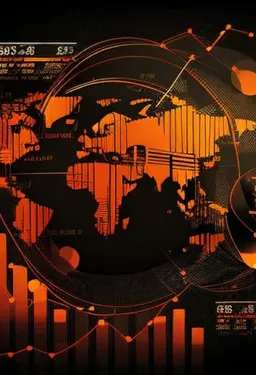

Global markets traded in a narrow band for the week as it waits for cues from this current reporting season as well as guidance and decision on interest rate by Fed’s on 2-3 May 2023. The World Equities Index (MXWD) declined by 0.28%, outperforming the Global Fixed Income Index (LEGATRUU) which fell by 0.51%. MXUS was relatively flat, albeit declined by 0.11%. MXEF fell by 1.95% partly because of a 2.4% decline of MXCN. MXEU (Europe) however surprised on the upside by rising 0.54% as 1Q23 earnings have so far surprised on the upside.

Figure 1: Major Indices Performance

Source: Bloomberg

Source: Bloomberg

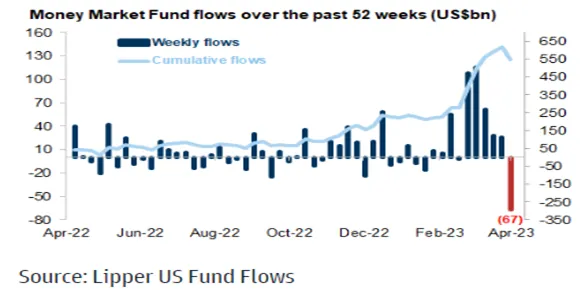

Recent stress in the banking sector and mixed economic data have clouded the US economic growth outlook. While rising jobless claims and a weak March ISM print reflect a potential slowing of US economic growth, early data for April has come in firm relative to expectations. Uncertainty around the outlook for credit conditions in the wake of the recent bank failures drove the Fed staff to project a mild recession in late 2023 at their March meeting. The probability of a recession in the next 12 months now stands at 65%.

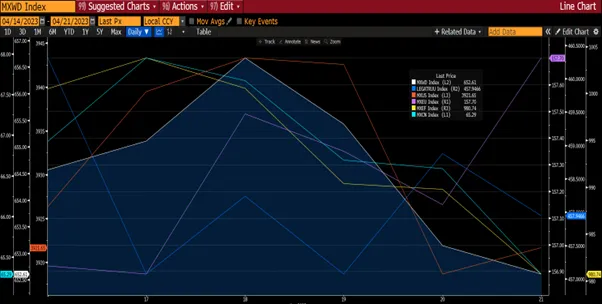

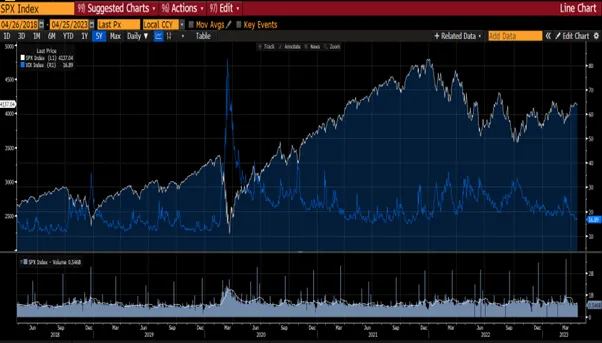

As such, we have been seeing signs of a flight to safety from a cumulative inflow of US$340b into the money market in the past 5 weeks. However, according to Lipper, US money market funds saw US$67b outflows this week, the largest weekly outflow in a year while equities mutual funds globally saw outflows of US$3b WoW (vs US$4b inflows in the previous week), driven by selling in most non-Asia mandates. Yet equity investors have taken the turmoil in stride with the S&P 500 is near its 12-month high, and the VIX index is now at a 17-month low. But with the S&P 500 now trading at a valuation multiple historically associated with mid-teens earnings growth, the market is pricing in a high probability of a near-perfect landing for the US economy. When US Treasury Secretary Janet Yellen said she expects moderate growth, and that the banking crisis could ultimately help the Fed to get just enough restraint with fewer rate hikes, the market took it as hints of rate hikes to pause and the economy would grow at a moderate rate.

Figure 2: SPX and VIX

Source: Bloomberg

Source: Bloomberg

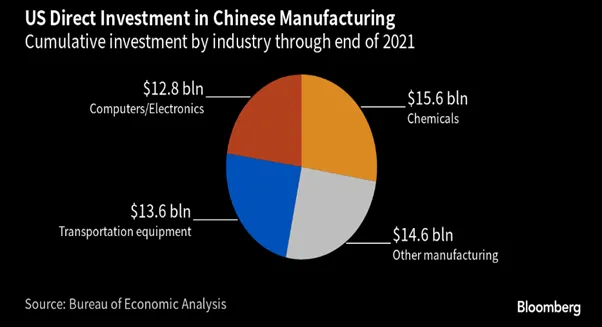

Another factor that we see pose a risk of further economic slowdown is the rising US/China geopolitical tension. During the week, Bloomberg reported that President Joe Biden aims to sign an executive order in the coming weeks that will limit investment in key parts of China’s economy by American businesses. The US says it is imposing the curbs on national security grounds, rather than to hold back the development of China. The executive order will cover the fields of semiconductor, artificial intelligence, and quantum computing – focusing on investments where US firms play an active role in management. That includes venture capital and private equity, as well as certain forms of technology transfer and joint ventures.

