly on stronger-than-expected labour and GDP data, while the persistent inversion in yield curves (an indicator of economic downturn) remained close to decade-high levels in the US, UK, and Germany.

Eurozone inflation falls in Spain and Italy but rises in Germany. In Spain, headline inflation fell below the ECB’s eurozone-wide target of 2% to 1.9% in June, down from 3.2% in May. In Italy, it fell to 6.4% from 7.6% in May, marking the lowest level for 14 months. However, core inflation (excluding food and energy prices) remained relatively high in both countries. However, German headline inflation rose from 6.1% to 6.4% over the month, while core inflation picked up from 5.4% to 5.8%. This was partly due to base effects as the German government introduced a fuel tax cut and public transport subsidies this time last year. Eurozone bond yields rallied late in the week.

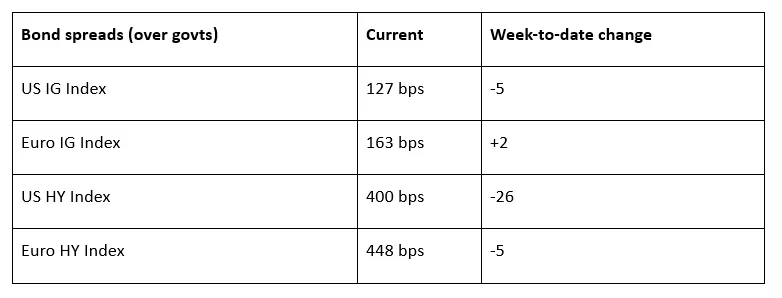

Bond market volatility shows signs of climbing again. The ICE BofAML MOVE bond volatility index climbed back above 110, having fallen to its lowest level since February in mid-June. The rise in volatility reflects investors' uncertainty about the mid-to-long-term outlook for interest rates and how close they are to peak levels. The index had risen above 180 in mid-March during the mini-banking crisis, the highest level since the Global Financial Crisis but had eased back since then. Generally, credit spread tightened across investment grade and high yield space. US high-yield bonds were the best performers last week.

Figure 7: Corporate spreads in USA and Eurozone.

For fixed income, we continue to like short-dated bonds. Although we remain defensive in our credit positioning, our preference is skewed towards credits with higher qualities. We also expect that credit spreads will widen to account for slowing growth and recession risks.