Figure 3: Money Market Fund Flows

Figure 4: US Direct Investment in Chinese Manufacturing

According to Janet Yellen, “these national security actions are not designed for the US to gain a competitive economic advantage, or stifle China’s economic and technological modernization”. The US will pursue its security concerns regarding China “even when they force trade-offs with our economic interests” and will “engage and coordinate with our (US) allies and partners”.

Furthermore, as US and Europe head into the 1Q23 corporate reporting season, volatility should start to increase on concerns of consensus earnings estimates for the back half of the year in the US remains too optimistic. Earnings guidance will provide some colour on the outlook going forward and that could tilt consensus view in the coming week. So far, comments from banks during this earnings season are suggesting that a moderate tightening of credit will impose a moderate drag on growth. Most regional banks reported that deposit outflows have been manageable and have slowed significantly.

Figure 5: S&P 500 Earnings Revised Down Since Mid Feb.

Source: Bloomberg

Source: Bloomberg

On 18 April 2023, China reported its 1Q23 GDP growth which accelerated to 4.5% from 2.9% in 4Q22. Although it was ahead of Bloomberg consensus estimates of +4%, the market took it negatively and the market fell by 0.4% on the day of announcement. The market subsequently continued to fall over the next 4 days. We attribute the decline to the heightened US-China and cross-strait tensions, weaker Asian FX, further consensus earnings cuts and muted foreign flows have contributed to the weakness, despite a strong China’s 1Q GDP (+4.5% YoY).

Figure 6: Market Performance On 18 April 2023

Source: Bloomberg

Source: Bloomberg

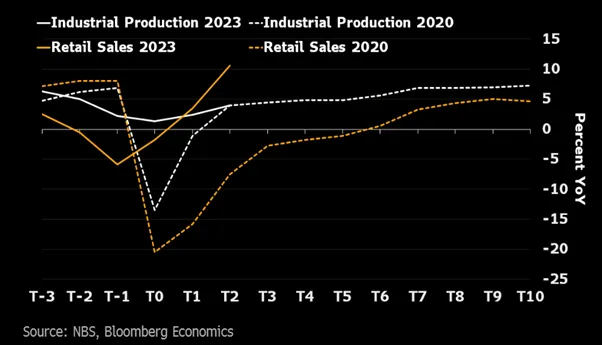

1Q GDP and March activity data point to a very strong growth recovery in China, led mainly by consumption and services sectors, thanks to the frontloading of reopening impulse and policy support. Retail sales and the Services Industry Output Index both rose significantly on year-on-year terms in March from January-February, led mainly by the continued improvement in Covid-sensitive services consumption and due partly to a weak comparison base.

Industrial production growth also rose in March from January-February, though slightly less than expected, driven by faster output growth of automobiles, telecom & electronics, and general equipment. That said, fixed asset investment growth slowed in March from January-February and missed expectations, with sequential deceleration in manufacturing and property investment.

Property-related activity growth was mixed in March despite favourable base effects and continued housing easing, as evidenced by the plunge in new home starts and the surge in new home completions amid the shift in policy focus to secure the delivery of pre-sold homes. Nationwide unemployment rates moderated seasonally in March from January-February, but the youth unemployment rate rose further. Taking into consideration NBS revisions to historical sequential GDP growth estimates, stronger-than-expected 1Q GDP and a likely subsiding of pent-up demand.

Figure 7: Downward EPS Revision In Recent Month

Source: Bloomberg

Source: Bloomberg

The brisk pick up in China’s GDP growth was to be expected. The pleasant surprise was the strength of retail sales in March – showing that a long-sought reorientation toward consumption driven growth was a big engine of the recovery from the Covid slump. Part of it was probably led by pent-up demand. That said, signs do suggest that the strength could persist into 2Q23 especially with the pump priming by the Chinese government. The Golden Week holiday in early May is likely to unleash more pent-up demand for travel and related spending.

Figure 8: China’s GDP and Activity

Figure 9: Domestic Consumption Driven Recovery

In summary, we believe equity markets will be range bound over the next 2 weeks as investors weigh earnings releases (US earnings recession), macro data, and decision from the Fed meeting on interest rate (expectation is for a 25bps hike). It has been a disappointing start to the US earnings season thus far with some big names like Tesla. As the Fed keeps monetary policy tight and the cost of capital stays elevated, smaller companies without the benefits of scale will face substantial challenges. Despite instability among the smaller regional banks in the US, there is calmness in the larger quality banks, as evidenced in the ongoing earnings season (ie. JP Morgan, Bank of America).